On 28 February 2023, the Government announced that it would reduce the superannuation tax concessions available to individuals whose total superannuation balance (TSB) exceeds $3 million, from 1 July 2025. The intention is to increase the headline tax rate to 30 per cent — up from the current 15 per cent — for earnings corresponding to the proportion of the individual’s TSB that is greater than $3 million. The announcement was subsequently followed up by the release of a Treasury fact sheet containing some detail about the intended operation of the proposed changes.

A month has passed, and on 31 March 2023, the Government released a consultation paper (the Consultation Paper) in relation to the implementation of the proposed changes. The consultation closes on 17 April 2023.

The Consultation Paper provides an overview of the proposed model for identifying who will be affected, how the tax will be calculated and what the new rules mean for individuals and trustees of both SMSFs and APRA-regulated funds. This article summarises the issues discussed in the Consultation paper.

Refer to our previous Banter Blog article titled Superannuation fund earnings for balances over $3m to be taxed at 30% from 1 July 2025 for an outline of the announcement and fact sheet.

The $3 million threshold applies to individuals of all ages, even if an individual is not eligible to access their superannuation benefits (i.e. under preservation age or under 65 and still working).

The threshold applies to individuals. It is not shared between spouses or family members, or between other individuals who have interests in the same fund, such as in a SMSF.

The measure commences on 1 July 2025, meaning the first test date will be 30 June 2026.

If an individual has more than one superannuation account, their TSB represents the combined value of all accounts as at 30 June each year. Individuals can check their TSB through ATO online services which can be accessed via myGov.

Example

Adapted from Consultation Paper example

Melanie is 62 and has three superannuation accounts with the following balances at 30 June 2026:

Melanie’s TSB on 30 June 2026 is $3.7 million. The earnings from $700,000 ($3.7 million – $3 million) will attract the additional tax.

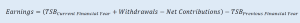

First, earnings in relation to an individual’s total superannuation interests are calculated as the difference between their TSB for the current year (adjusted for withdrawals and contributions) and their TSB from the previous financial year.

For example, on 30 June 2025, Sarah’s TSB is $5.5 million. On 30 June 2026, Sarah’s TSB increases to $6 million. Sarah makes a withdrawal of $150,000 during the year. Sarah’s calculated earnings are $650,000 ([$6 million + $150,000] – $5.5 million).

If the calculated earnings in the first step are negative, this amount is carried forward and can be used to offset future earnings for this purpose. In this case, no further calculations would be required.

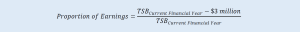

Second, earnings are attributed to superannuation balances of more than $3 million on a proportional basis. The proportion is equal to the proportion of the TSB over $3 million.

For example, Sarah’s TSB on 30 June 2026 is $6 million. The proportion of her TSB more than $3 million is 50 per cent ([$6 million – $3 million] ÷ $6 million). In this case 50 per cent of the calculated earnings from step 1 will attract the additional tax.

Finally, a flat tax rate of 15 per cent is applied to the proportion of earnings attributable to an individual’s balance over $3 million.

For example, Sarah’s calculated earnings are $650,000, however only 50 per cent of these earnings are attributed to her TSB more than $3 million and attract the additional 15 per cent tax.

Sarah’s tax liability is $48,750 (15% × $650,000 × 50%).

TSB — An individual’s TSB is the total value of accumulation phase and retirement phase interests plus in-transit rollovers and certain outstanding limited recourse borrowing arrangements (LRBA) less structured-settlement contributions.

Withdrawals — This is intended to capture amounts which have been removed from superannuation and are not reflected in the closing TSB.

Net Contributions — This is intended to capture amounts that were added to superannuation and are reflected in the closing TSB, net of any contributions tax.

The proposed adjustments for withdrawals and contributions are to ensure changes in TSB reflect earnings generated inside superannuation. The addback of withdrawals is to ensure that a decrease in the TSB as a result of a withdrawal does not represent negative earnings generated inside superannuation. The subtraction of after tax contributions is to ensure an increase in the closing TSB reflects positive earnings, not amounts an individual has contributed to their superannuation account during the year.

![]() Note:

Note:

Stakeholder views are being sought to determine whether modifications to the TSB are required for the purposes of calculating the earnings tax liability.

If an individual’s TSB from the previous financial year is less than $3 million and their TSB for the current financial year (after adjusting for withdrawals and contributions) is more than $3 million, the previous financial year’s TSB will be adjusted to equal $3 million for the purposes of calculating earnings. This approach ensures that any growth in the fund that occurs below the $3 million threshold is not counted as earnings.

