On 27 February 2024, Parliament passed the Treasury Laws Amendment (Cost of Living Tax Cuts) Bill 2024 (the Bill) containing the Government’s revisions to the Stage 3 personal tax cuts, which take effect from the 2024–25 financial year. At time of writing the Bill is awaiting Royal Assent.

The original Stage 3 tax cuts formed part of the Personal Income Tax Plan implemented by the Treasury Laws Amendment (Personal Income Tax Plan) Act 2018.

In late January 2024 the Government revealed the details of its proposed changes to the Stage 3 tax cuts by way of an announcement and information resources on the Treasury website.

On Monday 5 February, the Government released exposure draft legislation. The Bill was introduced into the House of Representatives the next day, 6 February.

This article was originally published upon the release of the Treasury material and prior to the release of the Bill — it has been updated to take into account the contents of the Bill as passed and the accompanying explanatory materials.

Also refer to the following Treasury resources:

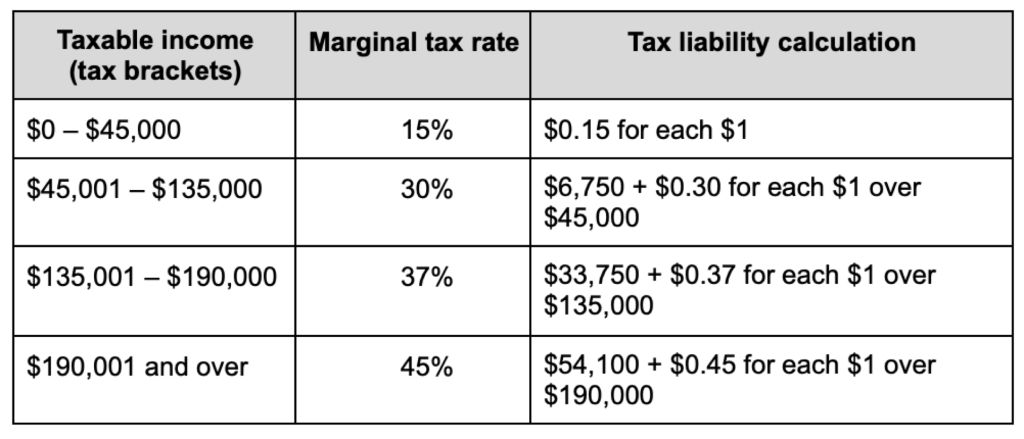

This article summarises the changes to the tax brackets and tax rates and illustrates the potential implications for taxpayers with a range of taxable incomes.

![]() Note:

Note:

The Government will also increase the Medicare levy low-income thresholds for 2023–24. This article will not cover this proposed change. See the Treasury Laws Amendment (Cost of Living – Medicare Levy) Bill 2024, which was also passed by Parliament on 27 February and is now awaiting Royal Assent.

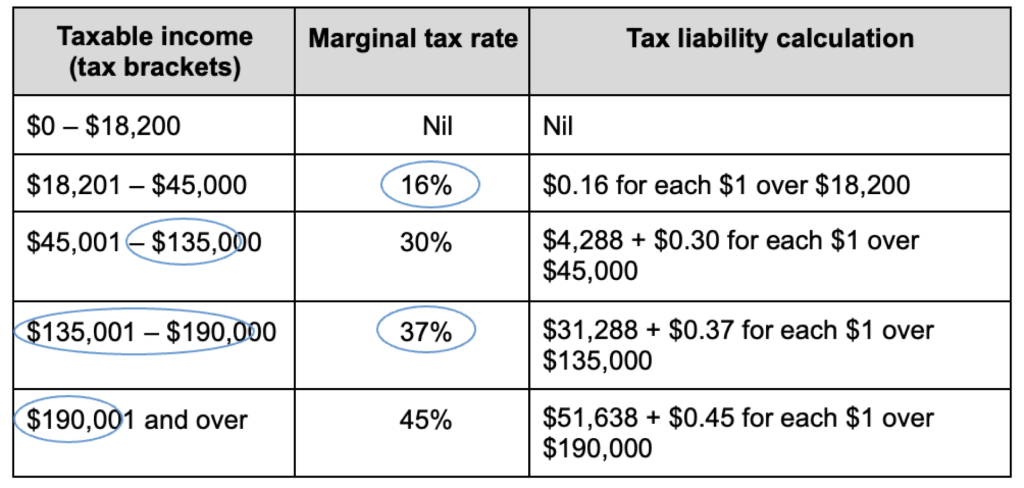

From 1 July 2024, the revised Stage 3 tax cuts will:

There will be no change to the current tax-free threshold of $18,200 or the tax-free threshold of $416 on eligible income under the taxation of minors rules.

