The ATO has released its final guidance in relation to a revised fixed-rate approach to claiming deductions for additional running expenses incurred while working from home with effect from 1 July 2022. PCG 2023/1 is available here and the accompanying Compendium here.

See the ATO’s media release here and its updated website guidance here.

Working from home deductions for additional running expenses

There are two categories of working from home expenses. Running expenses relate to the use of facilities within the taxpayer’s home (e.g. electricity, depreciation, internet and phone), and occupancy expenses are incurred by the taxpayer to own, rent or use their home (e.g. mortgage interest, rent, rates and home insurance). The revised ATO guidance, and this article, only relate to the claiming of additional running expenses incurred as a result of working from home. For guidance on the deductibility of occupancy expenses, refer to TR 93/30 and the ATO website guidance.

The legislation does not prescribe any specific method of calculating deductions for running expenses, but the ATO has long established methods which it allows taxpayers to use.

Prior to 1 July 2022

Prior to 1 July 2022, to calculate a deduction for expenses incurred as a result of working from home, the taxpayer had the choice of using one of the following methods:

- shortcut method — available from 1 March 2020 to 30 June 2022 — allowed 80 cents per hour for each hour a taxpayer worked from home. This temporary method was intended to provide administrative relief for the many taxpayers forced to work from home temporarily during COVID restrictions

- fixed-rate method — available from 1 July 1998 to 30 June 2022 — allowed 52 cents per hour for each hour a taxpayer worked from home (a revised fixed-rate method applies from 1 July 2022 — see below)

- actual cost method — calculating the actual expenses incurred as a result of working from home.

Changes from 1 July 2022

On Thursday 16 February, the ATO issued PCG 2023/1 titled Claiming a deduction for additional running expenses incurred while working from home — ATO compliance approach (the Guideline).

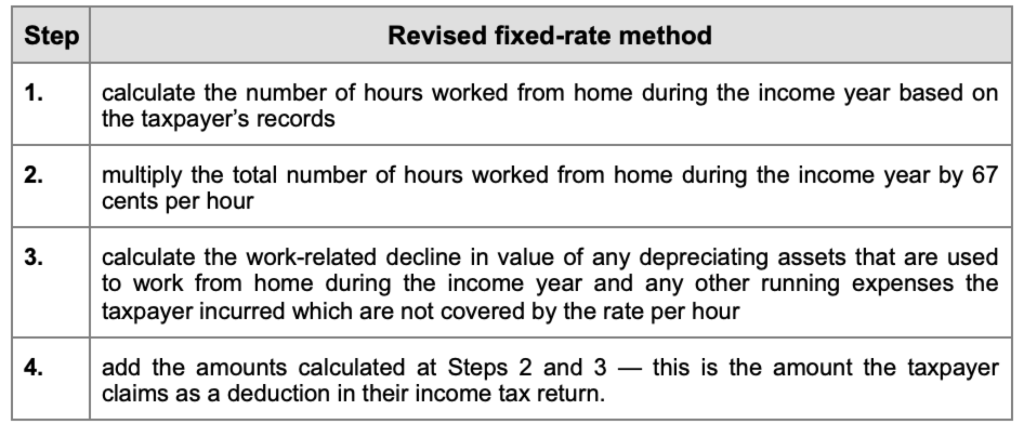

The Guideline outlines the ATO’s updated practical compliance approach, referred to as the revised fixed-rate method, which taxpayers can use to calculate their deduction for additional running expenses. The Guideline applies from 1 July 2022 and allows taxpayers to claim a rate of 67 cents per hour for particular expenses which are difficult to apportion, such as electricity and internet expenses. While the rate per hour has increased, the running costs included have changed and there are more record-keeping requirements.

