[lwptoc]

Two cases decided in December 2020 provide much needed guidance as to the operation of specific aspects of the JobKeeper scheme.

The Full Federal Court judgment in Qantas Airways Limited v Flight Attendants’ Association of Australia [2020] FCAFC 227 means that employers may reduce the necessary ‘top-up’ JobKeeper payment to an employee for a fortnight by any payments made in arrears during that fortnight in relation to work performed prior to that fortnight.

Meanwhile, in Apted and FCT [2020] AATA 5139 the Tribunal confirmed that an ABN with an effective date no later than 12 March 2020 will satisfy the eligibility requirement to hold an active ABN on that date, even if the application to reactivate (or register) a backdated ABN was granted after that date.

Update: On 24 March 2021, the Full Federal Court dismissed the Commissioner’s appeal against the decision of the Tribunal in FCT v Apted [2021] FCAFC 45.

Update 2: On 29 April 2021, the ATO updated its Decision Impact Statement and PS LA 2020/1 in response to the Full Court’s decision. The ATO intends to review its previous JobKeeper decisions that may be affected by the case.

Section 789GDA of the Fair Work Act 2009 (the FW Act) provides that an employer must ensure that the total amount payable to an eligible employee in respect of a JobKeeper fortnight is at least the greater of the following:

The case concerned two proceedings which were heard together:

In this article, the appellants are collectively referred to as ‘Qantas’ and the respondents as ‘the unions’.

Qantas regularly paid overtime amounts to employees in arrears during JobKeeper fortnights that commenced after the work was performed.

The core issue in this case can be set out in this very simplistic example (this is not based on actual facts but is merely illustrative):

Qantas owed $500 of overtime payments to an employee, Sally, for overtime work that she performed in February 2020. In mid-March, Qantas stood down Sally indefinitely due to flight cancellations. Sally agreed to be an eligible employee of Qantas for JobKeeper purposes commencing 30 March 2020. In accordance with its pay cycle, Qantas paid the $500 to Sally during the JobKeeper fortnight commencing 30 March 2020. Sally did not perform any employment duties during that fortnight. There is no suggestion that the payment in arrears breached the terms of any applicable employment contract or award.

The question before the Court concerned the meaning to be given to the words ‘amount payable’ in the phrase ‘the amounts payable to the employee in relation to the performance of work during the fortnight’ in s. 789GDA(2)(b) of the FW Act.

Qantas’s position: Qantas contended that expression means the amount that would ordinarily be payable to the employee during the fortnight in relation to the performance of work. In the example, this means that the $500 payment for work performed in February 2020 counted towards the minimum payment guarantee for Sally. Qantas would have been required to make a ‘top-up’ payment of only $1,000 to Sally to satisfy the minimum amount of $1,500 for the fortnight commencing 30 March 2020.

The unions’ position: The unions contended that the expression means the amount that was earned by the employee in relation to the performance of work during the fortnight. In the example, this meant that the $500 payment in arrears did not count towards the minimum payment guarantee. Qantas should have made a ‘top-up’ payment of $1,500 to satisfy the JobKeeper rules — on top of the $500 for work performed prior to 30 March 2020.

The primary judge, in a Federal Court judgment dated 24 September 2020, concluded that it means the amount that was both payable to and earned by the employee in relation to the performance of work during the fortnight.

The majority of the Full Court allowed Qantas’s appeal. Jagot and Wheelahan JJ held that there was ambiguity but preferred Qantas’s construction of s. 789GDA(2) for reasons including:

Bromberg J, dissenting, preferred the unions’ construction — i.e. ‘amounts payable’ is concerned with liability in a JobKeeper fortnight for performance of work in that fortnight.

The Full Court’s decision means that Qantas will not be required to backpay hundreds of workers, as payments in arrears count towards the minimum payment requirement. Under the overturned decision of the single judge, Qantas would not have been able to count these amounts and would therefore have had to make larger top-up payments to reach the minimum JobKeeper amount per fortnight. The overturned decision had also meant that if an employee was not paid for work performed in a fortnight in the same fortnight, then those amounts will not count towards the minimum payment guarantee in any fortnight.

This decision will potentially have implications for other businesses which, like Qantas, had furloughed or significantly reduced the work hours of its employees and were therefore liable to pay a top-up JobKeeper amount for a fortnight, and — critically — was also making payments in arrears for work actually performed prior to the relevant fortnight. Such businesses, which may have been preparing to backpay workers extra top-up payments in light of the Federal Court decision in September, may now no longer have to do so (but check the application of the JobKeeper and Fair Work rules to each business’s specific circumstances).

The media has recently reported that the unions intend to apply to the High Court for special leave to appeal this decision.

On 14 January 2021, the unions lodged an application for special leave to appeal to the High Court against the decision of the Full Federal Court.