No taxpayer will pay more tax than that which would apply under the 2023–24 rates but higher income taxpayers will receive a lower tax cut than under the previous Stage 3 plan.

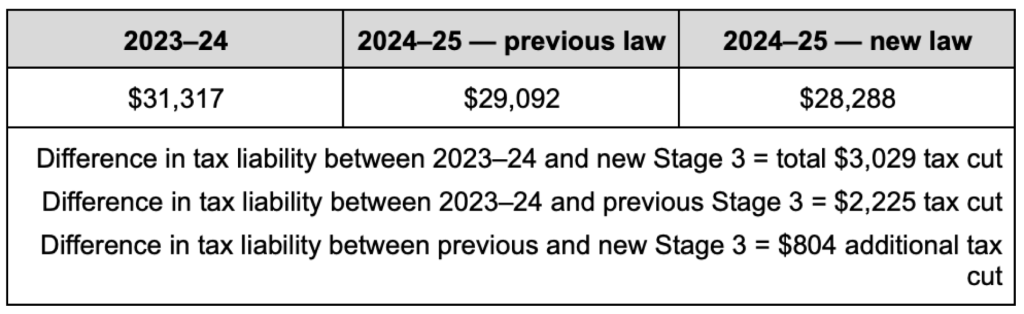

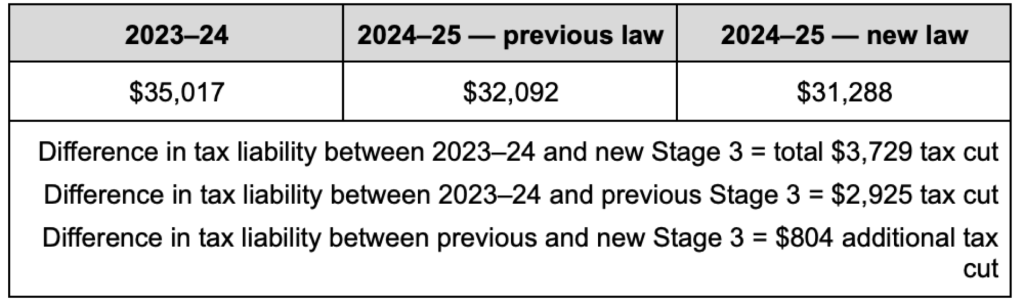

Taxpayers with taxable incomes up to $45,000 will benefit from a reduction of their marginal tax rate from 19 per cent to 16 per cent (maximum tax saving of $804). Under the previous Stage 3 plan, there was no change to the current (2023–24) tax bracket ($18,201 to $45,000) or marginal tax rate (19 per cent).

Middle income taxpayers will receive an extra tax cut of $804 (on top of the tax cut they would have received under the previous plan).