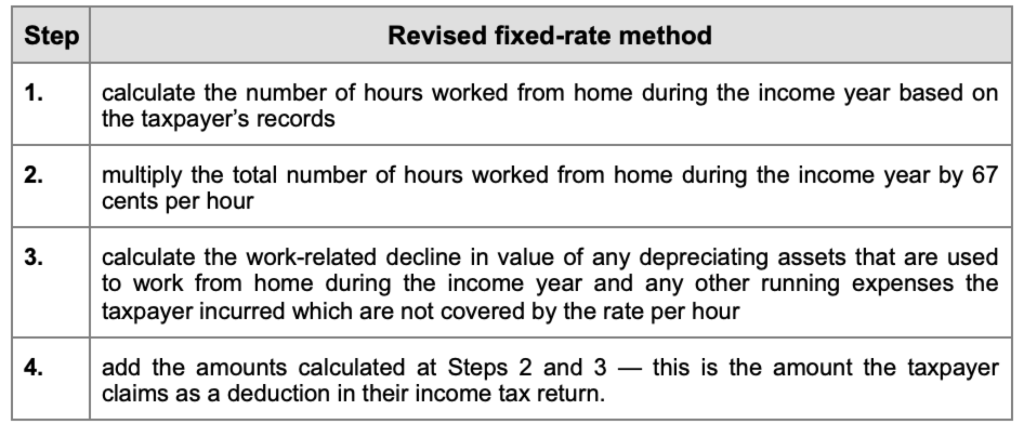

Deductions for the decline in value of all work-related depreciating assets are calculated separately.

From 1 July 2022 the taxpayer can only:

- use the revised fixed rate method to calculate the deduction, or

- claim actual expenses.

From 1 July 2022, the 80 cents per hour shortcut method is no longer available. If a taxpayer is unable to use the revised fixed-rate method, they will need to use their actual expenses to claim a deduction.

Note

Note

The Guideline was issued in draft as PCG 2022/D4 (the draft Guideline) on 2 November 2022. Material changes between the draft and final Guidelines are noted in the summary of the Guideline below.

PS LA 2001/6 has been updated as a result of the publication of the Guideline to remove the rules for the former 52 cents per hour fixed-rate method.

The revised fixed-rate method from 1 July 2022 — PCG 2023/1

Eligibility to use the revised fixed-rate method

Taxpayers are eligible to rely on the Guideline to calculate deductions using the revised fixed-rate method if they meet the following criteria.

Criteria 1 — Working from home

The taxpayer must be working from home while carrying out their employment duties or while carrying on their business on or after 1 July 2022. The work has to be substantive and directly related to the taxpayer’s income-producing activities.

Criteria 2 — Incurring deductible additional running expenses

The taxpayer must incur additional running expenses listed in the Guideline (see below) which are deductible under s. 8-1 of the ITAA 1997 as a result of working from home.

A comparative exercise is not required to demonstrate that a taxpayer has incurred additional running expenses as a result of working from home. This can be demonstrated by the number of hours the taxpayer has worked from home.

Where a third party (e.g. an employer) reimburses a taxpayer for additional running expenses, the taxpayer will not satisfy this criterion.

Where invoices and bills are in the name of one member of the household but the cost is shared, each member of the household who contributes to the payment of that expense will be taken to have incurred it.

