The end of another FBT year is now upon us. The ATO has released its Fringe benefits tax (FBT) return 2023 and the accompanying instructions.

Businesses which self-lodge will need to lodge the return and pay any FBT liability by 22 May 2023. The lodgment and payment due date for tax agents is 26 June 2023 (or 22 May if the return is lodged by paper).

There are always some changes to become familiar with at each FBT time. The following are recent legislative and administrative changes which take effect from either the 2022 or the 2023 FBT year.

From 1 July 2022, an FBT exemption applies to benefits provided in relation to eligible electric vehicles and associated car expenses.

Benefits are exempt if:

TR 2021/2 was finalised on 16 June 2021. The Ruling sets out when the provision of car parking is a ‘car parking benefit’ for the purposes of the FBT legislation.

An Addendum to the Ruling was issued on 22 February 2023 to confirm the Commissioner’s views on the meaning of ‘primary place of employment’, following the decision by the Full Federal Court in FCT v Virgin Australia Regional Airlines Pty Ltd [2021] FCAFC 209.

The Ruling applies before and after its date of issue with the following exception.

TR 96/26 (withdrawn 13 November 2019) expressed the view that car parking facilities that have a primary purpose other than providing all-day parking (that is, one that usually charges penalty rates significantly higher than the rates chargeable for all-day parking at commercial all-day parking facilities) were not commercial parking stations. That view is not retained in this Ruling in recognition of the decisions of the Federal Court in Qantas and the Administrative Appeals Tribunal in Qantas AAT. In respect of this changed view, the Ruling will apply to car parking benefits provided on or after 1 April 2022.

From 1 July 2021, individuals who incur expenditure in relation to a COVID-19 test for work-related purposes can claim an income tax deduction for the expenditure, where the purpose of the test is to determine whether the individual may attend or remain at their place of employment or business. The deduction applies to expenditure incurred on PCR tests and RATs.

If the individual’s employer buys, pays for or reimburses these expenses instead of the employee, the otherwise deductible rule may apply. This will reduce the taxable value of the expense payment, property or residual fringe benefit.

From 1 April 2021, eligible businesses with an aggregated turnover of $10 million or more and less than $50 million can now access the FBT exemptions in relation to:

Previously, these concessions were only available to businesses with aggregated turnover of less than $10 million.

TR 2021/1 was finalised on 17 February 2021. The Ruling provides guidance on when an employee can deduct transport expenses under s. 8-1 of the ITAA 1997.

This Ruling applies in determining whether such expenses, if paid by the employer as a fringe benefit, would be ‘otherwise deductible’ if they had been incurred by the employee.

The Ruling applies both before and after its date of issue.

TR 2021/4 was finalised on 11 August 2021. It explains:

The Ruling should be read in conjunction with PCG 2021/3 which outlines the ATO’s compliance approach to determining if employees in certain circumstances are travelling on work or living at a location away from their normal residence.

The Ruling applies both before and after its date of issue.

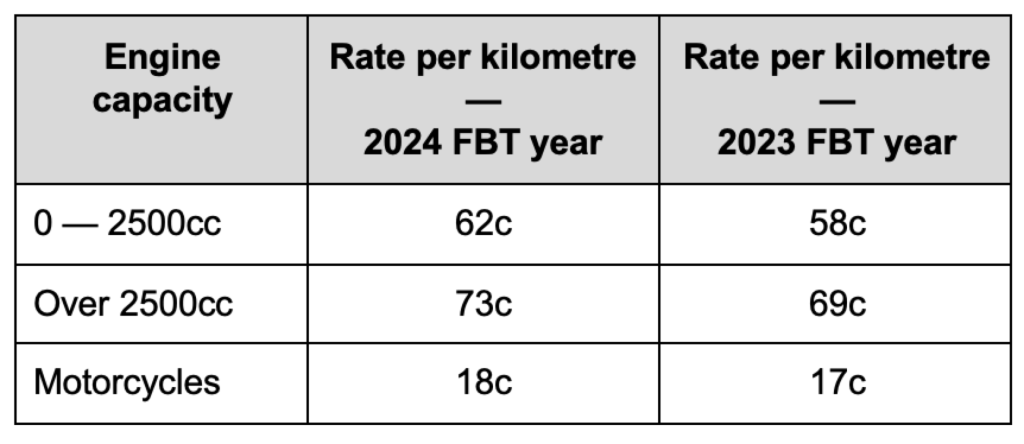

TD 2023/1 sets out the rates to be applied where the cents per kilometre basis is used to calculate the taxable value of a fringe benefit arising from the private use of a motor vehicle other than a car, for the FBT year commencing on 1 April 2023:

TD 2023/2 sets out the reasonable amounts for food and drink expenses incurred by employees receiving a LAFHA fringe benefit for the FBT year commencing on 1 April 2023 in relation to the amounts of reasonable food and drink:

Legislation before the Senate proposes to insert new s. 123AA into the FBTA Act to allow the Commissioner to make a legislative instrument that specifies alternative documents or records that employers can rely on, in lieu of statutory evidentiary documents, for FBT record keeping purposes.

While the legislation is yet to be passed, the Commissioner has already released four draft Legislative Instruments (the draft Instruments). The draft Instruments specify records the Commissioner will accept specified records as an alternative to an employee declaration in respect of expense payment fringe benefits where:

Once finalised, the draft Instruments are intended to reduce compliance costs for employers by allowing them to rely on adequate alternative records — rather than employee declarations — to

meet their FBT record keeping obligations.

These changes are proposed to take effect from the start of the first FBT year (1 April) after the date of Royal Assent of the legislation. Therefore the alternative records prescribed in the draft Instruments do not apply to the 2023 FBT year.

Join us at the beginning of each month as we review the current tax landscape. Our monthly Online Tax Updates and Public Sessions are excellent and cost effective options to stay on top of your CPD requirements. We present these monthly online, and also offer face-to-face Public Sessions at 17 locations across Australia.

Join us online

April Tax Update >

We can also present these Updates at your firm or through a private online session, with content tailored to your client base. Call our BDM Caitlin Bowditch at 0413 955 686 to have a chat about your specific needs and how we can assist.

Learn more about in-house training >

Our mission is to provide flexible, practical and modern tax training across Australia – you can view all of our services by clicking here.

Join thousands of savvy Australian tax professionals and get our weekly newsletter.