The Government has now released exposure draft legislation to implement the Small Business Energy Incentive (SBEI) first announced on 30 April 2023.

The SBEI is a temporary measure to support small businesses (with aggregated annual turnover of less than $50 million) in improving their energy efficient and save on energy bills. The incentive will take the form of a bonus deduction equal to 20 per cent of eligible expenditure, capped at a $20,000 deduction ($100,000 expenditure). The bonus deduction will only apply to eligible expenditure incurred from 1 July 2023 to 30 June 2024. While the legislation is still in exposure draft form, if and when it is enacted it will have retrospective application from 1 July 2023.

Note: all examples in this article are taken or adapted from the draft explanatory materials.

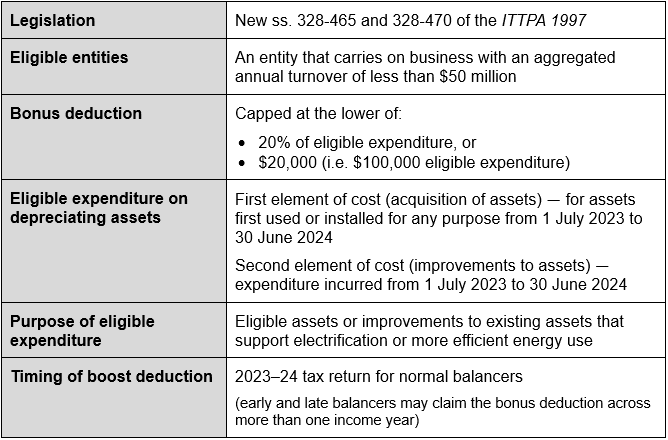

The draft legislation proposes to amend the Income Tax (Transitional Provisions) Act 1997 (ITTPA 1997). This table sets out a summary of the key elements of the SBEI.

An entity will be eligible for the bonus deduction if, in the income year in which the asset is first used or installed, or the improvement cost is incurred, it is:

The bonus deduction will be calculated based on eligible incurred expenditure which is:

Expenditure on a depreciating asset is eligible for the bonus deduction in any of the following situations.

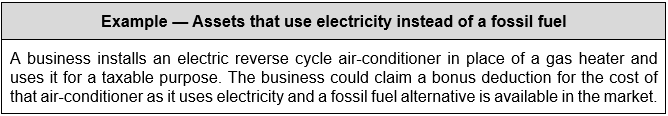

An asset is eligible for the bonus deduction if there is a new reasonably comparable asset that uses a fossil fuel available in the market, and the asset instead uses electricity.

An asset will not qualify for the bonus deduction if the only reasonably comparable asset that uses a fossil fuel is a second-hand asset.

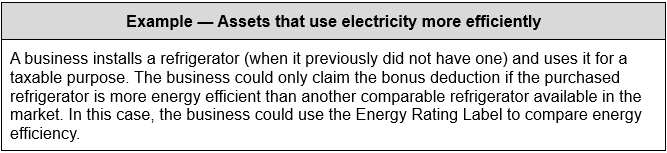

If the asset is replacing another depreciating asset, it must be more energy efficient than the asset it is replacing.

If the asset is not replacing another asset, then it must be more energy efficient than a new reasonably comparable asset available in the market at the time it is first used or installed ready for use for any purpose. The comparable asset cannot be a second-hand asset.

Demand management and enabling assets may be eligible for the bonus deduction:

Expenditure on an improvement to a depreciating asset is eligible in the following circumstances.

An improvement that allows an asset to only use electricity, or to use energy generated from a renewable source may be eligible for the bonus deduction if, prior to the improvement, the asset could use energy from a fossil fuel.

Example: an electric motor that replaces a diesel engine in an asset, allowing that asset to only use electricity.

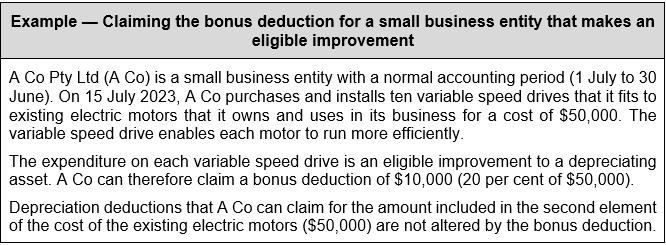

An improvement that allows the asset to be more energy efficient may be eligible for the bonus deduction, provided the asset being improved uses electricity or energy generated from a renewable source.

Example: a variable speed drive fitted to an existing electric motor.

An improvement that allows for energy use by an asset to be monitored, reduced at specific times, or confined to specific times may be eligible for the bonus deduction, provided the asset being improved uses electricity or energy generated from a renewable source.

Example: a switchboard-mounted device that enables the shifting of loads from peak times to off-peak times.

For assets first used or installed for any purpose during the bonus period, expenditure that is included in the first element of cost may be eligible for the bonus deduction to the extent the asset is used for a taxable purpose.

