The Treasury Laws Amendment (2022 Measures No. 4) Act 2023 passed both Houses of Parliament on Thursday 22 June 2023 and received Royal Assent on Friday 23 June 2023.

The Act introduces the technology investment boost and the skills and training boost for small businesses (with aggregated annual turnover of less than $50 million). Both boosts allow eligible businesses to claim a ‘bonus’ tax deduction equal to 20 per cent of qualifying expenditure. This article outlines how the rules for both boosts work, and the practical implications for this final week of the 2022–23 financial year.

The Act amends the Income Tax (Transitional Provisions) Act 1997 (ITTPA 1997).

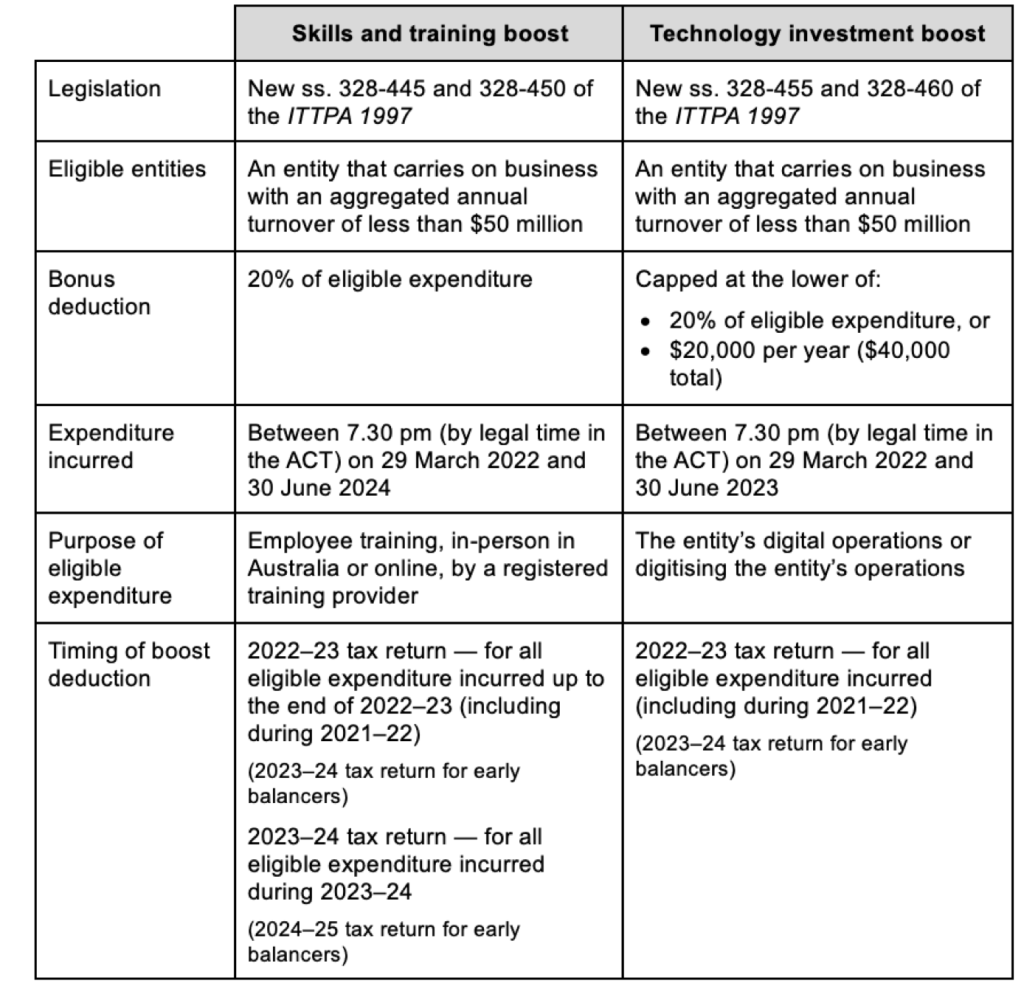

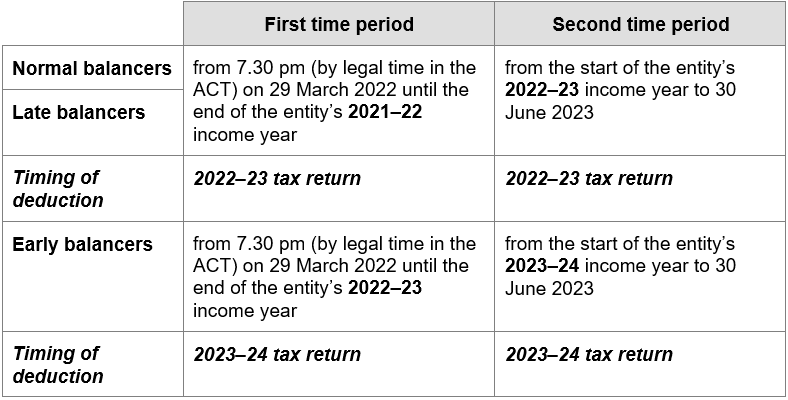

The following table is a handy summary:

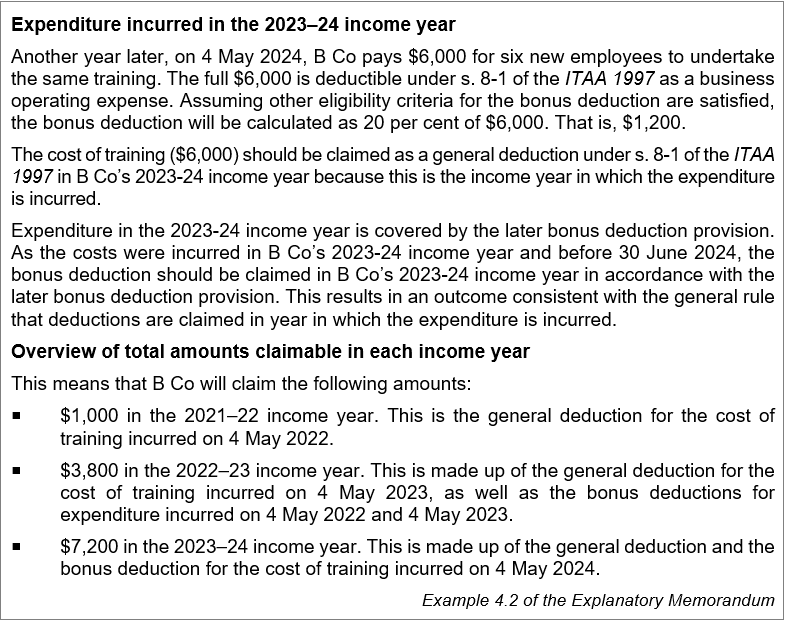

The skills and training boost provides a bonus deduction for small businesses that incur eligible expenditure on external training for their employees between 7.30 pm (AEDT) on 29 March 2022 and 30 June 2024.

