Almost invariably, the quick ‘introduce yourself’ at the start of every one of TaxBanter’s Tax Fundamentals sessions reveals a participant who is getting back into the game after a stint on the bench. Whether it has just been relatively short period of parental leave, or a more substantial period working in an area outside tax, the seemingly rhetorical question often uttered is, ‘how much could possibly have changed’? The answer usually surprises.

TaxBanter’s business is about this change. In the 2019 calendar year the Tax Update comprised 570,088 words, on 1,623 pages, and this was in a ‘slow year’ due to the federal election. So far this year TaxBanter has producted 491,495 words over 1,208 pages — (on target) even though there has been an economic meltdown and a slowdown of the Courts.

Whilst many tax changes are considered a ‘simplification’ or a ‘better targeting’ of the law and accordingly are relatively small in nature, incrementally they all add up. These teamed with larger ‘integrity’ type changes can result in significant knowledge gaps.

Whilst the above figures show the volume of change in even just one year, the following table outlines, from a tax fundamentals perspective, a selection of notable changes occurring in the past five years.

| Change | Details | Effective start time |

| Income | ||

| Domicile test for residency | The first statutory residency test for an individual includes a person whose domicile is in Australia, unless the Commissioner is satisfied that the person’s permanent place of abode is outside Australia.

The Full Federal Court decision in Harding v FCT [2019] FCAFC 29 determined that ‘place of abode’ refers not only to a dwelling but can also refer to a country. |

Interpretation of existing law |

| Working holiday maker tax regime | Rather than determining whether a ‘working holiday maker’ is a resident or not for tax purposes (and therefore which scale of tax rates apply), individuals holding a subclass 417 visa, a subclass 462 or certain bridging visas are instead subject to an income tax rate of 15 per cent for taxable income up to $37,000 — i.e. no tax-free threshold. The rates applicable to income above this amount are the same as the ordinary marginal income tax rates. | 1 January 2017 |

| Deductions | ||

| Travel to inspect rental properties | Subject to exclusions, travel expenditure incurred in gaining or producing assessable income from residential premises is not deductible and is not recognised in the cost base or reduced cost base of the property for CGT purposes. | 1 July 2017 |

| Deductions for vacant land | A deduction for a loss or outgoing incurred in relation to the holding of land on which there is no substantial and permanent structure is now available only in certain circumstances, such as where the land is in used, or available for use, in carrying on a business or for expenses incurred by specific entities such as a company.

Denied deductions can be included in the cost base of the asset. |

1 July 2019 |

| Capital Allowances | ||

| Instant asset write off | Whilst an instant deduction for ‘low-cost’ assets has been a key feature of the small business depreciation rules since their commencement, from 1 July 2015 there is ‘increased access’. ‘Increased access’ has taken the form of an increase in both the amount that can be immediately deducted and the turnover threshold for a business to be eligible.

Depending on when the asset was acquired and installed ready for use and the turnover of the entity, the amount of an immediate deduction has increased as follows:

* Up until 1 April 2019 available to SBEs only ** From 2 April available to business with turnover up to $50 million *** From 12 March 2020 business with turnover up to $500 million can access the measure See Banter Blog article $150,000 instant asset write-off extended to 31 December 2020 |

Various |

| Investment incentive | A time-limited investment incentive of a deduction for 50 per cent of the cost of an eligible asset first held and started to be used in the period with existing depreciation rules applying to the balance of the cost is available for businesses with a turnover of less than $500 million. | 12 March 2020 to 30 June 2021 |

| CGT | ||

| Foreign residents and the main residence exemption (MRE) | The MRE will no longer be available for an individual who is a foreign resident at the time the relevant CGT event happens to their dwelling. There are some limited exclusions and a transition rule for CGT events that happen before 1 July 2020.

See Banter Blog article Year end 2020 tax planning – foreign residents and sale of main residence |

7:30 pm (AEST) on 9 May 2017 |

| GST | ||

| ‘Netflix tax’ — GST on imported services and digital products | Broadly, these changes amended the GST Act in relation to supplies of digital products to:

|

1 July 2017 |

| GST on low value imported goods | This amendment ensures that GST is payable on certain supplies of low value goods that are purchased by consumers and are imported into Australia.

The amendments:

|

1 July 2018 |

| Withholding for GST on supplies of new residential premises | Purchasers of new residential premises and new subdivisions of potential residential land are required to make a payment of part of the purchase price to the ATO for the GST component of the supply.

The amount to be paid by the purchaser is generally 1/11th of the ‘contract price’ — unless the margin scheme applies, the supply is between associates, or there are multiple different types of supplies or multiple purchasers. |

