[lwptoc]

In February, the ATO released three new publications in relation to the income tax and FBT treatment of employee travel expenses. These are:

| TR 2021/1 | Income tax: when are deductions allowed for employees’ transport expenses?

This Ruling sets out when an employee can deduct transport expenses under s. 8-1 of the Income Tax Assessment Act 1997. This includes the cost of travel by airline, train, taxi, car, bus, boat, or other vehicle. |

| TR 2021/D1 | Income tax and fringe benefits tax: employees: accommodation and food and drink expenses, travel allowances, and living-away-from-home allowances

This draft Ruling explains:

|

| PCG 2021/D1 | Determining if allowances or benefits provided to an employee relate to travelling on work or living at a location — ATO compliance approach

This draft Guideline outlines the ATO’s compliance approach to determining if employees in certain circumstances are travelling on work or living at a location away from their normal residence (living at a location). |

![]() Note:

Note:

Draft Ruling TR 2017/D6 has been withdrawn. The content has been replaced by TR 2021/1 and TR 2021/D1.

An employee can only deduct a transport expense under s. 8-1 to the extent that:

Substantiation requirements must also be satisfied for the employee to claim the deduction.

While transport expenses will only be deductible if they satisfy the requirements of s. 8-1, the following factors (based on relevant case law) would support a characterisation of transport expenses as being incurred in gaining or producing assessable income:

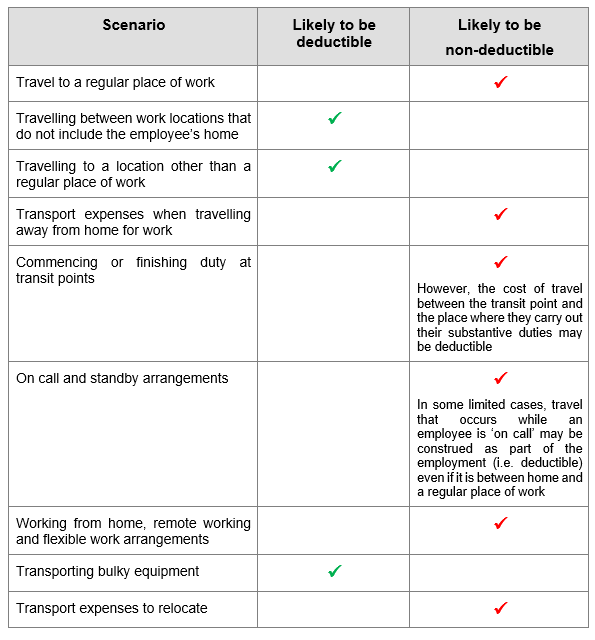

The Ruling considers the deductibility of employee transport expenses in a range of common circumstances listed below.

The following table summarises the general rule that applies to each category. However each category has conditions and exceptions and it is necessary to read the Ruling for detail.

The Ruling applies both before and after its date of issue (17 February 2021). To the extent that there is any conflict between the Ruling and draft Rulings TR 2017/D6 and TR 2019/D7, the Commissioner will have regard to the earlier draft rulings in deciding whether to apply compliance resources in income years to which the earlier draft applies.

The Ruling contains 12 examples. Set out below are two examples illustrating different outcomes where an employee travels between their home and a distant work location which requires an overnight stay, and one example about an ‘on call’ employee.

(Example 5 in TR 2021/1)

Isabelle is a specialist technician who lives in Brisbane. She works as an employee for a company based in Sydney on a part-time basis. On the days she is required to work (Wednesdays and Thursdays), she drives from her home in Brisbane to the airport, catches a flight to Sydney and then a taxi to her company’s office. She stays overnight in Sydney on Wednesday night and returns home on Thursday evening. Isabelle’s transport expenses (travel between her home and Brisbane airport, return flights from Brisbane to Sydney and taxis between Sydney airport and her office) are not deductible. Isabelle’s travel is undertaken to put her in the position to commence her duties and the expenses are not incurred in gaining or producing her assessable income. The expenses are incurred as a necessary consequence of Isabelle choosing to live in Brisbane and work in Sydney and are a prerequisite to gaining or producing her assessable income. Isabelle’s travel between her home and her regular workplace is also private in nature.

![]() Note:

Note:

In contrast, where the nature of the employment requires an employee to travel away from home overnight, for purposes explained by their employment and not because of where they have chosen to live, the transport expenses incurred in travelling to the alternative work location will be incurred in the course of gaining or producing the employee’s assessable income.