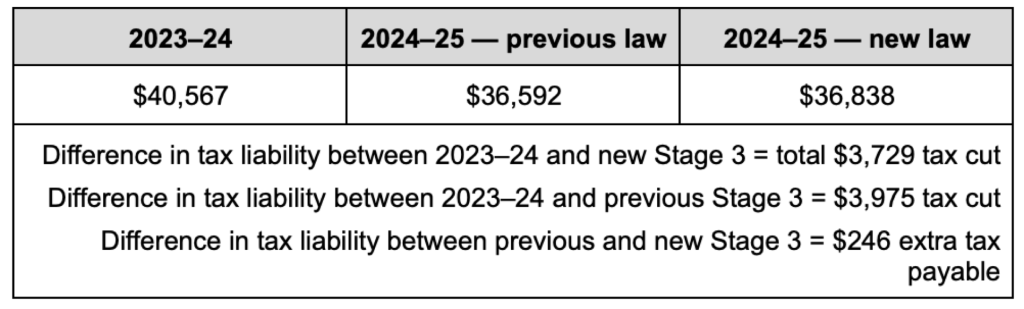

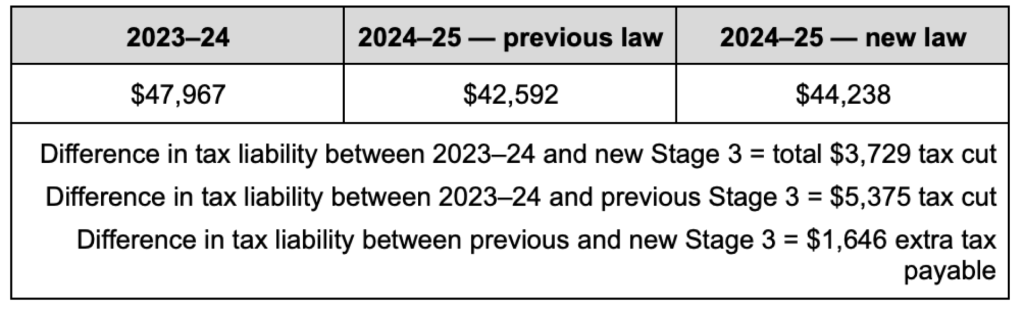

The benefit of the changes (in comparison to the previously legislated Stage 3 plan) cuts out at taxable incomes of approximately $147,000 — taxpayers at this income level will be $36 worse off under the changes (albeit with a saving of $3,729 from 2023–24 rates).

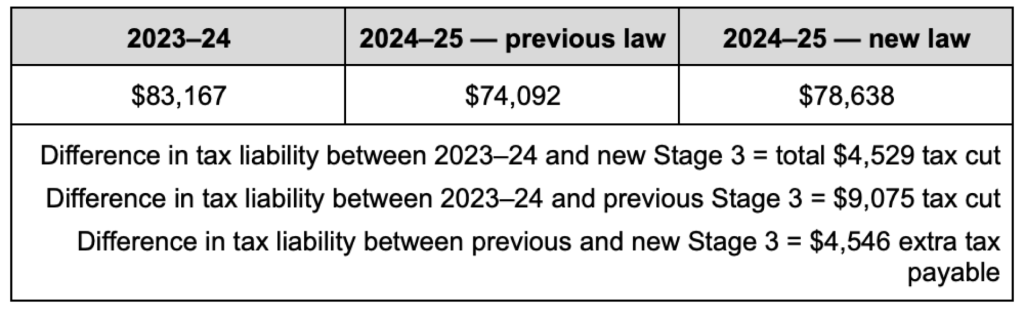

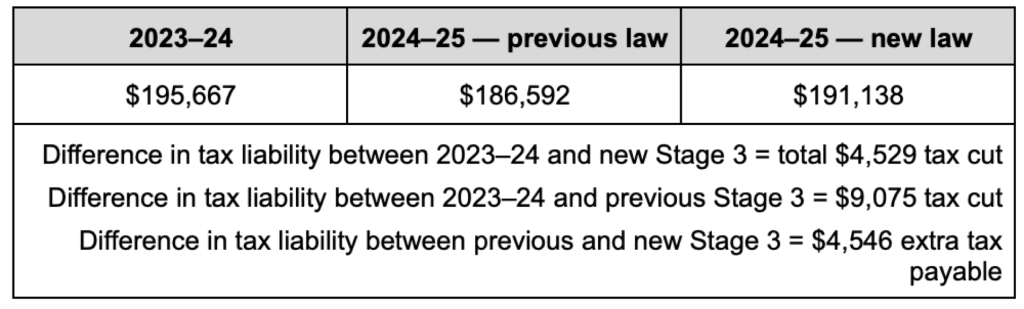

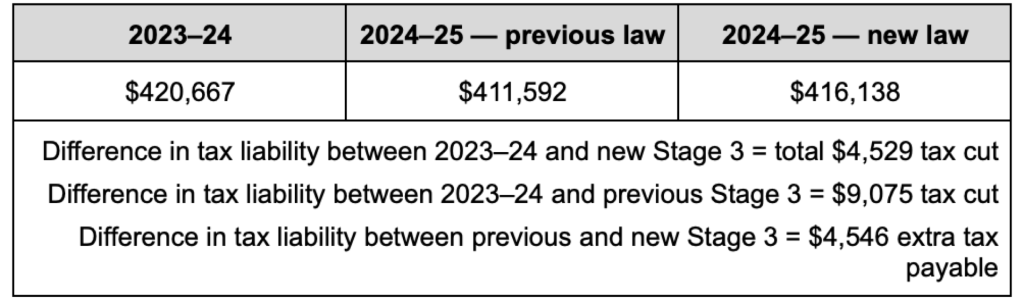

For taxpayers with taxable incomes of $200,000 and above, the tax cut will be worth $4,529 instead of $9,075 — i.e. the Stage 3 benefit will be cut by half.

![]() Note:

Note:

This article only considers the implications for resident individuals and ignores the effect of Medicare levy, the low income tax offset, and any other income tested levies, offsets and rebates on a taxpayer’s overall tax position.