An amount of negative earnings will be able to be used to offset positive earnings in future years. This will be done on a gross basis (that is, before proportioning of earnings occurs).

Negative earnings can be applied against any future positive earning, would not expire and could be applied over multiple years. Capital losses that are reflected in negative earnings can be used to offset any future positive earnings that relate to income, including rent and interest.

Where the current TSB (after factoring in withdrawals and net contributions) is less than $3 million, the current financial year’s TSB will be adjusted to equal $3 million for the purposes of calculating earnings. This ensures that individuals who drop below the threshold are able to have negative earnings recognised for future years (in the event that their balance grows again to exceed the threshold).

The amount of earnings which correspond to an individual’s balance that exceeds $3 million will be determined on a proportional basis. The proportion of earnings will be equal to the proportion of the individual’s TSB above $3 million.

A flat rate of 15 per cent tax will be applied to the proportion of earnings corresponding to an individual’s TSB more than $3 million. The amount of additional tax will be determined by the ATO and levied directly on individuals.

The 15 per cent tax would be imposed separately to personal income tax, and it is intended that the amount of tax payable would not be able to be reduced by deductions, offsets or losses available under the personal income tax system.

As ATO calculations will be based on information reported to them by superannuation funds, assessments for a financial year will only be able to be completed after superannuation funds have reported all required information.

Individuals would have the option of paying their liability either by releasing amounts from one or more of their superannuation interests or by paying the liability from funds held outside of superannuation.

As all superannuation funds, including SMSFs, already report the required information to calculate TSBs, this avoids imposing additional reporting obligations on funds and members. SMSFs with unlisted assets, such as real property, already report market valuations for these assets on an annual basis for the purposes of calculating the TSB. This measure will not require additional valuation reporting by SMSFs.

While the proposed approach is intended to leverage existing reporting requirements to minimise the regulatory impact on superannuation funds and members, it is expected some additional reporting by superannuation funds may be required. This would be expected to include reporting on benefit payments by APRA-regulated funds — noting SMSFs already report benefit payments at the member level on an annual basis.

Where additional information is required, it is proposed the ATO would receive this information directly from superannuation trustees. This could be done through changes to the general reporting requirements, specific requests for information by the ATO, or a combination of both.

The Consultation Paper also discusses issues specific to defined benefit interests and Constitutionally Protected Funds.

Various examples in the Consultation Paper

Carlos is 69 and retired. He has a total superannuation balance of $9 million on 30 June 2025, which grows to $10 million on 30 June 2026. He draws down $150,000 during the year and makes no additional contributions to the fund.

Carlos’s earnings are calculated by adding back the value of his withdrawals to his closing TSB and then taking the difference between his opening and closing TSB.

![]()

Earnings = ($10 million + $150,000) – $9 million = $1.15 million

The proportion of Carlos’ earnings attributable to excess amounts above $3 million are calculated using the following formula:

Using this calculation, the proportion of earnings attributed to his balance in excess of $3 million is ($10 million – $3 million) ÷ $10 million = 70 per cent.

Carlos’ earnings that are subject to tax at the higher rate are $805,000 (70 per cent x $1.15 million).

The 15 per cent tax is applied to Carlos’ calculated earnings of $805,000. This results in tax payable of $120,750.

Carlos receives the notice of his tax liability from the ATO. He has the choice to pay this amount using amounts in his personal name or release money from his superannuation account. He elects to pay the amount from his superannuation account by completing the election form. The ATO requests the release of $120,750 from Carlos’ superannuation fund.

On 31 March 2023, the Government released a consultation paper in relation to the proposal to increase the tax rate on superannuation balances exceeding $3 million. The paper sets out the proposed methodology for calculating earnings subject to the additional tax.

Join us at the beginning of each month as we review the current tax landscape. Our monthly Online Tax Updates and Public Sessions are excellent and cost effective options to stay on top of your CPD requirements. We present these monthly online, and also offer face-to-face Public Sessions at 17 locations across Australia.

Join us online

April Tax Update >

Upcoming webinars >

We can also present these Updates at your firm or through a private online session, with content tailored to your client base. Call our BDM Caitlin Bowditch at 0413 955 686 to have a chat about your specific needs and how we can assist.

Learn more about in-house training >

Our mission is to provide flexible, practical and modern tax training across Australia – you can view all of our services by clicking here.

Join thousands of savvy Australian tax professionals and get our weekly newsletter.