(Example 6 in TR 2021/1)

Duy works for a company in Rockhampton, where he lives. One of the employment duties attached to Duy’s role is to attend a two-day meeting and meet clients in Brisbane once a fortnight. Duy flies from Rockhampton to Brisbane on the day of the meeting and returns home the following evening. He also catches a taxi from his home to Rockhampton airport and from Brisbane airport to the office. He does the same in reverse when he returns home. The cost of Duy’s flights and taxis between his home in Rockhampton and the office in Brisbane are deductible as the travel occurs while Duy is engaged in carrying out the employment duties attached to his role. Duy has a regular place of work in Rockhampton and in the performance of his duties travel is undertaken to an alternative destination which is not a regular place of work. Duy is required by the specific requirements of his role to carry out his duties of employment both in Rockhampton and Brisbane. The travel to Brisbane is not attributable to Duy’s choice to live in Rockhampton, or do part of his job in Brisbane. Therefore, the transport expenses are incurred in gaining or producing Duy’s assessable income and are deductible.

(Example 10 in TR 20201/1)

Christine is a highly-trained computer consultant who is involved in supervising a major conversion in computer facilities which her employer provides for its customers. This requires her to be on call 24 hours a day. In order to assist in diagnosing and correcting computer faults while she is at home after her normal work hours, Christine’s employer installs specialised equipment at her home. Typically, matters can be resolved by Christine at home with the use of this equipment but if the problem cannot be resolved at home, Christine travels to the office in order to progress the matter further.

Christine’s cost of travel between her home and the office every day is not incurred in gaining or producing her assessable income. They relate to private travel between her home and her regular work location. However, in circumstances where Christine is called to correct a fault after hours and where she commences work on that fault at home but has to travel to her employer’s premises because she cannot rectify it at home, the cost of travel between her home and the office will be deductible. Although this travel is between her home and a regular work location, the cost of these abnormal journeys is deductible because Christine commences substantive work prior to leaving home and then completes that work once she attends the office. Christine does not choose to do part of the work of her job in two separate places, but rather the two places of work are a fundamental part of Christine providing specialised support arising from the nature of her special duties. The expenses she incurs in travelling to the office in such circumstances are incurred in gaining or producing her assessable income.

![]() Note:

Note:

A contrasting situation is where an employee waits at home for advice from their employer whether they are required to work, in a sense on ‘standby’, and does not commence any substantive duties at the place where they receive the call or request from their employer. In such a case, when the employee is advised that they are required at their regular place of work, the expenses of travelling to that regular place of work are not deductible.

The draft guidance for when an employee can deduct accommodation and food and drink expenses under s. 8-1 mirrors the guidance in TR 2021/1 in relation to the deductibility of transport expenses. That is, according to the draft Ruling, an employee can on deduct accommodation and food and drink expenses to the extent that:

The applicable substantiation requirements must also be satisfied for the employee to claim the deduction.

Living expenses are a prerequisite to gaining or producing an employee’s assessable income and are not incurred in performing an employee’s income-producing activities.

A person must eat and sleep somewhere, whether or not they engage in employment.

The occasion of the outgoing on accommodation and food and drink must be found in the employee’s income-producing activities, rather than in the personal circumstances of where the employee lives.

If any of the following factors apply, the employee will not be travelling on work and the accommodation and food and drink expenses incurred will be living expenses:

[The emphasised expressions are discussed in detail in the draft Ruling.]

Incidental expenses are minor, but necessary expenses associated with travelling on work. This might include a car parking fee, a bus ticket or a charge for using the phone or internet for work-related purposes. If an employee is travelling on work and incurs incidental expenses, those expenses will be deductible under s. 8-1.

If accommodation and food and drink expenses are only partly incurred in gaining or producing assessable income, apportionment is required. Only that portion of the expense that relates to the employee’s income-producing activities is deductible.

In cases where there is no obvious method of apportionment, it is to be done on a ‘fair and reasonable’ basis.

Employees who travel frequently to the same location may choose to rent or buy a property rather than stay in a hotel or other commercial accommodation when travelling on work.

A deduction is allowable for expenses incurred in financing, holding and maintaining an additional property which an employee purchases or rents if it is occupied by them as accommodation in the course of travelling on work, except to the extent the expenses are capital, private or domestic in nature.

No deduction will be allowed for additional property expenses if the travel undertaken by the employee is a consequence of the employee’s personal circumstances, including their choice about where to live.

Additional property expenses must be apportioned between deductible and non-deductible where:

There may be FBT implications for an employer where the employer:

The draft Ruling contains 12 practical examples.

(Example 6 in TR 2021/D1)

Mario lives and works in Melbourne. He is employed by a large insurance company. Mario’s regular place of work is his employer’s office in the Melbourne CBD. One of Mario’s duties is to train new staff. When his employer engages some new staff in its Warrnambool office (260 kilometres away), Mario is required to travel to Warrnambool to train the new staff on site for a three-week period. Mario stays in a motel near the Warrnambool office from Sunday to Thursday night for each of the three weeks he is giving the training and returns home on Friday evenings for the weekend.