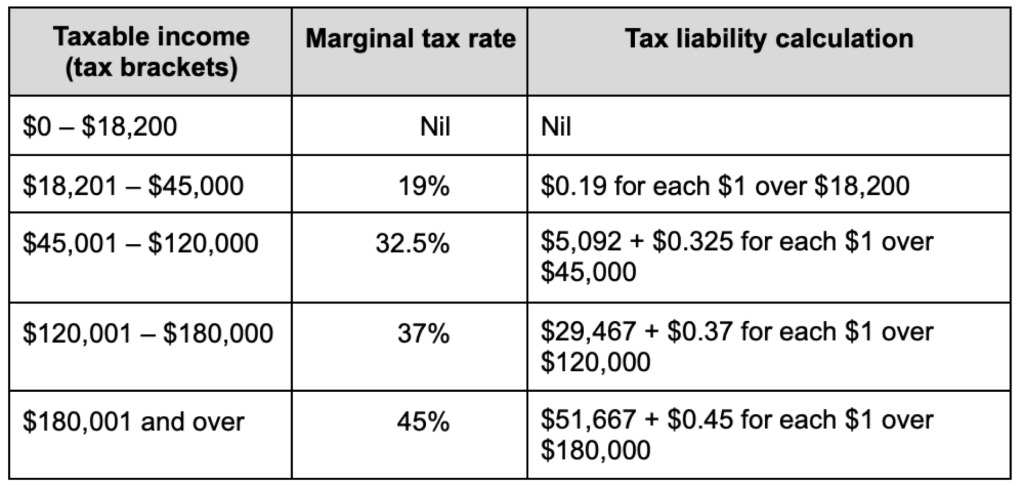

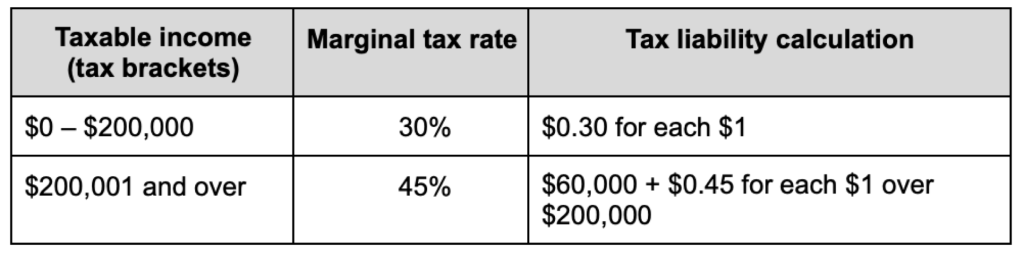

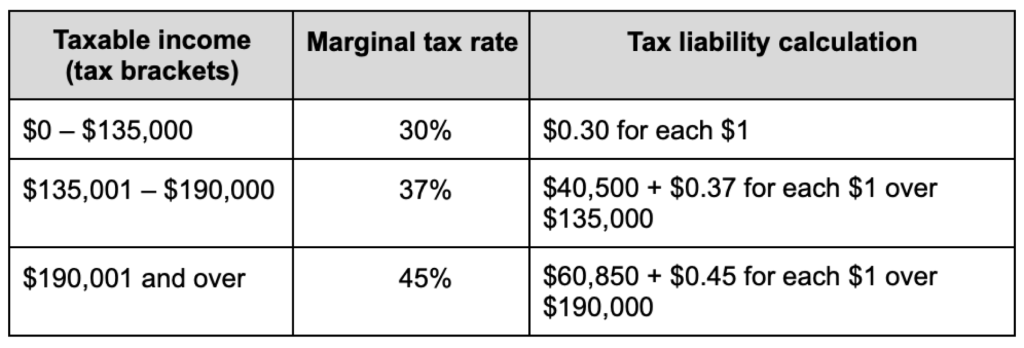

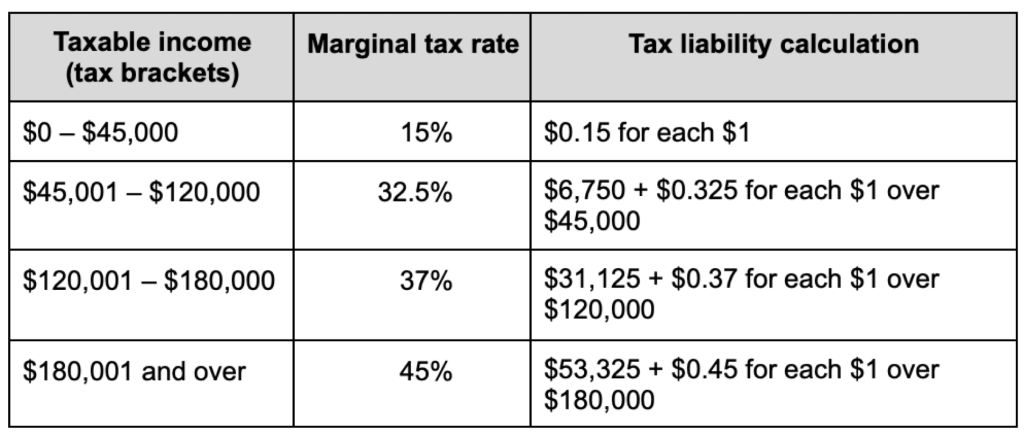

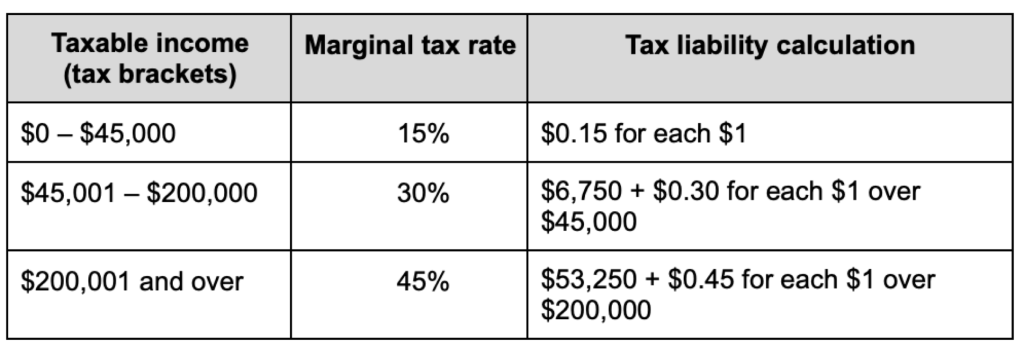

Resident individual tax rates 2020–21 to 2023–24 — Stage 3 not yet implemented

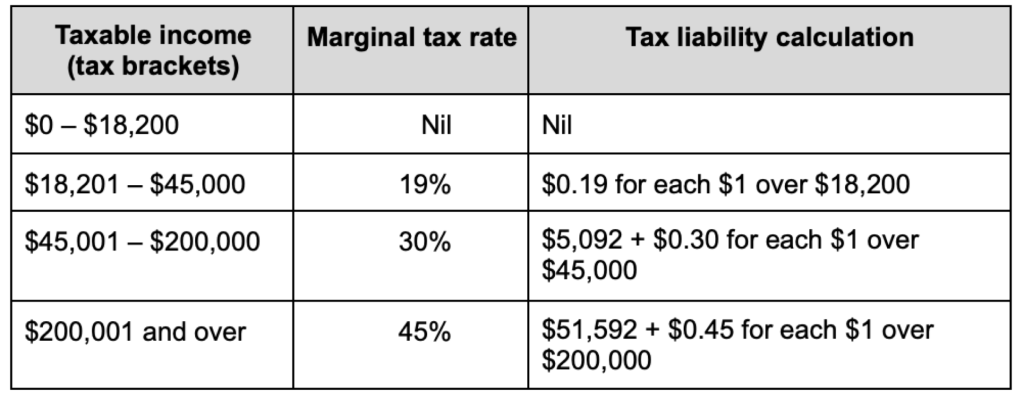

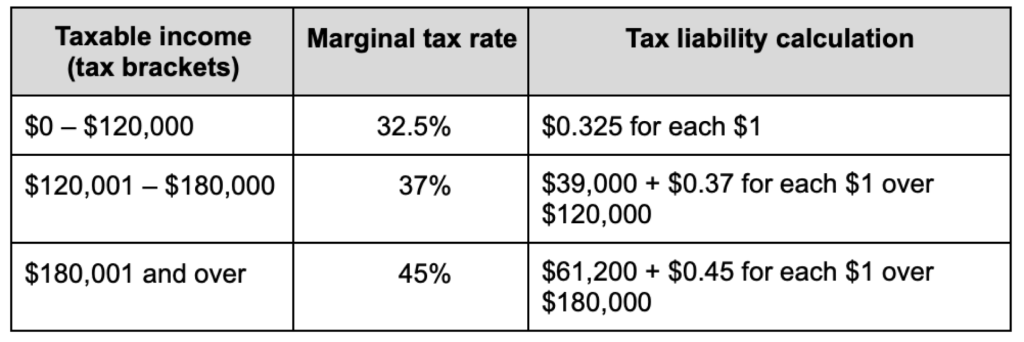

Resident individual tax rates 2024–25 — formerly legislated Stage 3 tax plan

Resident individual tax rates 2024–25 — revised Stage 3 tax plan

Some of the key implications of the changes to the legislated Stage 3 tax plan are as follows:

There will be no change to the tax-free threshold of $18,200 or the top marginal tax rate of 45 per cent for taxpayers with taxable incomes over $200,000.

