On Tuesday 28 February 2023, the Government announced that the superannuation fund concessional tax rate applied to accumulation phase earnings will increase from 15 per cent to 30 per cent for taxpayers with superannuation balances above $3 million, from the 2025–26 income year.

The Treasury has now released its Better targeted superannuation concessions factsheet containing more detail about how the proposed measure will operate.

By 2025–26 the reduction in the tax concession is expected to affect fewer than 80,000 individuals, or less than 0.5 per cent of people with a superannuation account.

The 2022–23 Tax Expenditures and Insights Statement — also released on Tuesday — shows that revenue foregone from superannuation tax concessions amounts to about $50 billion a year, and is projected to exceed the cost of the Age Pension by 2050. The proposed restriction to the tax concession is expected to generate revenue of about $2 billion in its first full year of revenue.

The higher 30 per cent rate only applies to the proportion of earnings corresponding to the part of the account balance that exceeds $3 million.

![]() Important

Important

Earnings corresponding to the balance up to $3 million will continue to be taxed at the 15 per cent concessional rate.

The superannuation fund will continue to pay tax at 15 per cent on earnings in accummulation. The individual will be liable for the additional tax of 15 per cent.

Earnings will be calculated with reference to the difference between the individual’s total superannuation balance (TSB) at the start and end of the financial year, adjusting for withdrawals and contributions.

![]() Note

Note

An individual’s TSB includes all of their superannuation interests and is not a separate figure for each interest — i.e. the $3 million threshold will be applied on a per-individual basis and not on a per-account or per-fund basis.

Individuals can view their TSBs via ATO online services.

The Government seeks to avoid imposing significant and costly systems and reporting changes that could indirectly affect the majority of members who will be unaffected by this measure. The proposed approach is based on existing fund reporting requirements. As funds do not report (or generally calculate) taxable earnings at an individual member level, the proposed measure uses an alternative method for identifying taxable earnings for affected individuals.

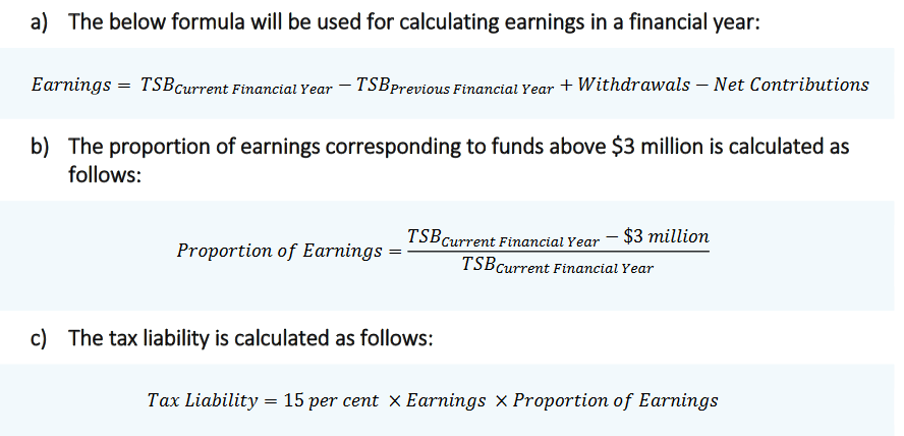

The calculation method, as reproduced from the fact sheet, is as follows:

The formula calculates the difference between the member’s TSB for the current and previous financial years and adjusts for net contributions (which excludes contributions tax paid by the fund on behalf of the member) and withdrawals.

![]() Important

Important

The calculation of earnings includes all notional (unrealised) gains and losses, similar to the way superannuation funds currently calculate members’ interests.

Negative earnings will be able to be carried forward to reduce the tax liability in future years.

Individuals will have the choice of either paying the tax themselves or from their superannuation funds.

Individuals with multiple funds will be able to elect the fund from which the tax is paid.

The tax will be separate to the individual’s personal income tax liabilities.

TSBs in excess of $3 million will be tested for the first time on 30 June 2026, with the first notices of a tax liability expected to be issued to individuals in the 2026–27 financial year.

Individuals will be notified of their liability to pay this tax by the ATO.

The Government intends to minimise any additional reporting requirements for superannuation funds. The ATO already uses superannuation fund reporting to calculate the total amount that individuals have in the superannuation system, for other purposes, such as eligibility to make non-concessional contributions.