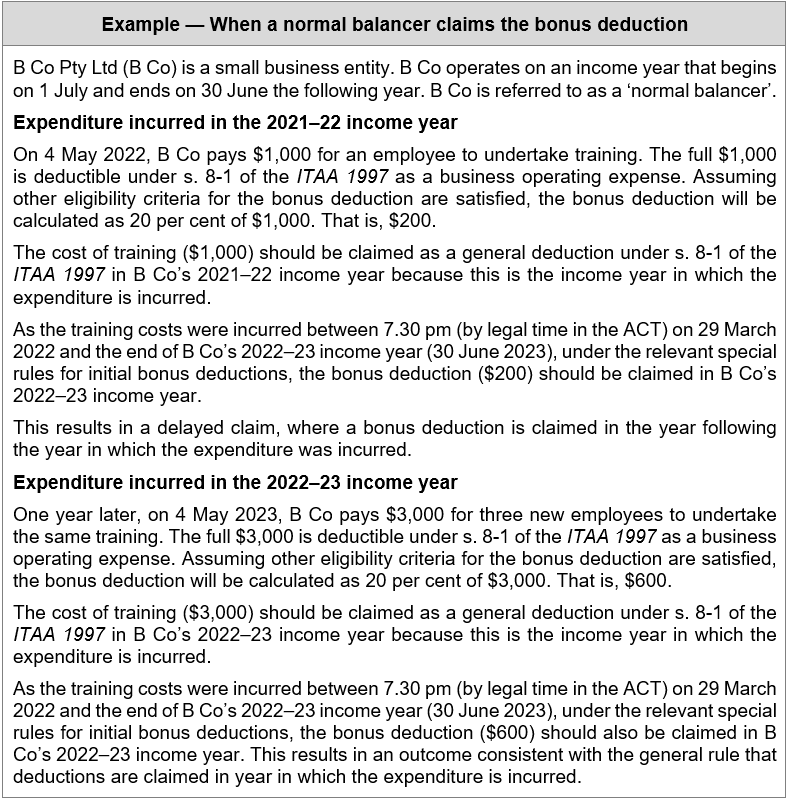

The bonus deduction is calculated as 20 per cent of the amount of expenditure that is both eligible for the bonus deduction and deductible under another taxation law provision.

An entity will be eligible for the bonus deduction if, in the income year the expenditure is incurred, it is:

The bonus deduction will be calculated based on eligible incurred expenditure which meets the following criteria:

The Explanatory Memorandum notes that the cost of in-house or on-the-job training is not eligible expenditure for the purpose of the bonus deduction.

The training provider must be registered with at least one of the following government authorities: Australian Skills Quality Authority (ASQA) (within the meaning of the National Vocational Education and Training Regulator Act 2011); Tertiary Education Quality and Standards Agency (TEQSA) (within the meaning of the Tertiary Education Quality and Standards Agency Act 2011); Victorian Registration and Qualifications Authority (within the meaning of the Education and Training Reform Act 2006 (Vic)); or Training Accreditation Council of Western Australia (within the meaning of the Vocational Education and Training Act 1996 (WA)).

Expenditure for training persons other than employees is not eligible — i.e. the bonus deduction is not available for the training of non-employee business owners such as sole traders, partners in a partnership and independent contractors.

The amount of the bonus deduction is calculated as 20 per cent of the total amount of eligible expenditure. Unlike the technology investment boost, there is no cap on the bonus dedduction.

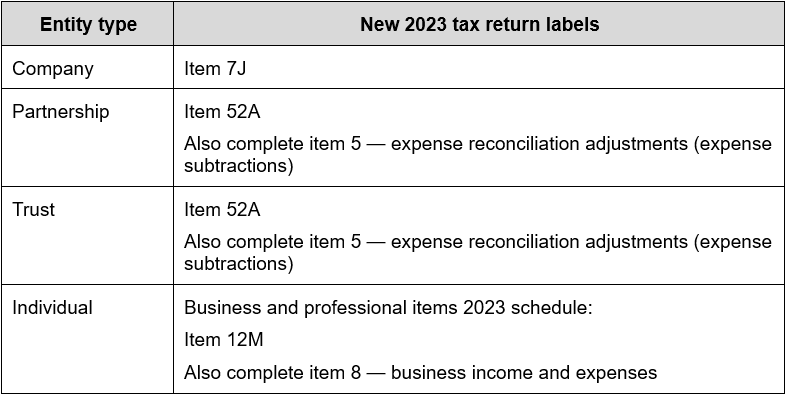

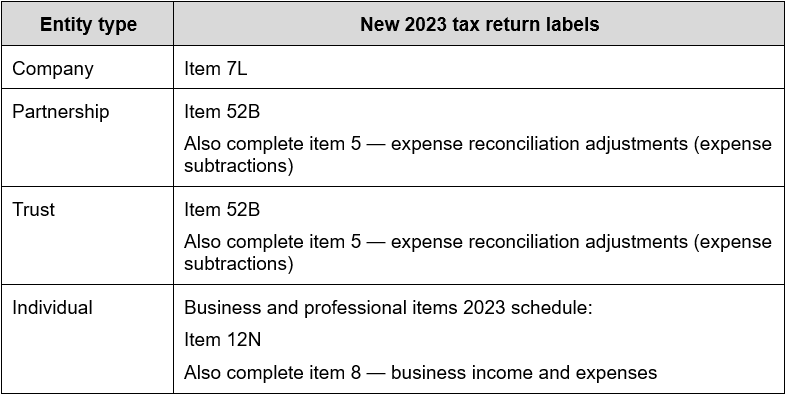

The ATO’s 2023 tax return stationery includes new disclosures for the skills and training boost:

The skills and training boost runs until 2023–24. An eligible entity will be able to claim the bonus deduction next year if they do not manage to incur the expenditure by 30 June 2023.