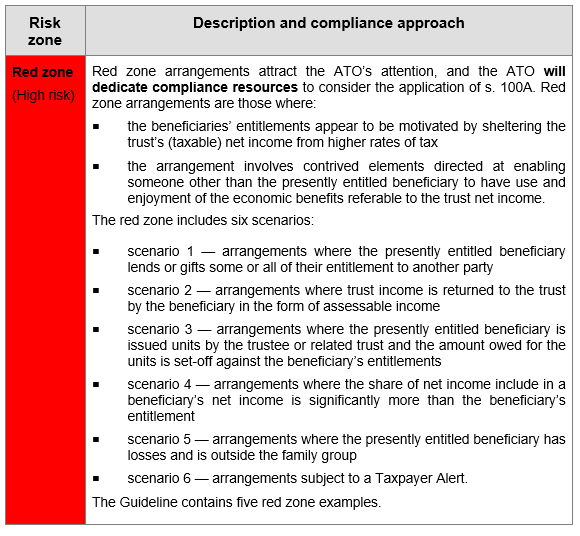

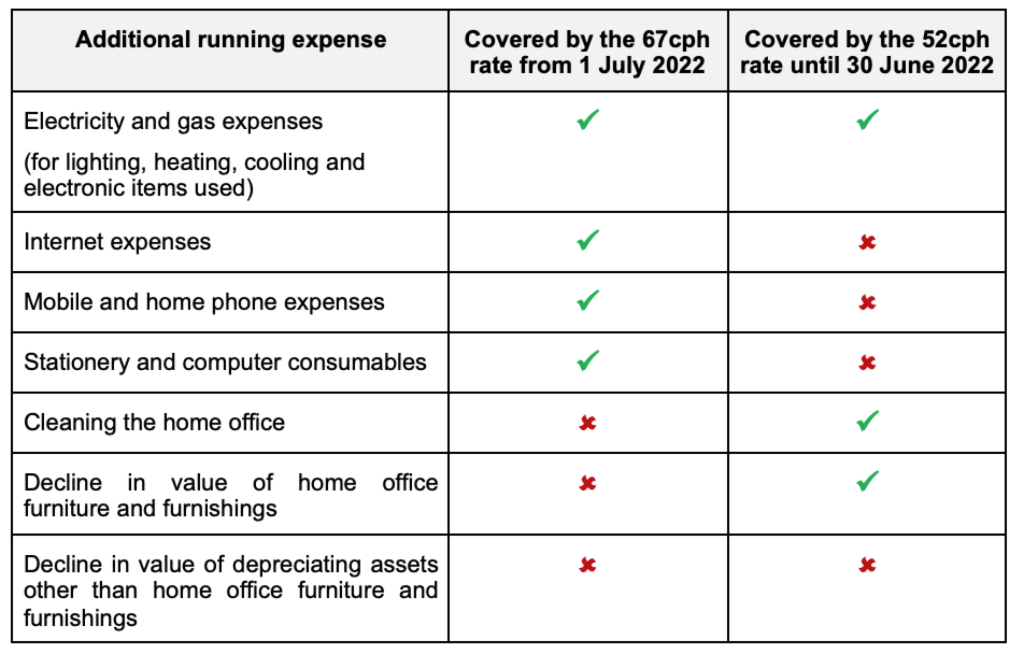

The additional running expenses which are covered by the 67 cents per hour rate differ from the expenses covered by the previous 52 cents per hour rate:

Under both the former and new fixed-rate rules, a taxpayer who uses the fixed-rate method to calculate their deduction for additional running expenses cannot claim a separate deduction for any expenses covered by the rate ( ). They can however, claim a separate deduction for any expenses not covered by the rate (

). They can however, claim a separate deduction for any expenses not covered by the rate ( ), in accordance with the relevant rules, e.g. s. 8-1 general deductions, Div 40 decline in value deductions or Div 28 car expense deductions. These additional deductions are not subject to the ATO’s compliance approach that applies to the relevant fixed-rate method.

), in accordance with the relevant rules, e.g. s. 8-1 general deductions, Div 40 decline in value deductions or Div 28 car expense deductions. These additional deductions are not subject to the ATO’s compliance approach that applies to the relevant fixed-rate method.

Note

Note

In response to a submission that the inclusion of mobile phone expenses in the revised fixed-rate, particularly taxpayers with high mobile phone expenses, is unfair, the ATO notes in the Compendium that based on its evidence, taxpayers find it difficult to apportion mobile phone expenses and including this expense in the rate overcomes this difficulty. A deduction for the decline in value of the phone can also be claimed.

The ATO provides the same explanation for the inclusion of internet expenses in the revised fixed rate.

Cleaning expenses are not included in the rate as they are only deductible where a taxpayer has a separate dedicated home office space, which is not a requirement to use the revised fixed-rate method.

Criteria 3 — Keeping and retaining relevant records

The taxpayer must keep:

- records showing the total number of hours they worked from home during the income year (see below)

- one document (e.g. an invoice, bill or credit card statement), for each of the listed running expenses which they have incurred during the income year.

In addition, a taxpayer claiming a deduction for the decline in value of depreciating assets (separately from the fixed-rate per hour deduction) used while working from home must keep relevant records (see below).

