[lwptoc]

The ATO understands that as a result of the COVID-19 situation, some Div 7A borrowers are facing problems in making minimum repayments for 2020–21 due to circumstances beyond their control. The ATO will support these taxpayers by allowing an extension of the repayment deadline in eligible circumstances. A similar extension was provided to taxpayers in respect of minimum repayments for the 2019–20 income year.

This article will outline the legislative requirements to make Div 7A minimum yearly repayments (MYRs) and the conditions for the ATO repayment extension.

Under Div 7A of the ITAA 1936, certain loans and payments made, and loans forgiven, by a company (or certain interposed entities) to a shareholder or an associate of a shareholder of the company in an income year constitutes a deemed unfranked dividend assessable to the shareholder for that income year unless a complying loan agreement is put in place in accordance with the requirements in s. 109N. The requirements include that the agreement must specify an interest rate that is equal to or greater than the benchmark interest rate for the year, and a loan term that does not exceed the maximum allowable term (i.e. 25 years for loans secured over real property and seven years otherwise).

The borrower (taxpayer) must make the MYR by the end of the private company’s income year. If this amount is not paid, the taxpayer will be considered to have received an unfranked dividend, generally equal to the amount of any MYR shortfall.

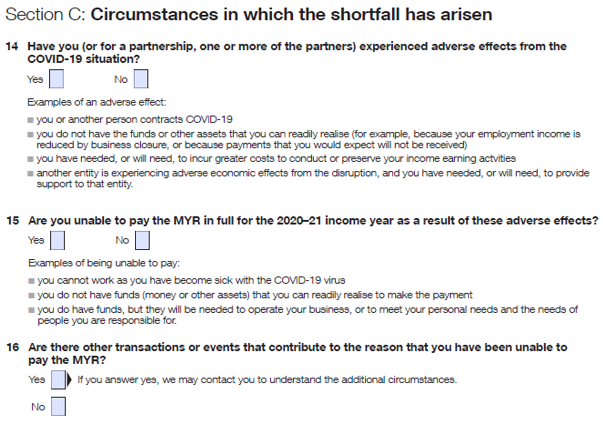

Taxpayers who are unable to make their 2020–21 MYR by 30 June 2021 may apply for an extension. It is not an automatic extension. The taxpayer must make the request by completing a ‘streamlined’ online application and the ATO will advise if the application is approved.

In the application the taxpayer will need to disclose the shortfall amount, that the COVID-19 situation has affected them and that they are unable to pay the MYR as a result. It is not necessary to submit further evidence with the application.

If the application is approved, the taxpayer will not be considered to have received an unfranked dividend in 2020–21. The shortfall is due to be paid by 30 June 2022 — i.e. it is a 12-month extension.

The streamlined application only applies to applications for an extension for the 2020–21 income year of up to 12 months.

The application form is available here. An excerpt is reproduced below.

The ATO instructions for filling out the form include the following information:

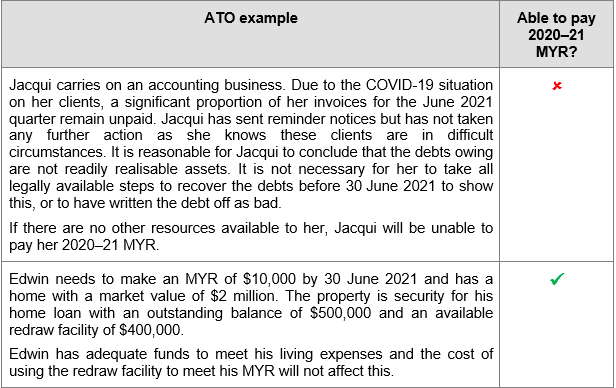

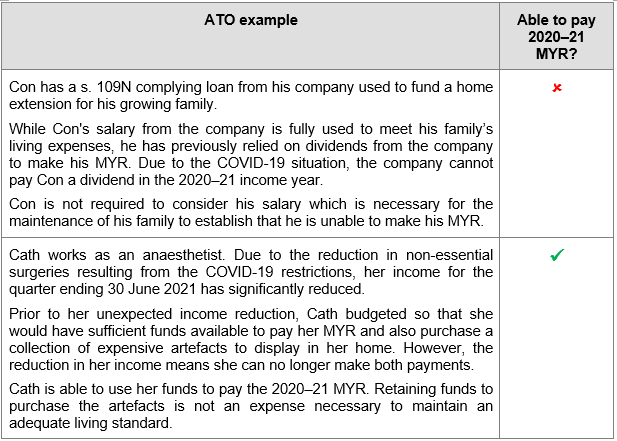

‘Unable to pay’ is about cash flow, not whether there is an excess of assets over liabilities. It is a question of fact to be determined in a practical business environment and taking into account all of the circumstances. In general, the ATO’s view is that:

A taxpayer is able to pay an amount if they can readily sell their assets or use them as security to obtain finance. Whether they can readily realise assets in time to make the payment depends on factors including the availability of a market, commercial costs of realisation in a short time, time required to sell the asset or use it as security, and the interest of joint owners.

A business taxpayer is unable to pay if they have to use the money and assets to maintain existing activities. However, this does not extend to other expenses, such as a future expansion. For an individual, the test extends to others they are responsible for, e.g. payment of children’s school fees.

Payments required under a previous extension for the 2019–20 income year would be taken into account in determining whether a taxpayer is able to pay their 2020–21 MYR.

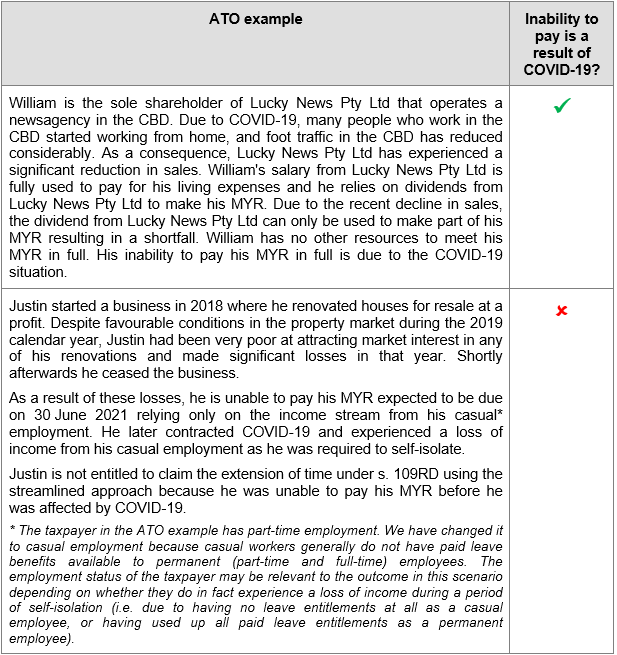

The taxpayer needs to confirm that their inability to pay is a result of the COVID-19 situation, either because it directly affected the taxpayer, or it affected another person with a flow-on effect for the taxpayer. The taxpayer must also confirm that their inability to pay has not been caused by another reason.

Section 109RD allows the Commissioner to extend the period for repayments. It is under this power that the ATO created the streamlined process specifically for taxpayers whose repayment ability has been affected by COVID-19.

COVID-19 affected taxpayers may also apply under the same provision, outside of the streamlined process, to obtain an extension of time for longer than 12 months, i.e. beyond 30 June 2022.

In addition, any eligible taxpayer, regardless of the reason that they cannot make their MYR on time (i.e. whether COVID-19 related or not), may:

The streamlined process was also made available last year for eligible taxpayers affected by COVID-19 to delay their 2019–20 MYRs until 30 June 2021. Taxpayers who obtained this extension need to ensure that they repay their 2019–20 shortfall by the due date to avoid an unfranked dividend.

If the taxpayer is unable to make the repayment, they cannot apply through the currently available streamlined process for 2020–21. Their available options are to:

![]() Implications

Implications

If a taxpayer who obtains the 2020–21 extension does not make their deferred repayment by 30 June 2022, at that time they will have to similarly either obtain another extension or other relief, or amend their 2020–21 tax return to include a Div 7A dividend.