The expenditure may be incurred in a different year to the year in which the training is delivered. The bonus deduction is calculated in relation to the year in which the expenditure is incurred. There is no requirement that the training must have been delivered by the end of the income year in which the bonus deduction is claimed, i.e. if expenditure is incurred on 29 June 2023 but the training is provided on 3 July 2023, the boost is deductible in 2022–23. However the boost cannot be claimed where the training was provided before 7.30 pm (by legal time in the ACT) on 29 March 2022 even if the expenditure was not incurred until after that time.

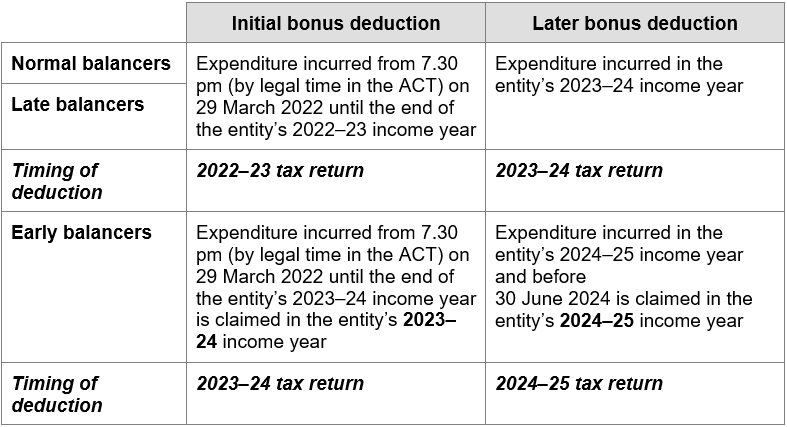

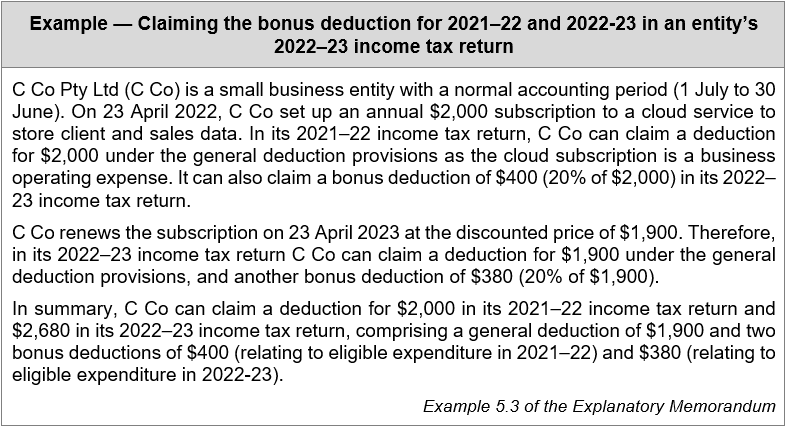

The bonus deduction has no effect on the year in which the expenditure is deductible under another provision of the law. For example, a deduction under s. 8-1 may be claimable in 2021–22 while the boost is claimed in 2022–23.

If an eligible entity incurred qualifying expenditure in 2021–22, there is no need to amend the 2021–22 tax return — the bonus deduction is only to be claimed in the 2022–23 tax return.

The technology investment boost provides eligible businesses with access to a bonus deduction equal to 20 per cent of their eligible expenditure incurred on expenses and depreciating assets for the purposes of their digital operations or digitising their operations between 7.30 pm (AEDT) on 29 March 2022 and 30 June 2023.

To be eligible for the bonus deduction:

In respect of each of the 2021–22 and 2022–23 income years, eligible businesses may claim a bonus deduction equal to the lower of:

An entity will be eligible for the bonus deduction if, in the income year the expenditure is incurred, it is either:

To be eligible for the bonus deduction, expenditure must be incurred wholly or substantially for the purposes of an entity’s digital operations or digitising the entity’s operations. That is, the eligible expenditure must have a direct link to the entity’s digital operations for its business.

According to the Explanatory Memorandum, expenditure on digital operations or digitising operations may include, but is not limited to, business expenditure on:

![]() Note

Note

To claim the bonus deduction for an amount of expenditure, the entity must be able to deduct the eligible expenditure under another provision of the taxation law, regardless of which income year they claim the deduction.