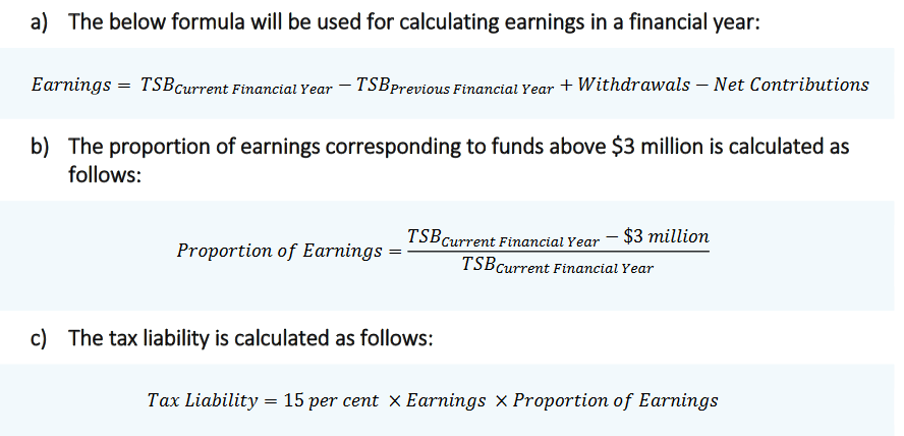

Calculating the deduction using the revised fixed-rate method

A taxpayer’s total deduction for running expenses using the revised fixed-rate method is calculated using the following steps:

Record-keeping requirements

Keeping records of hours worked

For the 2022–23 income year

Special transitional rules apply for the 2022–23 income year. A taxpayer must keep the following records:

- from 1 July 2022 to 28 February 2023 — a record which is representative of the total number of hours worked from home

- from 1 March to 30 June 2023 — a record of the total number of actual hours worked from home for the period.

In the draft Guideline, taxpayers could use a representative record only until 31 December 2022. The end date has been extended as the Guideline was not finalised until 16 February 2023.

For the 2023–24 and later income years

From 1 July 2023, A taxpayer must keep a record for the entire income year of the number of hours worked from home.

A record of hours for the income year can be in any form, provided it is kept contemporaneously. For example, records may be kept in one of the following forms:

- timesheets

- rosters

- logs of time the taxpayer spent accessing employer systems or online business systems

- time-tracking apps

- a diary or similar document kept contemporaneously.

(The third and fourth examples have been included since the draft Guideline was published.)

This is not an exhaustive list of the types of records which may be appropriate.

Important

Important

The ATO will not accept an estimate based on hours worked during a shorter period during the income year.

Keeping records of running expenses

The taxpayer must also keep evidence for each of the additional running expenses that they incurred.

For energy, mobile and home phone and internet expenses, the taxpayer must keep one monthly or quarterly bill. If the bill is not in the taxpayer’s name, they will also have to keep additional evidence showing they incurred the expenses, e.g. a joint credit card statement showing payment or a lease agreement showing they share the property, and therefore the expenses, with others.

For stationery and computer consumables, which are occasional expenses, the taxpayer must keep one receipt for an item purchased.

Critical Point

Critical Point

If the taxpayer does not keep evidence of the total hours they worked from home and for each of the running expenses they incurred, they will not be able to rely on the Guideline to calculate their additional running expenses.

Keeping records for decline in value

As the decline in value of depreciating assets is not covered by the revised fixed-rate per hour, to claim a deduction for decline in value the taxpayer must keep the written evidence required by Div 900 or the ITAA 1997 (for employees) and s. 262A of the ITAA 1936 (for taxpayers carrying on a business).

An employee must keep, for each depreciating asset, a document which shows:

- the name or business name of the supplier

- the cost of the asset

- the nature of the asset

- the day the asset was acquired

- the day the record was made out.

The taxpayer must also keep records which demonstrate their work-related use of the depreciating asset. This can be evidenced by records of a representative four-week period that show personal and income-producing use of the depreciating assets.

For depreciating assets used in carrying on a business, they must keep records that record and explain all transactions.

The ATO’s compliance approach

The Commissioner will not apply compliance resources to review a taxpayer’s deduction for working from home expenses if the taxpayer:

- meets the eligibility criteria to use the revised fixed-rate method

- uses the method to calculate additional running expenses incurred as a result of working from home.

Important

Important

The Guideline will not apply if:

-

- the number of hours which the taxpayer uses in Steps 1 and 2 above exceeds the number of hours they actually worked at home

- the taxpayer claims a separate deduction for any of the listed expenses

- the taxpayer lodges an objection in relation to their working from home expenses for whatever reason — only the actual expenses the taxpayer incurred as a result of working from home and for which the taxpayer has adequate records will be allowed as a deduction.

The ATO notes that:

‘When a taxpayer disputes whether a working from home expense is deductible, either at objection or before the Administrative Appeals Tribunal or Courts, they will need to establish that the particular expense was incurred and is deductible under the law. This is a different process to us not applying compliance resources to verify if a particular expense is deductible.’

