The Treasurer, Dr Jim Chalmers, handed down the Albanese Government’s first Federal Budget last night (Tuesday 25 October 2022). You will have already received our special Budget Night documents summarising the key announcements in the tax and superannuation space, and a quick reference timeline that sets out the proposed application dates at a glance.

For your convenience, the links to these documents are here:

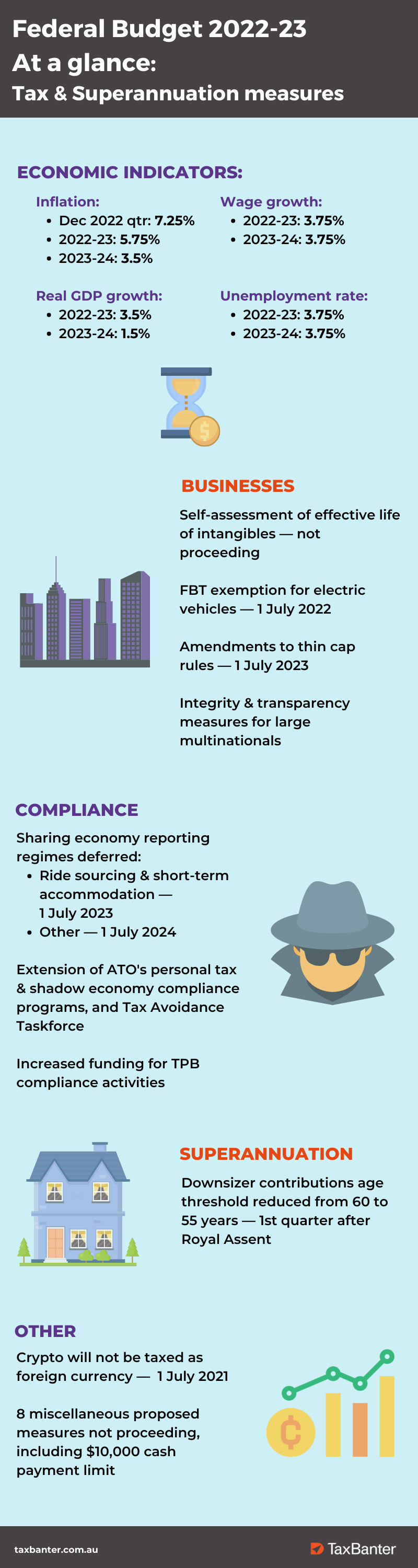

We have also prepared a handy Budget infographic, which is at the end of this article.

The above downloads set out all you need to know about what was in the Budget that is relevant to the tax profession. But new announcements do not render previous ones forgotten. This article will provide a status stocktake of previously announced measures.

While there are no big-ticket tax and superannuation revelations for individuals, family groups and SMEs, the Budget documents do provide certainty about which previously announced — but as yet unlegislated — measures will not proceed:

The Budget documents also confirm that the start dates for the following proposed measures will be deferred to allow sufficient time for legislation and implementation:

The Budget documents are silent on some key tax matters which have previously been flagged for attention, including:

As expected, and as confirmed by the Treasurer himself before Tuesday night, the Budget does not include any changes to the legislated stage 3 personal tax cuts which are due to commence on 1 July 2024.

There was also no announcement about the SBE instant asset write-off threshold which is due to revert to $1,000 on 1 July 2023. While $1,000 is the threshold in statute, due to various temporary incentives it has not been less than $20,000 since before 12 May 2015. It is currently uncapped until 30 June 2023.

Upon coming into office in May as a first-term government, Labor inherited many unenacted measures initiated by the previous Morrison Government.

When the 46th Parliament was dissolved on 11 April 2022, 250 Bills before Parliament lapsed and are therefore not proceeding unless re-introduced.

The following Bills which lapsed when Parliament was dissolved have been reintroduced as indicated below or have yet to be reintroduced.

| Treasury Laws Amendment (2021 Measures No. 7) Bill 2021 | Proposed to extend the Taxable Payments Reporting System to the sharing economy (including ride-sourcing and short-term accommodation) and to remove the $250 non-deductible threshold for work-related self-education expenses — now included in Treasury Laws Amendment (2022 Measures No. 2) Bill 2022, introduced on 3 August 2022 |

| Treasury laws Amendment (2020 Measures No. 4) Bill 2020 | Proposed to make refunds of large scale generation shortfall charges NANE income; and to facilitate the closure of the Superannuation Complaints Tribunal (which has been legislated) |

| Treasury Laws Amendment (Enhancing Tax Integrity and Supporting Business Investment) Bill 2022 | Proposed to insert the Patent Box regime as new Div 357 of the ITAA 1997 |

| Treasury Laws Amendment (Streamlining and improving economic outcomes for Australian) Bill 2022 | Proposed to enable SBEs to apply to the Small Business Taxation Division of the Tribunal for an order staying operation or implementation of decisions of the Commissioner that are being reviewed by the Tribunal — now included in Treasury Laws Amendment (2022 Measures No. 2) Bill 2022 |

| Treasury laws Amendment (Modernising Business Communications) Bill 2022

|

Proposed to amend the Corporations Act 2001 to, among other things:

|

The tax measures announced by the previous Government in its last federal Budget 2022–23 on 29 March 2022 and which had bipartisan support may be re-introduced into Parliament by the new Government.

| Proposed measure | Current status |

| Small business technology boost — a bonus 20 per cent tax deduction for eligible expenditure incurred between 7.30 pm (AEDT) on 29 March 2022 and 30 June 2023 on expenses and depreciating assets that support digital operations | Consultation on Draft legislation Treasury Laws Amendment (Measures for consultation) Bill 2022: technology investment boost closed on 19 September 2022. |

| Small business skills and training boost — a bonus 20 per cent tax deduction for eligible expenditure incurred between 7.30 pm (AEDT) on 29 March 2022 and 30 June 2024 on external training delivered to employees by providers registered in Australia | Consultation on Draft legislation Treasury Laws Amendment (Measures for Consultation) Bill 2022: skills and training boost closed on 19 September 2022 |

| Patent box expansion — proposed Div 357 of the ITAA 1997 | Bill implementing this lapsed |

| Reducing regulatory burden for Australia’s foreign investment framework | Implemented by the Foreign Acquisitions and Takeovers Amendment Regulations 2022 |

| Strengthening the Australian Business Number System | Deferral of a measure announced in the 2019–20 Budget |

| Modernisation of PAYG instalment systems — allowing companies to pay their PAYG instalments based on current financial performance | Due to commence from 1 January 2024 |

| Digitalising trust income reporting and processing |

Join us at the beginning of each month as we review the current tax landscape. Our monthly Online Tax Updates and Public Sessions are excellent and cost effective options to stay on top of your CPD requirements. We present these monthly online, and also offer face-to-face Public Sessions at 16 locations across Australia. Click here to find a location near you.

Personalised training options

Personalised training optionsWe can also present these Updates at your firm or through a private online session, with content tailored to your client base – please contact us here to submit an expression of interest or visit our In-house training page for more information. You can also reach us at 0413 955 686 for a chat about your training needs and how we can assist you.

Join thousands of savvy Australian tax professionals and get our weekly newsletter.