Recently the Australian National Audit Office (ANAO) released its performance audit report into the ATO titled Australian Taxation Office’s Engagement with Tax Practitioners.

Reviews in 2015 and 2018 of the ATO’s engagement with and support for tax practitioners identified concerns with the ATO’s transparency, communication and level of service. The ATO’s engagement with tax practitioners was identified by the Joint Committee of Public Accounts and Audit as an audit priority of the Parliament.

The objective of the audit was to assess the effectiveness of the ATO’s engagement with tax practitioners in achieving efficient and effective taxation and superannuation systems.

To form a conclusion against the objective, the following criteria were adopted:

The audit methodology included:

The ATO is largely effective in implementing its tax practitioner engagement activities. The development of a strategic and performance framework for tax practitioner engagement would allow the impact on the efficiency and effectiveness of the taxation and superannuation systems from the ATO’s engagement activities to be assessed.

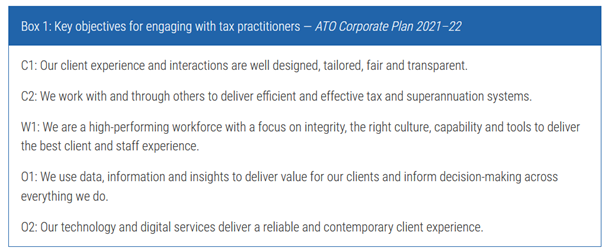

The ATO has a partly effective strategic framework for engaging with tax practitioners. While there have been various engagement objectives and documented strategies over time, these are not always clearly aligned to demonstrate how the strategies contribute to achieving the engagement objectives. Coordinated strategic planning is developing. The implementation of tax practitioner targeted strategies has not always been supported by documented implementation planning. External performance reporting on tax practitioner engagement is limited in scope. The ATO does not have a fully formed performance framework to assess the effectiveness of its strategic approach to engaging with tax practitioners.