All taxpayers will receive a tax cut compared to 2023–24 but taxpayers with taxable incomes of approximately $147,000 and higher will receive a lower tax cut under the changes as compared to the formerly legislated tax rates.

On a taxable income of $146,000, the tax liability under current law is $35,392 vs under proposed changes is $35,358 (a $34 benefit under the proposed change). On $147,000, tax liabilities are $35,692 vs $35,728 (a $36 detriment).

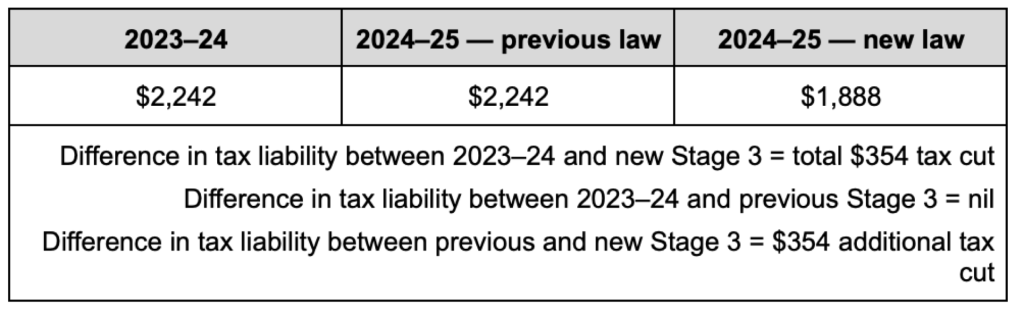

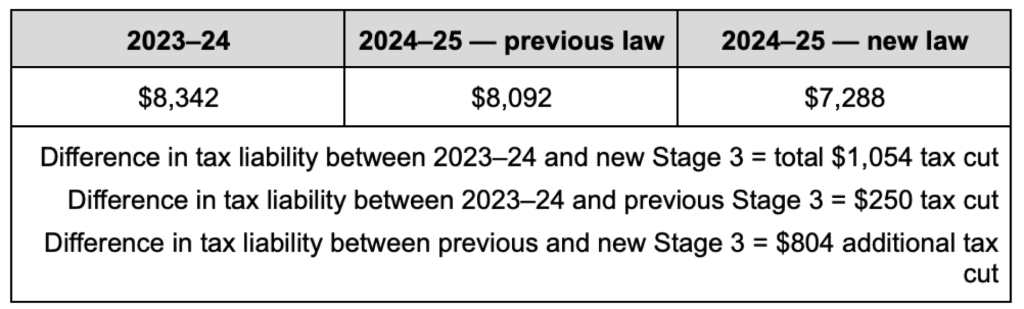

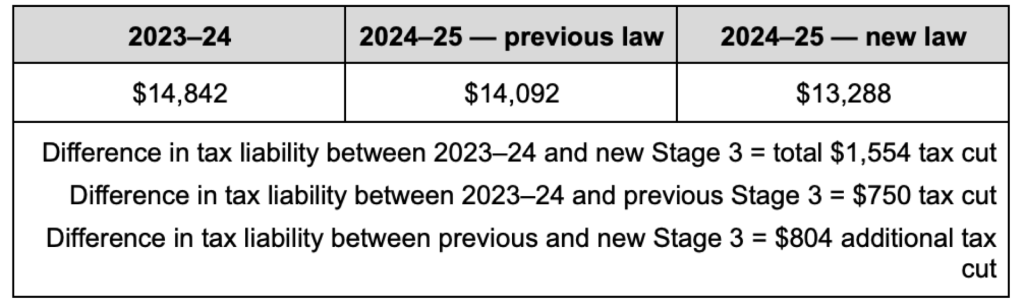

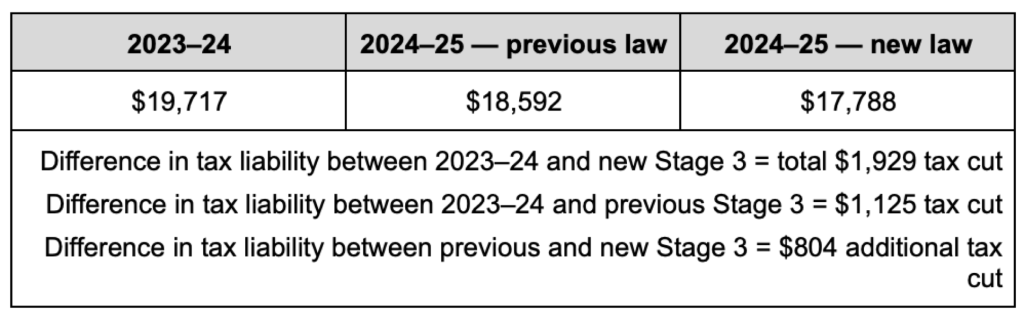

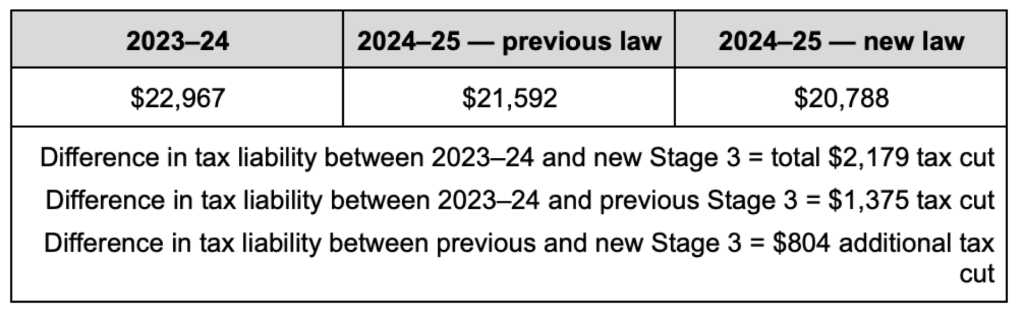

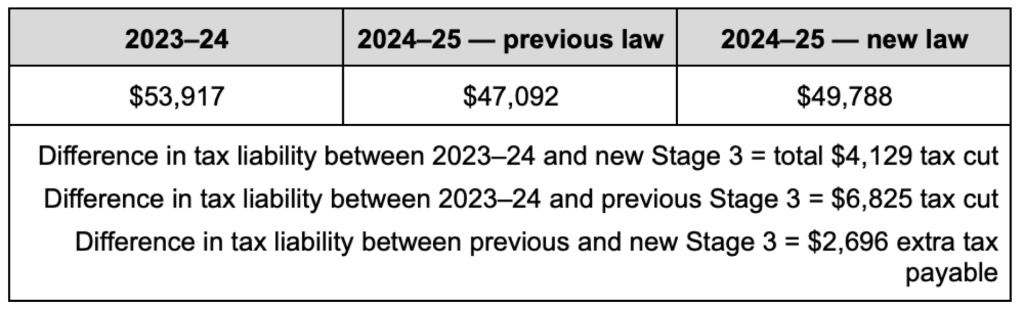

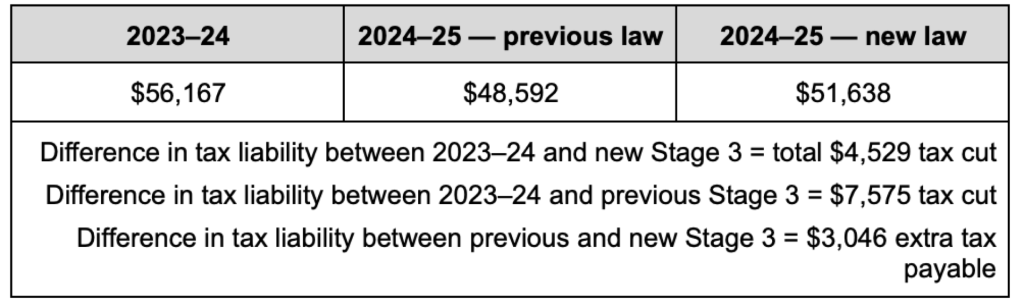

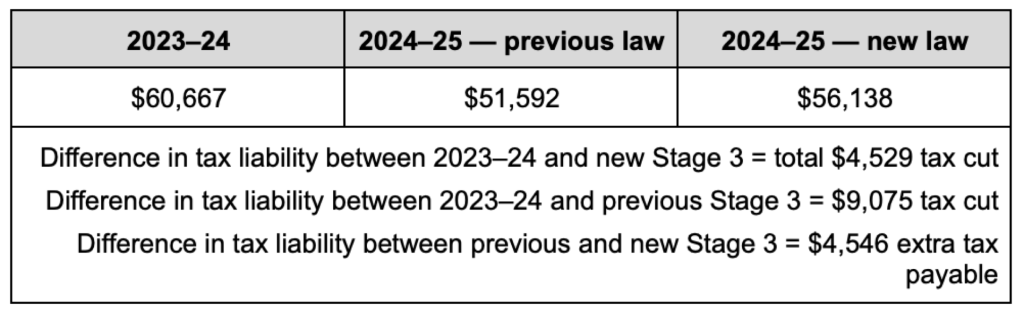

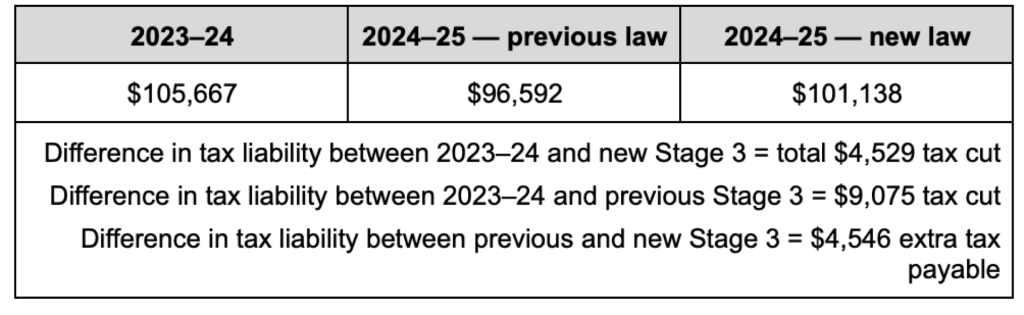

The following examples set out the tax liability that would arise for a given taxable income under the current (2023–24) tax rates, the formerly legislated Stage 3 rates from 2024–25 and the revised Stage 3 rates from 2024–25.

Assume that each taxpayer’s taxable income is the same in 2023–24 and 2024–25.

![]() Note:

Note:

The Treasury’s tax cut calculator takes into account the basic tax scales, low-income tax offset (as applicable) and the Medicare levy. As mentioned above, the following illustrative examples only take into account the basic tax rates. Therefore the outcomes from the Treasury’s calculator will not be the same as what is represented below.

![]() Reference:

Reference:

See the Government’s fact sheet for detailed distributional tables setting out the impact of the revised Stage 3 plan at a multitude of taxable incomes for single and dual income households.

Abbie’s taxable income for 2023–24 and 2024–25 is $30,000.

Ben’s taxable income for 2023–24 and 2024–25 is $55,000.

Cameron’s taxable income for 2023–24 and 2024–25 is $75,000.

Dana’s taxable income for 2023–24 and 2024–25 is $90,000.

Evie’s taxable income for 2023–24 and 2024–25 is $100,000.

Frank’s taxable income for 2023–24 and 2024–25 is $125,000.

Greg’s taxable income for 2023–24 and 2024–25 is $135,000.

Hannah’s taxable income for 2023–24 and 2024–25 is $150,000.

![]() Note:

Note:

The benefit of the new changes begins to cut out at just under $147,000. Taxables with taxable incomes of $146,000 will benefit under the new changes by $34 as compared to the formerly legislated Stage 3 rates. However, taxpayers with taxable incomes of $147,000 will receive a tax cut that is $36 less than that which would arise under the formerly legislated Stage 3 plan.