Mario is not living in Warrnambool away from his usual residence for the three-week period he is giving the training because:

The expenditure that Mario incurs on accommodation and food and drink during the period of the training is occasioned by Mario’s income-producing activities. Mario is travelling on work and the expenditure he incurs on accommodation and food and drink while he is working at the Warrnambool office is deductible.

(Example 5 in TR 2021/D1)

Yumi works as a senior executive for an employer based in Brisbane. Her employer is setting up a new office in Townsville and assigns her to the new office for a period of four months in order to assist in setting it up. After spending four months working at the Townsville office, Yumi will return to her usual employment in the Brisbane office.

During the period she is in Townsville, Yumi will occasionally travel to other locations around Australia (including Brisbane) for one or two days to attend work meetings or meet with clients. Yumi will live in a two-bedroom apartment close to the office in Townsville and her family will remain in the family home in Brisbane. However, the apartment in Townsville is big enough to accommodate Yumi’s family.

Yumi will be living in Townsville away from her usual residence for the four-month period due to:

The expenses that Yumi incurs on accommodation and food and drink while she is in Townsville are living expenses and will not be deductible. This would not change even if Yumi returned to Brisbane each weekend to be with her family. However, when Yumi travels from Townsville to other locations around Australia for work meetings or to meet with clients, she will be travelling on work and the amount she incurs on accommodation and food and drink will be deductible.

(Example 10 in TR 2021/D1)

Anwar is employed as an engineer. He lives with his spouse in Adelaide near his regular place of work. His employer assigns him to work on a project in Mount Gambier, almost 500 km away, for nine months.

Anwar will have to travel to Mount Gambier twice a month for three nights at a time. He decides to rent a fully furnished unit in Mount Gambier.

During the nine-month period, Anwar stays in the rented property for 65 nights. The rent was $210 per week. Anwar’s additional property expenses for the period amount to $7,560 ($210 × 36 weeks). This is less than the amount he would have spent if he had stayed in a nearby hotel.

Anwar will be entitled to claim a deduction of $7,560 for accommodation expenses and the amount he spent on food and drink for the periods he was in Mount Gambier. Anwar was travelling on work: his regular place of work remained in Adelaide, he continued living at his usual residence and he was only away overnight for short periods of time.

An employer who provides the following to their employees (who do not work on a fly-in fly-out or drive-in drive-out basis) may rely on the Guideline once finalised:

The Commissioner will accept that an employee is travelling on work and will generally not apply compliance resources to determine if the above listed benefits relate to expenses for living at a location when all of the following circumstances are satisfied:

The former MT 2030 had since its release in 1986 provided taxpayers with a ‘practical general rule’ that where the period that the employee spends away from their home base does not exceed 21 days the allowance will be treated as a travelling allowance rather than a LAFH allowance.

MT 2030 was withdrawn with effect from 12 July 2017, two weeks after the release of TR 2017/D6. The (now withdrawn) TR 2017/D6 did not stipulate a practical general rule of 21 days or of any other length of time. This was the result of a ‘deliberate move’ away from relying on the 21 day rule or in fact any other line in the sand, in favour of the guidance and examples in the draft ruling (see the minutes of the FBT States and Territories Industry Partnership meeting held on 28 February 2017).

The preliminary practical guidance set out in PCG 2021/D1 reintroduces a quantitative rule of thumb of 21 consecutive days for determining whether an employee should be treated as travelling rather than living away from home, but with additional requirements as set out above — including an aggregate of fewer than 90 days in the same location in the FBT year.

The draft Guideline contains three practical examples, of which example 1 is reproduced below.

(Example 1 in PCG 2021/D1)

Kate lives in Perth and does most of her work at her employer’s head office in Perth. From time to time, Kate is required to spend a period of no more than 21 days working in various remote locations in Western Australia. Kate returns to her home in Perth for periods of more than a week before her next trip.

The employer pays Kate an allowance which she spends on accommodation and food and drink. Kate is away for a period of fewer than 90 days in total in the same location in the FBT year.

The allowance is included in Kate’s assessable income and Kate may be entitled to a deduction for her accommodation and food and drink expenses.

The employer is able to rely on the Guideline (once finalised) — i.e. the requirements are met such that the Commissioner would accept that Kate is travelling on work. The employer is paying Kate a travel allowance and not a LAFHA. The employer is not liable for FBT on the allowance paid.

Join us at the beginning of each month as we review the current tax landscape. Our monthly Online Tax Updates and Public Sessions are excellent and cost effective options to stay on top of your CPD requirements. We present these monthly online, and also offer face-to-face Public Sessions at locations across Australia. Click here to find a location near you.

If you’re not a current client, we can also present these Updates at your firm (or through a private online session) with content tailored to your client base – please contact us here to submit an expression of interest or visit our In-house training page for more information.

Our mission is to offer flexible, practical and modern tax training across Australia – you can view all of our services by clicking here.

Join thousands of savvy Australian tax professionals and get our weekly newsletter.