[lwptoc]

The impact of the COVID-19 pandemic on the economy has been far-reaching, and almost everyone’s work habits have been impacted in some way. Whether that is a change of schedule, updated responsibilities, or a change in work location. Many people are now taking client meetings via zoom, working from home, and are restricted in movements due to government-imposed lockdowns.

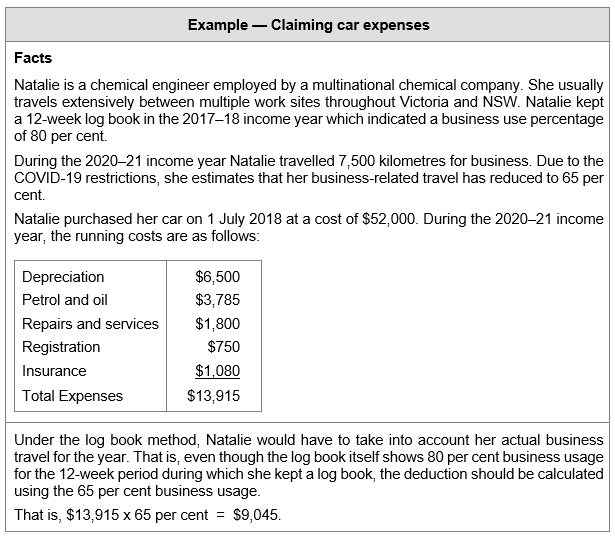

For many people, this may mean that there will be a decrease in car and travel expenses for the 2020–21 and potentially the 2021–22 income year. When claiming car and travel expenses using the logbook method, a taxpayer uses a representative period from the last five years as indicative of current use. But what does this mean for claiming car expenses for a period where the use of the car has changed due to changed work habits as a result of the COVID-19 pandemic?

Given the ATO’s extensive and ever-expanding compliance and data matching capabilities, incorrect car expense claims are more likely to be detected and disproved than ever before. Car and travel expense claims are a focus for the Commissioner year-on-year, and the Commissioner has already flagged that work-related expense claims will be targeted to ensure taxpayers aren’t copy and pasting claims from previous years, given the impact that the pandemic has had on many people’s day-to-day work habits.

The car expense deduction rules for individuals in Div 28 of the ITAA 1997 permit taxpayers to calculate deductions using one of two methods — the ‘cents per kilometre’ method and the ‘log book’ method. This article provides an overview of claiming car expenses using the log book method, and what to do if work habits have changed since the logbook was recorded.

Reference

Reference

The rules for using the log book method are set out in Subdiv 28-F of the ITAA 1997.

A taxpayer can use the logbook method if they held, i.e. owned or leased, a car for some or all of the income year. The logbook provides a record of the car use for at least continuous 12 weeks, which will serve as a representative period of car travel for the income year. The records are then used to determine a business-use percentage, by comparing the proportion of business-related kilometres to total kilometres travelled (i.e. business-related travel plus travel of a private or domestic nature).

The percentage determined from the logbook can be used to claim a deduction for car expenses for up to five years, assuming that the percentage is still representative of the actual use of the car during that income period.

![]() Definition — car expense

Definition — car expense

A ‘car expense’ is defined in s. 28-13.

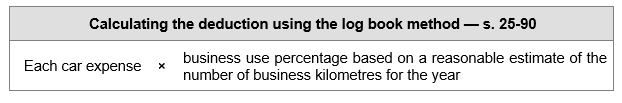

When using the logbook method, a deduction for car expenses is worked out as follows:

![]() Implications

Implications

While the substantiation requirements of using the log book are the most onerous of the methods available, if there is extensive business travel throughout the year, using the logbook method can be preferable because the amount that may be claimed is greater.

The business use percentage which the taxpayer can use is calculated under s. 28-90(3) as:

The number of business kilometres is based on a ‘reasonable estimate’. In making that reasonable estimate, the taxpayer must take into account all relevant matters including:

The substantiation requirements for the log book method are set out in Subdivs 28-G, 28-H and 28-I. They require that:

The rules about keeping a log book are prescriptive:

Odometer records

Odometer records basically document the total number of kilometres the car travelled during a particular period. They also record the car’s engine capacity and other details.

Specifically, the records must state in English:

The records must be in English and made as soon as possible after the start or end of the period or the particular replacement day.

The records must also state:

These records must be made prior to lodging the return or within such time as the Commissioner allows.

Retention of log book and odometer records

Log books must be retained for five years after the end of the latest year in which the person relied on the log book. The five-year period runs from the due date for lodging the return for the latest year or, if the taxpayer lodges late, from the actual date of lodgment. If the log book is not retained for the whole period, the claims made based on the log book can be disallowed.

Odometer records must be retained for the period in each year when the car is held. If a log book is retained, odometer records must be kept for the same period as the log book. The five-year retention period applies in the same way.

If the year of income is one during which a log book was not kept, the odometer records must be kept and retained for the same period as any written evidence of the expenses is kept for that year. This will also generally be for five years.