1 July 2018 |

| FBT | ||

| Exempt work-related items — portable devices | Small business entities (SBEs) are able to provide more than one work‐related portable device to employees, even if the devices perform substantially similar functions. Other employers are limited to one device per FBT year. | 1 April 2016 |

| Commercial car park interpretation | The ATO has changed, and as such widened, its position on what constitutes a commercial car park for the purposes of the FBT car parking fringe benefits rules. In Draft Ruling TR 2019/D5 the Commissioner’s preliminary position is that a car park, which satisfies all other requirements, can still be considered a ‘commercial parking station’ even if:

|

1 April 2021 |

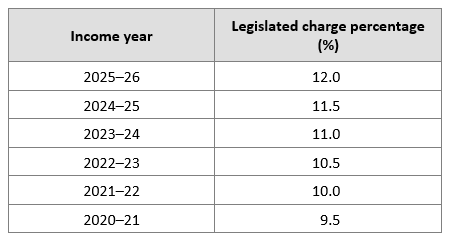

| Superannuation | ||

| Superannuation overhaul — Fair and Sustainable Superannuation | As part of the ‘Fair and Sustainable Superannuation’ legislative package, changes were made to the superannuation system including:

|

1 July 2017 |

| Catch-up concessional contributions | Individuals who have a total superannuation balance of less than $500,000 on 30 June of the previous year can increase their concessional contributions cap in the next financial year if they have unused concessional contributions cap amounts from the previous five financial years. | 1 July 2018 |

| Non-arm’s length income (NALI) | A superannuation entity’s NALI now includes income where expenditure incurred in gaining or producing it was not an arm’s length expense (known as non-arm’s length expenditure or NALI).

This includes circumstances where no expense was in fact incurred, but might be expected to have been incurred if the transaction was on arm’s length terms. |

1 July 2018 |

| Salary sacrifice and superannuation guarantee (SG) | Broadly, the legislation now ensures that:

|

1 January 2020 |

| Multiple employers and SG | The SGA Act allows individuals to ‘opt out’ of the SG regime to avoid unintentionally breaching their concessional contributions cap when they receive superannuation contributions from multiple employers. These employees can apply to the Commissioner for an ‘employer shortfall exemption certificate’. The effect of the Certificate is that an employer’s maximum contribution base is nil in relation to the employee for the quarter to which the Certificate relates. Accordingly, the employer will not be liable for SG charge (or face other consequences under the SGA Act) if they do not make contributions on behalf of the employee for the quarter. | 1 July 2018 |

| Deductions for superannuation contributions made through the Small Business Superannuation Clearing House (SBSCH) | In Practical Compliance Guideline PCG 2020/6 the Commissioner states that he will not apply compliance resources to determine which income year an employer can deduct superannuation contributions made through the SBSCH to a superannuation fund or RSA where:

|

Ongoing |

| Business structures | ||

| SBE definition | The aggregated turnover threshold for access to most small business tax concessions has been increased to $10 million. However, the aggregated turnover threshold for access to:

|

1 July 2016 |

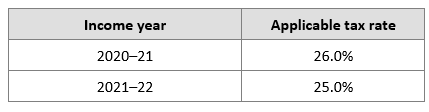

| Base rate entity (BRE) and the corporate tax rate | From 1 July 2017, the concept of a ‘base rate entity’ has been introduced into the tax law and is relevant for determining eligibility for the lower corporate tax rate.

A base rate entity is a company that:

|

1 July 2017 |

| Corporate tax rate for imputation purposes | In calculating the maximum franking credit that can be allocated to a company distribution, the definition of the corporate tax rate for imputation purposes requires the entity to make the following additional assumptions:

|

1 July 2017 |

| Tax Administration | ||

| Foreign Resident Capital Gains Withholding Payments | Where a foreign resident disposes of certain taxable Australian property, the purchaser must withhold 12.5 per cent of the first element of cost base (i.e. usually the purchase price) from the sale proceeds and pay that amount to the ATO.

There are a number of exclusions, including a where the market value of the CGT asset is less than $750,000, and the CGT asset is:

|

1 July 2016 |

| Single Touch Payroll (STP) | The STP reporting framework require the real-time reporting of withholding payments, amounts withheld, salary or wages and ordinary time earnings, and superannuation contributions, including salary sacrificed contributions, at the time of withholding or payment.

Subject to some limited exceptions, all employers need to use STP to report the above amounts to the ATO. |

1 July 2018 |

| No tax deduction for non-compliant payments | A tax deduction for a payment:

is denied if the associated withholding obligations have not been complied with. |

1 July 2019 |

Some of the changes which have occurred have not yet taken effect, and some have been proposed but not legislated.

Back in the 2016–17 Federal Budget (handed down on 3 May 2016) the Government announced that it would make targeted amendments to improve the operation and administration of Div 7A by:

The start date of these proposed changes has been deferred several times. Most recently, on 30 June 2020, the Assistant Treasurer announced the start date would again be revised, to income years commencing on or after the date of Royal Assent of the enabling legislation.

There is a current proposal to increase the maximum number of allowable members in SMSFs and small APRA funds from four to six. Whilst this measure was initially proposed to commence from 1 July 2019, the Assistant Treasurer on 30 June 2020 announced a deferral of the start date to Royal Assent of the enabling legislation.

On Wednesday 7 Oct, we will be facilitating a Federal Budget webinar with our Managing Director Neil Jones at 10am – we’ll cover the implications of the news, along with a live Q&A so you can get around the latest changes. You can attend live or listen to the recording post-session.

Click here for more info.

Our Tax Fundamentals Online program is geared for recent graduates, those returning to the profession and anyone wishing to get a refresher in the world of tax. It’s a nine-module, interactive course that you can finish in your own time.

It covers:

Click here for more info or to register for the program.

Join thousands of savvy Australian tax professionals and get our weekly newsletter.