Examples

The Guideline contains eight practical examples.

Example 2 — Taxpayer cannot rely on the practical compliance approach

Dan is employed as a financial adviser. Under the terms of his employment agreement, Dan must be in the office at least 3 days per week and can either work in the office or from home for the other 2 days per week. Dan only works from home if he does not have client meetings, so he does not always work 2 days per week from home.

In his tax return for the 2022–23 income year, Dan claims a deduction of $815 for his working from home expenses using the revised fixed-rate method.

In February 2024, Dan’s claim for his working from home expenses for the 2022–23 income year is subject to review by the ATO. When he responds to the request to substantiate his claim of $815, Dan sends a document setting out the following calculation:

Hours worked from home = 2 days per week × 8 hours per day × 49 weeks = 784 hours

Office chair = $290

Additional running expenses = 784 hours × 67c = $525

Total deduction = $525 + $290 = $815.

Dan does not provide any records to demonstrate that he worked from home for 784 hours during the income year, nor does he provide any evidence to show he incurred any running expenses. However, he does provide his purchase receipt for the chair that shows it was purchased on 10 December 2022 for $290.

When questioned about how he calculated the number of hours he worked from home, Dan indicates that he estimated that he worked from home on average for 2 days each week for around 8 hours a day and that he had 3 weeks’ leave during the year. In relation to his running expenses, Dan indicates he incurred electricity, internet and mobile phone expenses and that he might have some documents to demonstrate he incurred them but he would need to look for them.

When Dan is asked if he was able to locate one bill for his electricity, internet and mobile phone expenses, Dan indicates that he has been able to locate a mobile phone and internet bill but not any of his electricity bills. However, Dan is able to provide one of his credit card statements showing a payment to an electricity provider on 10 February 2023.

Dan cannot rely on the practical compliance approach because he has not kept a record of the hours he worked from home during the income year. Instead, an estimate was provided.

However, Dan can claim the actual expenses he incurred as a result of working from home. Based on the evidence Dan has been able to provide, his only deduction will be for his office chair. As the office chair costs less than $300 and was only used for work purposes, Dan’s deduction for working from home expenses is reduced from $815 to $290.

If Dan objects to his Notice of Amended Assessment for the 202–-23 income year, he is not able to use the revised fixed-rate method as the basis for his objection. He must use the actual expenses method. The objection would only be allowed if he is able to substantiate that these expenses were incurred as a result of working from home.

Example 6 — Taxpayer not incurring additional running expenses

Sergei is employed as a graphic design artist. He works in the office 3 days per week and works from home 2 days per week. Sergei lives with his parents and when he works from home, he works in his bedroom using his employer-provided laptop and mobile phone. Sergei does not pay his parents any rent and he does not contribute to any of the household bills.

Although Sergei is carrying out his employment duties while working from home, he is not incurring additional running expenses. Accordingly, Sergei is not entitled to a deduction for additional running expenses and he cannot rely on the Guideline.

Example 7 — Keeping and retaining relevant records

Pamela is employed as a solicitor. She works from home some evenings or on the weekend, in order to meet deadlines. The number of hours Pamela works from home varies from week to week.

During the income year, Pamela keeps a record of the total number of hours she spends working from home. She does this by making an entry in her electronic calendar when she starts and finishes working from home on a particular day.

When she is working from home during the income year, Pamela incurs electricity and internet expenses. Pamela is also claiming the decline in value of a desk and a laptop computer she uses when she works at home.

To show she has incurred additional running expenses, Pamela keeps:

- one quarterly electricity bill

- one monthly invoice for her home internet

- receipts for the desk and laptop that she purchased and uses while working from home

- records demonstrating her work-related use of her desk and laptop.

Pamela has kept relevant records for the income year. If Pamela meets the other criteria in the Guideline, she can rely on the Guideline to calculate her additional running expenses.

Further info and training

Join us at the beginning of each month as we review the current tax landscape. Our monthly Online Tax Updates and Public Sessions are excellent and cost effective options to stay on top of your CPD requirements. We present these monthly online, and also offer face-to-face Public Sessions at 17 locations across Australia.