Izzy’s taxable income for 2023–24 and 2024–25 is $170,000.

Jaclyn’s taxable income for 2023–24 and 2024–25 is $185,000.

Ken’s taxable income for 2023–24 and 2024–25 is $190,000.

Leonard’s taxable income for 2023–24 and 2024–25 is $200,000.

Mark’s taxable income for 2023–24 and 2024–25 is $250,000.

Natasha’s taxable income for 2023–24 and 2024–25 is $300,000.

Olivia’s taxable income for 2023–24 and 2024–25 is $500,000.

Pete’s taxable income for 2023–24 and 2024–25 is $1,000,000.

Non-resident individual tax rates 2020–21 to 2023–24 — Stage 3 not yet implemented

Non-resident individual tax rates 2024–25 — formerly legislated Stage 3 tax plan

Non-resident individual tax rates 2024–25 — revised Stage 3 tax plan

Working holiday maker tax rates 2020–21 to 2023–24 — Stage 3 not yet implemented

Working holiday maker tax rates 2024–25 — formerly legislated Stage 3 tax plan

Working holiday maker tax rates 2024–25 — revised Stage 3 tax plan

Our mission is to provide flexible, practical and modern tax training across Australia – you can view all of our services by clicking here.

Join thousands of savvy Australian tax professionals and get our weekly newsletter.