The general record-keeping provisions in Div 900 of the ITAA 1997 also apply. Subdivision 900-C (about substantiating car expenses) provides that for the log book method of deducting a car expense, the taxpayer must substantiate the expense by getting written evidence in accordance with Subdiv 900-E.

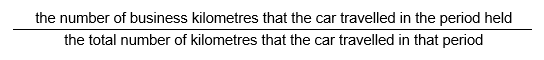

For expenses (other than the decline in value of a depreciating asset) a document must be obtained from the supplier and it must set out, in English or in the language of the country in which the expense was incurred:

PS LA 2005/7 sets out the evidence that the Commissioner will generally accept for substantiating an individual’s claim for deductible work and car expenses (for non-business taxpayers).

Generally, a document or a combination of documents (such as invoices, receipts etc.) that contain the five items stated in s. 900-115(2) — see above — should be accepted as written evidence.

Records made and stored electronically are recognised as documents.

Where the above documents are insufficient, the Commissioner will accept the following documents (or combinations of documents) as evidence of expenses:

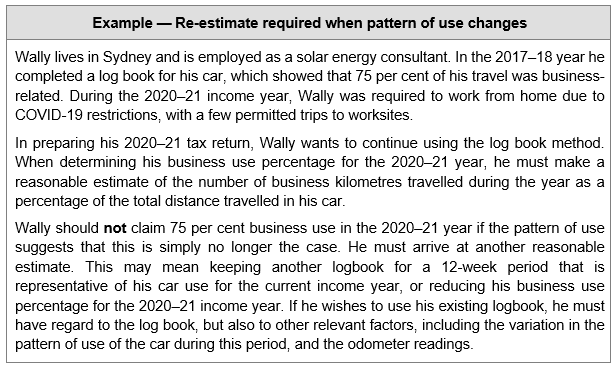

As outlined above, a log book provides a representative period of travel which is used to work out how much of a car expenses is deductible. If the pattern of car usage has changed after the log book was completed due to COVID-19 movement restrictions, does a new logbook need to be kept for an updated representative period of private and business usage during the COVID-19 pandemic? Not necessarily.

Under the law there are only two situations in which a taxpayer is legally obliged to keep a log book for an income year before the five-year expiry:

However this does not mean that taxpayers should or could simply apply the business use percentage calculated using pre-pandemic logbook data. A log book is only one of the ‘relevant matters’ which the taxpayer is required to take into account in determining their reasonable estimate of the business kilometres travelled (see ‘Working out the business use percentage’ above). The taxpayer is obliged to consider the impact of work restrictions as well as any other relevant matter in conjunction with their log book.

However there is nothing to prevent a taxpayer from voluntarily creating a new log book. Indeed, in some cases this may be advantageous for the taxpayer to support a higher business use percentage where they could travel substantial distances as an authorised/permitted worker but private use of the vehicle decreased by comparison.

The ATO has provided the following guidance in its COVID-19 FAQ — Work-related car expenses:

Question: I claim my car-related expenses using the logbook method. Will I need to keep a new logbook for an updated representative period of private and business usage during COVID-19?

Answer: No, you are not required to keep a new logbook for the period in which your travel has been affected by COVID-19 as long as you account for any variation in the use of the car when working out your business kilometres and your business use percentage at the end of the income year.

When working out your business kilometres at the end of the income year, you need to make a reasonable estimate based on any logbooks, odometer records or other records you have.

In relation to the period in which your travel has been affected by COVID-19, you may keep a new logbook if you think it will provide a more accurate indication of your business use of the car. However if your overall business usage has not changed and you are merely using the car less, the odometer readings will reflect this and you will not need to keep another logbook.

![]() Note

Note

A taxpayer may choose between the log book method and the cents per kilometre method per car on a year-by-year basis. Where the pattern of car usage changed substantially for an income year, the method which the taxpayer does not usually use may produce a better outcome.

For more information about car expense deductions, and other overview and refresher tax topics designed to mirror the everyday tasks found in the workplace, check out our upcoming 2 day Tax Fundamentals workshop, taking place in Sydney and Melbourne throughout the next few weeks.

One of our most popular offerings, this workshop is a great way to upskill your junior staff, those returning to the accounting profession, or anyone wishing for a refresher to the complex Australian tax system.

What we’ll cover: Deductions, Assessable income, Depreciation rules, CGT, GST, FBT, Business & investment structures, Superannuation & Business administration

Right now, we’re also offering 2 spaces for the price of one – so get in quick!

Sydney | 24-25 November | Details and registrations >

Melbourne | 1-2 December | Details and registrations >

Catering and all materials are included.

Can’t make these sessions or prefer online training? Check out Tax Fundamentals Online or sign up to be notified for our 2022 offerings.

Our mission is to offer flexible, practical and modern tax training across Australia – you can view all of our services by clicking here.

Join thousands of savvy Australian tax professionals and get our weekly newsletter.