Join us online

March Tax Update >

April Tax Update >

Join us at an upcoming workshop

Gold Coast Tax Workshop > 22 Feb

Mitcham Tax Workshop > 24 Feb

Fremantle Tax Workshop > 2 March

Melbourne Tax Workshop > 9 March

View all upcoming workshops >

Personalised training options

Personalised training options

We can also present these Updates at your firm or through a private online session, with content tailored to your client base. Call our BDM Caitlin Bowditch at 0413 955 686 to have a chat about your specific needs and how we can assist.

Learn more about in-house training >

Our mission is to provide flexible, practical and modern tax training across Australia – you can view all of our services by clicking here.

![]() Note

Note

![]() Note:

Note:

Personalised training options

Personalised training options

Important

Important Critical Point

Critical Point

![Now hiring: Administrative Assistant role available [Melbourne, hybrid]](https://taxbanter.com.au/wp-content/uploads/2023/01/job-blog-2.png)

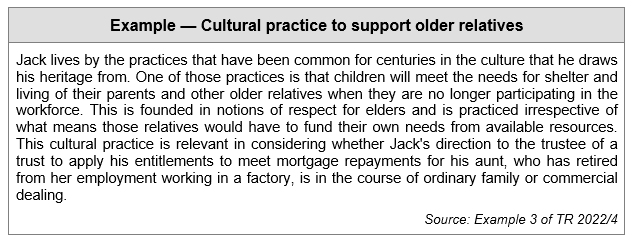

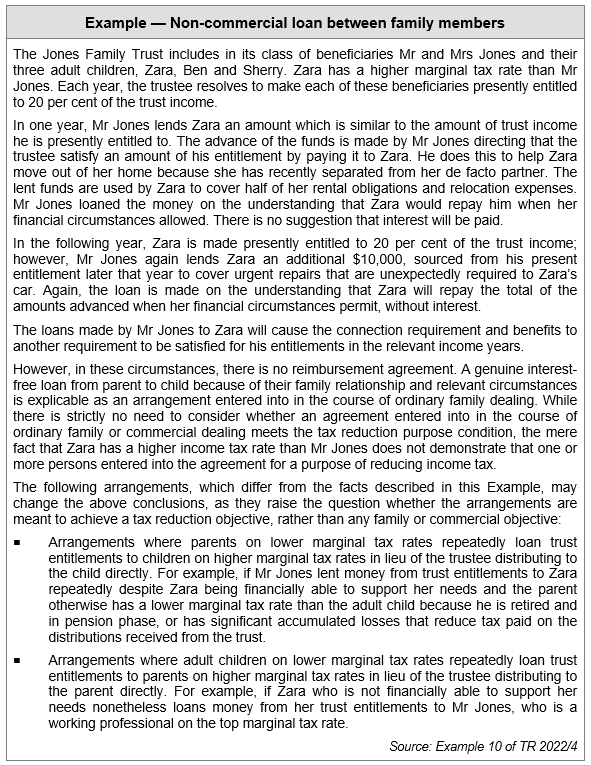

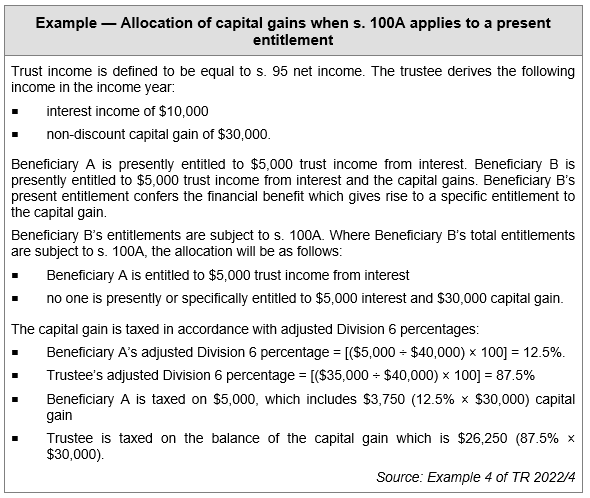

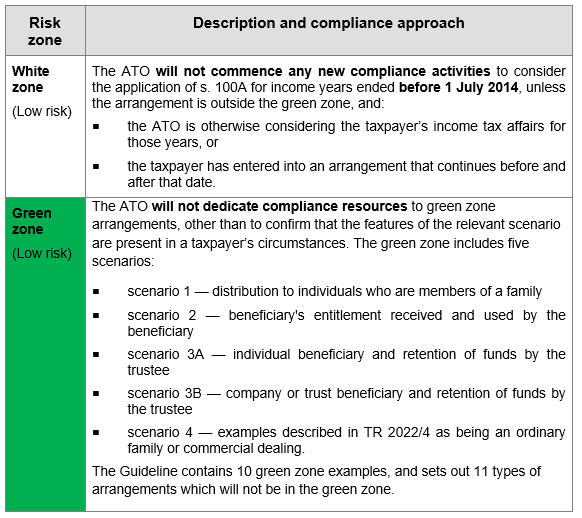

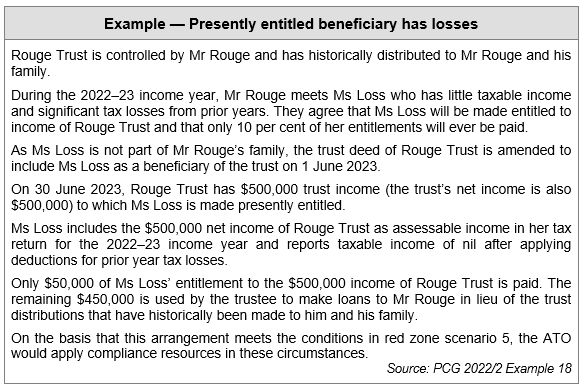

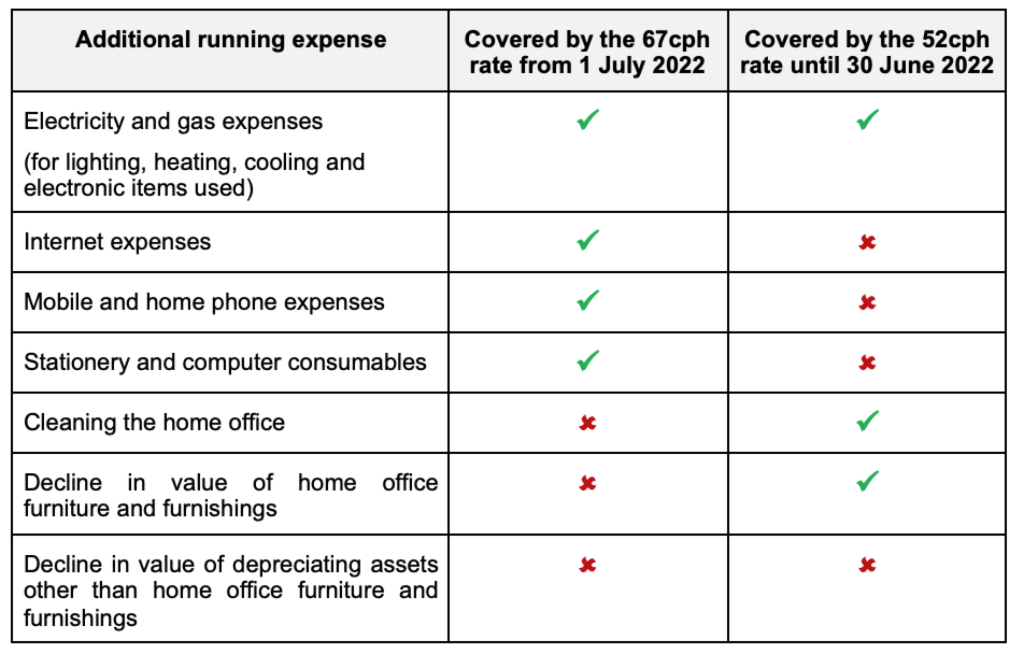

Note: There are two Federal Court decisions which concern s. 100A that are currently subject to appeal in the Full Federal Court. Those decisions are Guardian AIT Pty Ltd ATF Australian Investment Trust v FCT [2021] FCA 1619 (Guardian) and BBlood Enterprises Pty Ltd v FCT [2022] FCA 1112 (BBlood). The Ruling refers to these cases.

Note: There are two Federal Court decisions which concern s. 100A that are currently subject to appeal in the Full Federal Court. Those decisions are Guardian AIT Pty Ltd ATF Australian Investment Trust v FCT [2021] FCA 1619 (Guardian) and BBlood Enterprises Pty Ltd v FCT [2022] FCA 1112 (BBlood). The Ruling refers to these cases.