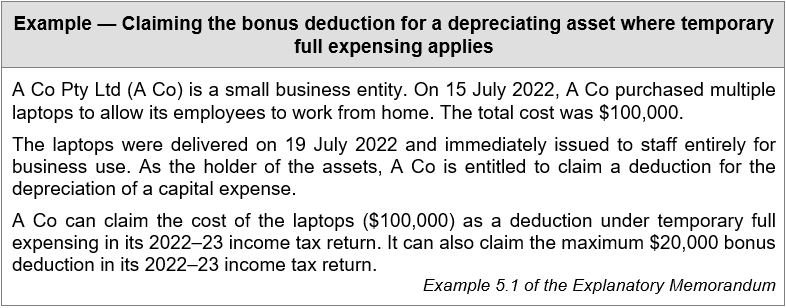

An entity can claim the bonus deduction for expenditure on a depreciating asset only if the asset is first used, or installed ready for use, before 1 July 2023. This rule does not apply to expenses incurred in the development of in-house software allocated to a software development pool, consistent with current pooling rules.

An entity cannot claim the bonus deduction for expenditure on a depreciating asset if any balancing adjustment event occurs to the asset while the entity holds it during the relevant time period, unless the balancing adjustment event is an involuntary disposal. This means, for example, that an entity cannot claim the bonus deduction if it sells the asset within the relevant time period.

Some types of expenditure are ineligible for the bonus deduction even where they would otherwise meet the requirements. These are:

The amount of the bonus deduction is calculated as 20 per cent of the total amount of eligible expenditure, up to a maximum bonus deduction of $20,000 per time period (i.e. income year).

This means that total expenditure eligible for the bonus deduction is effectively $100,000 over each time period, with a maximum bonus deduction of $20,000 per time period and an overall maximum total bonus deduction of $40,000.

For depreciating assets, the bonus deduction is equal to 20 per cent of the cost (within the meaning of Div 40 of the ITAA 1997) of an eligible depreciating asset that is used for a taxable purpose. This means that regardless of the method of deduction that the entity takes (i.e. whether immediate or over time), the bonus deduction in respect of a depreciating asset is calculated based on the asset’s cost.

When calculating the bonus deduction for expenditure on a depreciating asset, it is assumed that:

![]() Note

Note

The temporary full expensing rules for Div 40 taxpayers and the uncapped instant asset write-off for SBEs, which both provide an immediate write-off for the cost of acquiring eligible depreciating assets in the year incurred, apply for 2022–23.

The ATO’s 2023 tax return stationery includes new disclosures for the technology investment boost:

The technology investment boost ends on 30 June 2023 (unlike the skills and training boost which runs for another year). Taxpayers with intentions to invest in the digitalisation of their business will only be able to benefit from the boost if they incur the expenditure by 30 June 2023 — i.e. the end of this week.

In addition, if the expenditure is incurred in the acquisition of a depreciable asset (other than in-house software), the asset must be first used, or installed ready for use, before 1 July 2023. This means that the business cannot place an order this week and take delivery next week, i.e. in July — the expenditure would not be eligible for the boost.

The bonus deduction has no effect on the year in which the expenditure is deductible under another provision of the law. For example, a deduction under s. 8-1 may be claimable in 2021–22 while the boost is claimed in 2022–23.

If an eligible entity incurred qualifying expenditure in 2021–22, there is no need to amend the 2021–22 tax return — the bonus deduction is only to be claimed in the 2022–23 tax return.

Join us at the beginning of each month as we review the current tax landscape. Our monthly Online Tax Updates and Public Sessions are excellent and cost effective options to stay on top of your CPD requirements. We present these monthly online, and also offer face-to-face Public Sessions at 17 locations across Australia.

![]() Join us online

Join us online

Upcoming webinars >

![]() Register for a workshop

Register for a workshop

Upcoming workshops by state >

We can also present tax updates or specialty topics at your firm or through a private online session, with content tailored to your client base. Call our BDM Caitlin Bowditch at 0413 955 686 to have a chat about your specific needs and how we can assist.

Learn more about in-house training >

Our mission is to provide flexible, practical and modern tax training across Australia – you can view all of our services by clicking here.

Join thousands of savvy Australian tax professionals and get our weekly newsletter.