The Government intends to ensure broadly commensurate treatment for defined benefit interests. Treasury will consult on the appropriate treatment for defined benefit interests.

While the media announcement focused on accumulation phase earnings, the subsequently released detailed fact sheet indicates that earnings subject to the additional tax will be calculated based on a comparison of the individual’s closing and opening TSBs. An individual’s TSB at a point in time relevantly includes the retirement phase value of their superannuation interests, as well as the accumulation phase value. Therefore the taxable earnings will take into account the unrealised gain or loss in the retirement phase balance as well as the accumulation phase value.

The media release and fact sheet are silent as to whether the $3 million threshold will be indexed.

The proposed measure will not impose a limit on superannuation balances in the accumulation phase. It only affects the taxation of the earnings on the balance exceeding $3 million.

Legislation has not yet been drafted. The Government will introduce legislation ‘as soon as practicable’ and will be consulting with the superannuation industry and other relevant stakeholders regarding implementation of the measure.

Carlos is 69 and retired. His SMSF has a superannuation balance of $9 million on 30 June 2025, which grows to $10 million on 30 June 2026. He draws down $150,000 during the year and makes no additional contributions to the fund.

This means Carlos’s calculated earnings are:

$10 million – $9 million + $150,000 = $1.15 million

His proportion of earnings corresponding to funds above $3 million is:

($10 million – $3 million) ÷ $10 million = 70%

Therefore, his tax liability for 2025–26 is:

15% × $1.15 million × 70% = $120,750

Louise is 40 and working. At 30 June 2026, she has a balance of $2 million in an APRA-regulated fund, and a balance of $3 million in an SMSF. At 30 June 2025, the balance of her APRA-regulated fund was $1.9 million and the balance of her SMSF was $2.9 million. She does not meet a condition of release, so she has no withdrawals during the year. She makes $20,000 of concessional contributions into her SMSF. Her contributions net of tax on contributions is $17,000.

This means Louise’s calculated earnings are:

$5 million – $4.8 million – $17,000 = $183,000

Her proportion of earnings corresponding to funds above $3 million is:

($5 million – $3 million) ÷ $5 million = 40%

This means her tax liability for 2025–26 is:

15% × $183,000 × 40% = $10,980

Louise elects to pay $5,000 from her APRA-regulated fund and $5,980 from her SMSF.

Dave is 70 and has two APRA-regulated funds and one SMSF. At 30 June 2025, his TSB across all funds was $7 million. During 2025–26, he withdraws $400,000 from his SMSF and makes no contributions. At 30 June 2026, his TSB across all funds is $6 million.

This means Dave’s calculated earnings are:

$6 million – $7 million + $400,000 = – $600,000

His proportion of earnings corresponding to funds above $3 million is:

($6 million – $3 million) ÷ $3 million = 50%

The earnings loss attributable to the excess balance is $300,000. Dave can carry forward the $300,000 to offset future excess balance earnings.

At 30 June 2027, Dave’s funds make earnings on his excess superannuation balance of $650,000. He carries forward the earnings losses attributable to his excess balance at 30 June 2026 of $300,000 and is only liable to pay the tax on $350,000 of earnings.

This means his tax liability for 2026–27 is:

15% × $350,000 = $52,000

Join us at the beginning of each month as we review the current tax landscape. Our monthly Online Tax Updates and Public Sessions are excellent and cost effective options to stay on top of your CPD requirements. We present these monthly online, and also offer face-to-face Public Sessions at 17 locations across Australia.

Join us online

March Tax Update >

April Tax Update >

Join us at an upcoming workshop

Melbourne Tax Workshop > 9 March

Perth Tax Workshop > 9 March

Werribee Tax Workshop > 10 March

Newcastle Tax Workshop > 15 March

Personalised training options

Personalised training optionsWe can also present these Updates at your firm or through a private online session, with content tailored to your client base. Call our BDM Caitlin Bowditch at 0413 955 686 to have a chat about your specific needs and how we can assist.

Learn more about in-house training >

Our mission is to provide flexible, practical and modern tax training across Australia – you can view all of our services by clicking here.

Join thousands of savvy Australian tax professionals and get our weekly newsletter.