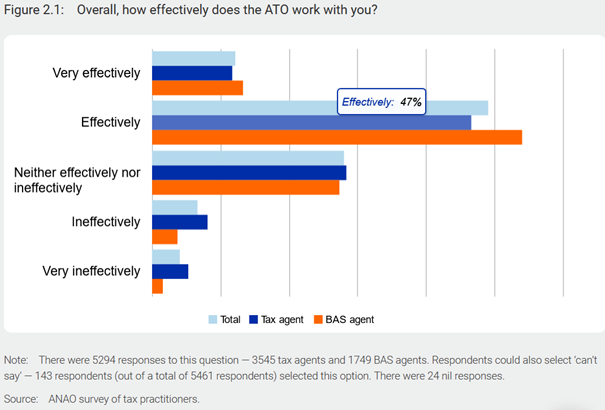

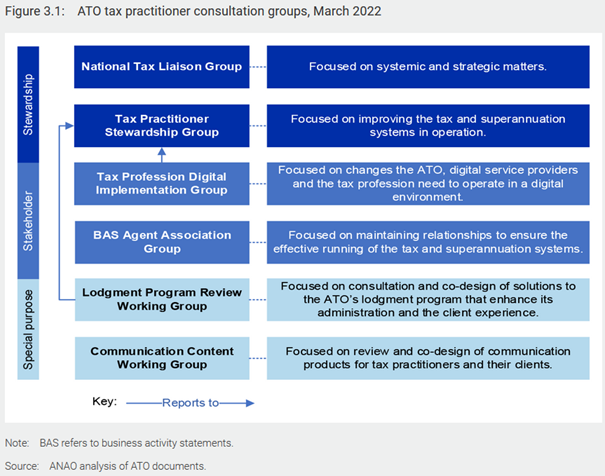

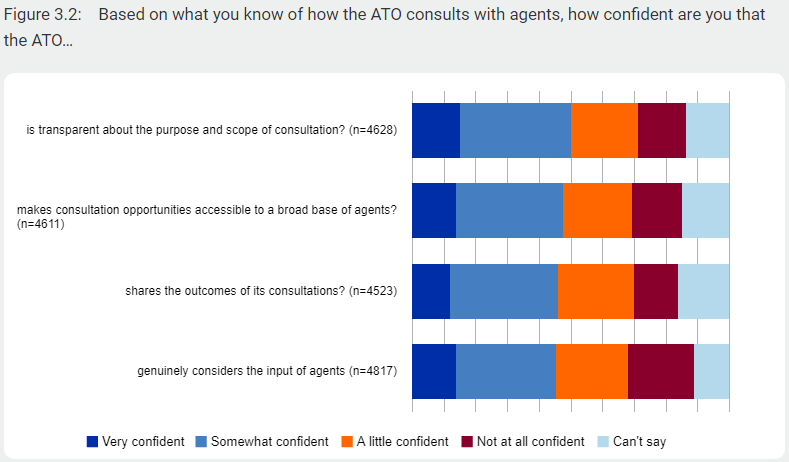

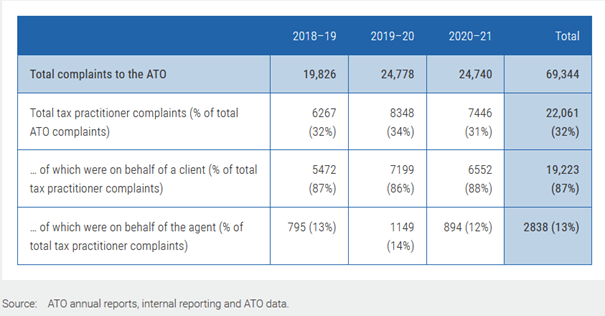

The ATO has a largely effective approach to consulting tax practitioners to inform the development of its strategy, services and support. There is an entity-level consultation framework and there are tax practitioner consultation channels, including standing and special purpose consultation groups. Tax practitioner consultations reviewed by the ANAO are broadly consistent with Australian Public Service standards for engagement. The ATO has an established process for identifying consultation participants, although criteria supporting the selection of consultation group members are not defined. The ATO publicly reports key messages from its consultation group meetings and provides some public information about the outcomes of its consultation activities. The ATO has not comprehensively reviewed the effectiveness of its tax practitioner consultation practices.

The ATO provides largely effective services and support for tax practitioners. The ATO plans, although it does not always review the effectiveness of, its communications to tax practitioners. Two key tax practitioner programs reviewed as part of the audit are supported through largely effective communications. The ATO monitors the performance of its tax practitioner enquiry channels in terms of timeliness of response. Monitoring of service quality through the channels, including whether enquiries were satisfactorily resolved by skilled staff, is less evident. Digital services for tax practitioners are largely fit for purpose.

Recommendation no. 1

In finalising its overarching tax practitioner engagement strategy, the ATO more clearly link its strategies to its tax practitioner engagement objectives and better communicate its strategic engagement approach with tax practitioners.

ATO response: Agreed.

The ATO will more clearly link its strategies to tax practitioner engagement objectives and better communicate its strategic engagement approach with tax practitioners.

Recommendation no. 2

The ATO develop a performance framework that provides a basis for assessing its performance in engaging with tax practitioners to achieve efficient and effective taxation and superannuation systems.

ATO response: Agreed.

The ATO will develop a performance framework that provides a basis for assessing its performance in engaging with tax practitioners to achieve efficient and effective taxation and superannuation systems.

Recommendation no. 3

The ATO document selection criteria to support transparency, consistency and diversity in selection of tax practitioners for standing and special purpose consultation groups.

ATO response: Agreed.

The ATO will document selection criteria to support transparency, consistency and diversity in selection of tax practitioners for standing and special purpose consultation groups.

Recommendation no. 4

The ATO consult with tax practitioners to better understand their concerns regarding the registered agent phone line and use this feedback to guide the development of future service offerings.

ATO response: Agreed.

The ATO agrees that it will consult with tax practitioners to better understand their concerns regarding the registered agent phone line and use this feedback to guide the development of future service offerings.

The ATO welcomes this review and the report’s finding that the ATO is largely effective in implementing its tax practitioner engagement activities.

Tax practitioners are one of the ATO’s key partners and we value the strong collaborative relationship that exists. We are very proud of our engagement with tax practitioners and we are pleased the audit recognises the strength of our approach to consultation and the services and support we offer to tax practitioners.

We note the period covered by the audit was one during which tax practitioners and the ATO encountered unprecedented impacts and challenges arising from COVID-19. We are proud of the way we worked with the tax profession to deliver critical stimulus measures to the community, and immediate and tailored support for tax practitioners and their clients.

The ATO is focussed on continuous improvement and provision of contemporary products and services to tax practitioners and their clients. The report makes four recommendations which are agreed by the ATO. We will take on board the report’s findings as we continue to refine and improve the ways by which we engage with tax practitioners.

Join us at the beginning of each month as we review the current tax landscape. Our monthly Online Tax Updates and Public Sessions are excellent and cost effective options to stay on top of your CPD requirements. We present these monthly online, and also offer face-to-face Public Sessions at 16 locations across Australia. Click here to find a location near you.

Upcoming Public Offer sessions:

Personalised training options

Personalised training optionsWe can also present these Updates at your firm, or through a private online session, with content tailored to your client base – please contact us here to submit an expression of interest or visit our In-house training page for more information. You can also reach us at 1300 TAX CPD for a chat about your training needs and how we can assist you.

Our mission is to offer flexible, practical and modern tax training across Australia – you can view all of our services by clicking here.

Join thousands of savvy Australian tax professionals and get our weekly newsletter.