This example is based the example in the ATO fact sheet.

Oz Land Pty Ltd (Oz Land) lent its shareholder Dorothy $1,000 under a s. 109N complying loan agreement during its 2018 income year. The term of the loan is seven years and the loan agreement does not provide for the capitalisation of interest (at the benchmark interest rate) that is not paid by the due date.

Assume:

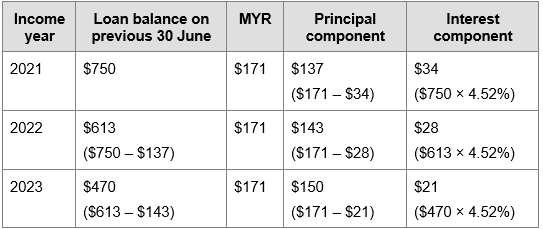

Dorothy would expect her 2021, 2022 and 2023 MYRs to be:

Dorothy is unable to pay any of the 2021 MYR due to the COVID-19 situation. The Commissioner makes a decision under s. 109RD to disregard the dividend Oz Land is taken to have paid Dorothy in the 2021 income year, provided Dorothy pays the amount of the shortfall ($171) to Oz Land by 30 June 2022.

To avoid Div 7A dividend consequences, Dorothy will need to pay by 30 June 2022:

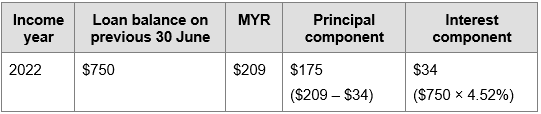

The 2022 MYR that Dorothy will need to pay is calculated under the formula in s. 109E(6).

Dorothy did not pay the 2021 MYR by 30 June 2021. As the loan agreement does not provide for the capitalisation of interest, the unpaid interest on the loan was not capitalised but Dorothy will still be required to pay that interest under the terms of the loan agreement.

Dorothy’s 2022 MYR is calculated as:

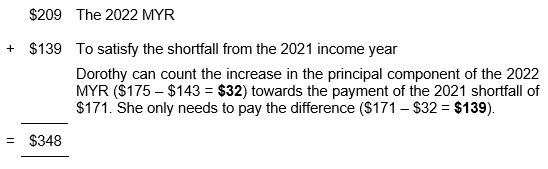

On 30 June 2022, Dorothy will need to pay $348 comprising:

The required payment of $348 can also be explained this way:

If the shortfall amount is not paid by 30 June 2022, the Commissioner’s decision will cease to apply and Dorothy will need to include a dividend in the 2021 income year. If Dorothy does not make at least the 2022 MYR of $209 there could be a dividend in that year.

Dorothy could at any time apply, outside the streamlined process, for a further extension of time under s. 109RD to pay the 2021 and 2022 shortfall amounts to have the dividends disregarded.

Alternatively, she could apply to have the dividends disregarded under s. 109Q, the reason being that they would cause undue hardship.

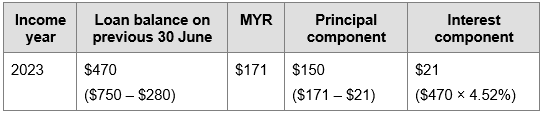

Dorothy has paid the shortfall. For calculating the 2023 MYR, the loan balance as at 30 June 2022 will be $470:

$750 less payments made on 30 June 2022 not attributed to interest ($348 – $68 = $280)

Based on the original repayment schedule, Dorothy was due to pay principal of $137 in 2021 and $143 in 2022. $137 + $143 = $280.

The 2023 MYR will return to the normal schedule of payments:

Each month, TaxBanter’s Tax Updates will keep you informed of the latest developments in this space. We present Tax Updates online, in cities across Australia and offer private tailored training sessions to firms of all sizes.

Brush up for the EOFY by training with us! Our next Online Tax Update takes place Tuesday, 6 July. You can register for it here. New clients can take 50% off the session with the code EOFY50.

To learn more about our various training options, click here.

Join thousands of savvy Australian tax professionals and get our weekly newsletter.