In 2018, housing wealth represented 54 per cent of total wealth for Australians aged 60 to 99. This is set to increase to 66 per cent by 2048. Notably, inheritance of real estate is anticipated to reach about $100bn (in 2019 dollars) in 2035, assuming house prices rise in line with inflation.

TaxBanter regularly receives client queries in relation to how the CGT main residence exemption (MRE) applies in the case of an inherited dwelling.

The beneficiary who inherits the deceased’s main residence has multiple options including:

What the beneficiary does with the property will impact the extent the MRE will apply. Another significant factor is whether the deceased used the dwelling for income-producing purposes before their death.

The MRE rules provide a tax exemption for a capital gain that an individual makes upon the sale of a dwelling that is their ‘main residence’. A full exemption applies where the property was the taxpayer’s main residence for the entire duration of their ownership. The exemption is reduced — to a partial exemption — where the dwelling was not the taxpayer’s main residence for a period of time and where the dwelling was used for an income-producing purpose. Special rules also apply to allow the taxpayer to treat the dwelling as their main residence for a period of time even though they were absent from the property.

A taxpayer who inherits a dwelling can also access the MRE in relation to a capital gain on the sale of that property if a number of conditions are satisfied.

Note: Special rules apply to modify the cost base (or reduced cost base) in the hands of the beneficiary for the purposes of calculating the capital gain (or loss).

If the deceased had acquired the dwelling post-CGT, it must have been their main residence just before death and was not being used to derive income. If it was acquired pre-CGT then the use of the property is not relevant.

In addition, one of the following must apply:

Finally, the MRE can only apply if the deceased was not an ‘excluded foreign resident’ just before their death, i.e. they had been a foreign resident for a continuous period of more than six years.

If not all of the above conditions are satisfied, this does not mean that the beneficiary cannot access the exemption. They may still be eligible for a partial exemption.

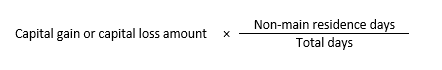

If a full exemption does not apply — i.e. the taxpayer cannot satisfy all of the MRE requirements listed above — then the capital gain (or loss) is calculated as follows:

This may result in a partial exemption or no exemption at all.

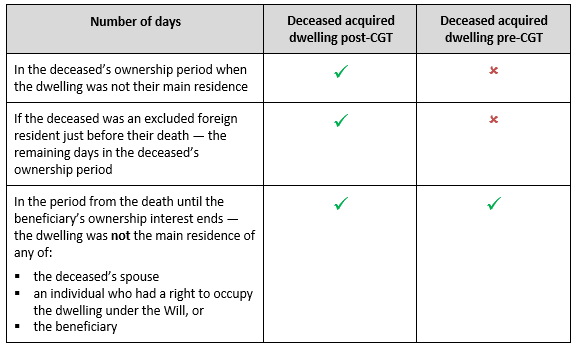

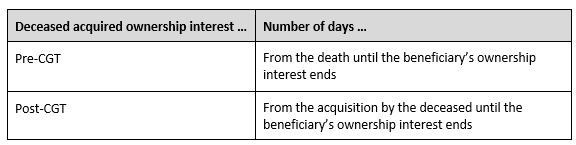

The number of ‘non-main residence days’ is the total of the following:

The number of ‘total days’ is:

Adjustments to the number of non-main residence days or the total days apply in certain circumstances, and also where the deceased had themselves inherited the dwelling.

Tricia’s grandfather Robert acquired a dwelling in October 2004. He passed away in October 2019 and the property passed to Tricia under the terms of Robert’s Will.

From October 2006 to October 2016, the dwelling was rented out to a third party tenant and was not Robert’s main residence (assume that he had another property that he was living in and his executor has chosen the other property to be treated as Robert’s main residence during that period). He moved back into the property and it was his main residence again from October 2016 until his death in October 2019.

Once she inherited the property Tricia rented it out to a third party. She sold it in 2024 and settlement occurred in October 2024. Tricia makes a capital gain of $200,000 (in these circumstances the first element of cost base in Tricia’s hands is the market value of the property on the day of death).

Tricia is ineligible for a full MRE as she did not dispose of the dwelling within two years of Robert’s death (i.e. by October 2021).

Tricia’s taxable capital gain, applying a partial MRE, is calculated as follows:

$200,000 × 15 yrs / 20 yrs = $150,000

Non-main residence days = 15 years — comprising:

Total days = number of days from Robert’s acquisition until Tricia’s ownership interest ends = 20 years (Oct 2004 to Oct 2024).

Tricia can access the general CGT discount, i.e. the taxable gain is $75,000.

Now assume that all of the above facts apply except that the settlement of Tricia’s sale of the dwelling occurred in October 2020 — i.e. within two years of Robert’s death.

Tricia is eligible for a full CGT exemption on the $400,000 capital gain. Because Robert has been living in the dwelling and not using it to derive income just before his death, Tricia notionally ‘saves’ tax on $150,000 compared to the partial exemption scenario, even though in both scenarios the property was not Robert’s main residence for 10 years out of the 15 years of his ownership and Tricia had rented it out for the entirety of her ownership period.

How the MRE applies in various inheritance situations, and other aspects of the MRE rules, will be explained with practical examples in our upcoming Online Special Topic presentation – click here to register, or visit our upcoming training page for more information.

Main Residence Exemption | Presenting on 8 February 2023 @ 11am AEDT

Our mission is to provide flexible, practical and modern tax training across Australia – you can view all of our services by clicking here.

Join thousands of savvy Australian tax professionals and get our weekly newsletter.