This means that, if an entity first uses or installs an asset before 1 July 2023, the entity cannot claim a bonus deduction for the first element of cost of the asset. This is the case even if the entity does not use the asset for a taxable purpose until after 1 July 2023.

Expenditure on the part of the second element of cost of an asset that is incurred during the bonus period may be eligible for the bonus deduction. The time that the improvement or the asset being improved is used or installed is not relevant.

The second element of cost of an asset can only be claimed if it allows the asset to be more energy efficient, able to store energy, monitor energy use, use energy at a different time, or enable the asset to run solely on electricity or renewable energy.

The cost of an improvement to an asset can be claimed for assets first used or installed before or during the bonus period. This means that if an entity first uses or installs an asset during the bonus period, and also improves the asset during the bonus period, it can claim the bonus deduction for the first element of cost of the asset and for the cost of the improvement.

The entity must be able to deduct the eligible expenditure under another provision of the taxation law, regardless of which income year or income years in which they claim the deduction.

Generally, the cost of an asset can only be deducted to the extent that that asset is used for a taxable purpose.

Therefore, if expenditure is for a mix of private and business use, the bonus deduction will only apply to the proportion of the expenditure that is for a taxable purpose.

The bonus deduction will be considered a specific deduction under Div 25 of the ITAA 1997.

![]() Note

Note

The proposed amendments include a clarification that the following existing provisions of the ITAA 1997 which prohibit various double deductions will not prevent a taxpayer from claiming the bonus deduction:

Ineligible assets and expenditures are:

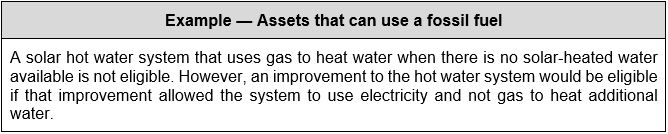

If an asset can use a fossil fuel, then that asset and any expenditure on that asset is not eligible for the bonus deduction, unless that use is merely incidental.

This is the case even if, in practice, the asset predominantly or solely uses electricity, or other energy that is generated from a renewable source.

The only exception to this exclusion is an improvement that allows an asset to only use electricity, or other energy that is generated from a renewable source.

An entity cannot claim the bonus deduction for the cost of a depreciating asset, or an improvement to a depreciating asset, if any balancing adjustment event occurs to the asset — for example the entity sells the asset — while the entity holds it during the bonus period (i.e. 1 July 2023 to 30 June 2024), unless the balancing adjustment event is an involuntary disposal.

The amount of the bonus deduction is calculated as 20 per cent of the total amount of eligible expenditure, up to a maximum bonus deduction of $20,000 across the bonus period.

This means that total expenditure eligible for the bonus deduction is effectively $100,000 over the bonus period.

Implications

Implications

An SBE taxpayer may be eligible to claim an immediate deduction for an asset costing under $1,000 under the instant asset write-off. Regardless of the method of depreciation deduction — i.e. whether immediate or over time — the bonus deduction in respect of a depreciating asset is calculated based on the asset’s cost.

For depreciating assets first used or installed during the bonus period, entities must claim the bonus deduction in the income year in which the asset is first used or installed.

For improvements made to existing assets, entities must claim the bonus deduction in the income year in which the improvement cost is incurred.

For most taxpayers this will be the 2023–24 income year.

Early and late balancers may claim the bonus deduction across more than one income year — provided the eligible asset was first used or installed, or the improvement cost was incurred, during the bonus period. The $20,000 cap is a limit on the total bonus deduction that may be claimed, even if it is claimed across multiple income years.

It is assumed that the entity will continue to hold the asset throughout its effective life; and:

The bonus deduction does not affect any other deductions.

The requirement that expenditure is deductible under a taxation provision means that there are certain exclusions to eligible expenditure. For example, if a business is registered for GST, the bonus deduction is calculated on the amount of expenditure less the GST amount claimable as an input tax credit. The GST component of expenditure that is claimed as an input tax credit is not deductible.

Join us at the beginning of each month as we review the current tax landscape. Our monthly Online Tax Updates and Public Sessions are excellent and cost effective options to stay on top of your CPD requirements. We present these monthly online, and also offer face-to-face Public Sessions at 17 locations across Australia.

![]() Join us online

Join us online

Upcoming webinars >

![]() Register for a workshop

Register for a workshop

Upcoming workshops by state >

We can also present tax updates or specialty topics at your firm or through a private online session, with content tailored to your client base. Call our BDM Caitlin Bowditch at 0413 955 686 to have a chat about your specific needs and how we can assist.

Learn more about in-house training >

Email us to have a chat >

Our mission is to provide flexible, practical and modern tax training across Australia – you can view all of our services by clicking here.

Join thousands of savvy Australian tax professionals and get our weekly newsletter.