The Taxpayer — Mr Apted — operated a business as a sole trader. He retired in 2018 and cancelled his ABN registration. In mid-2019, he came out of retirement and resumed his business. However, he did not reactivate his ABN at that time due to a misunderstanding of the no-ABN withholding rules.

On 31 March 2020, the Taxpayer successfully applied to reinstate the ABN with an effective date of 31 March 2020.

In April 2020, the Taxpayer lodged a JobKeeper application for himself as a business participant in relation to his business. The Commissioner advised the Taxpayer he was not eligible for Jobkeeper as he:

The Taxpayer subsequently applied for the Commissioner to exercise his discretion to allow an entity further time to meet the requirement to have had an ABN on 12 March 2020. The Commissioner did not grant the request because the ABN was not active as at 12 March 2020 and the reactivation had occurred after that date.

In June 2020, the Registrar of the Australian Business Register (ABR) agreed to adjust the ABR to amend the effective date of the reactivated ABN to 1 July 2019 (when the Taxpayer resumed his business). However, the Commissioner maintained his position that the Taxpayer was ineligible for JobKeeper as he did not hold an active ABN on 12 March 2020, but rather, had reactivated a dormant ABN after that date.

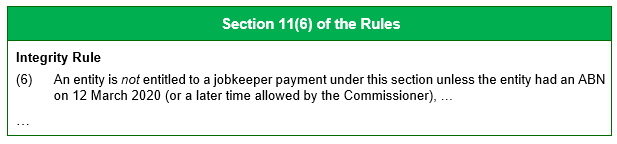

The Tribunal found that the Taxpayer did have an active ABN on 12 March 2020 for the purposes of s. 11 of the Rules.

The integrity rule assumes a level of confidence in the integrity of the ABN registration process. That process includes a determination by the Registrar of the date of effect, including one which predates the application. The Tribunal was not provided with any evidence to suggest the ABN registration process lacked integrity or rigour.

The Tribunal also found that it was within its jurisdiction to review the Commissioner’s exercise of the discretion to allow a later date. While it was not necessary for it to determine this issue, the Tribunal addressed the question because this was a test case to provide guidance on the administration of the ABN rule. The Tribunal further concluded that if its decision that the Taxpayer had an active ABN on 12 March 2020 was wrong, then the discretion should be exercised in the Taxpayer’s favour.

The Tribunal observed that most entities in the Taxpayer’s position will not require the Commissioner to consider exercising the discretion, and instead will be more appropriately dealt with by engaging with the established ABN registration process. Provided the ABN has a date of effect that pre-dates 12 March 2020, even if the registration or re-registration was granted retrospectively after that date, the integrity rule will be satisfied. In other cases, entities which have to rely upon the exercise of the discretion have access to Tribunal review.

The ATO has published an interim Decision Impact Statement (DIS) on the Apted case. The DIS states that the decision is inconsistent with the Commissioner’s view. In particular, the Commissioner considers that:

The Commissioner has filed an appeal to the Full Federal Court in respect of the Tribunal decision. Pending the conclusion of the appeal:

The Cash Flow Boost rules contain an identical requirement to have an ABN on 12 March 2020 (or a later time allowed by the Commissioner). The Commissioner intends to apply the same approach as outlined here to the Cash Flow Boost.

The Full Federal Court has dismissed the Commissioner’s appeal against the decision of the Tribunal, albeit for different reasons to the Tribunal.

In its reasoning, the Full Court made the following conclusions in relation to three issues.

The Taxpayer contended that an entity has an ABN on 12 March 2020 if the entity has an ABN on the ABR with a date of effect which covers 12 March 2020.

The Commissioner contended that s. 11(6) directs attention to what the ABR showed on that day.

The Full Court — overturning the Tribunal’s decision in respect of this issue — held that the Commissioner’s construction was to be preferred. Therefore the Taxpayer did not have an ABN on 12 March 2020 within the meaning of s. 11(6).

The Full Court held that the ‘later time’ discretion formed part of the reviewable decision. Accordingly, the Tribunal had jurisdiction to exercise the discretion.

Even if the discretion did not form part of the reviewable decision, the Tribunal had jurisdiction to exercise the discretion by reason of s. 43(1) of the AAT Act. Section 43(1) provides that:

[f]or the purpose of reviewing a decision, the Tribunal may exercise all the powers and discretions that are conferred by any relevant enactment on the person who made the decision.

The Full Court held that the Commissioner did not establish that the Tribunal relevantly erred in exercising the discretion to allow a ‘later time’. The key reasons included that:

On 29 April 2021, the ATO updated its Decision Impact Statement in relation to the Full Court decision. It states that the Commissioner:

The ATO has also updated Law Administration Practice Statement PS LA 2020/1 Commissioner’s discretion to allow further time for an entity to hold an ABN or provide notice to the Commissioner of assessable income or supplies in response to the Court’s decision.

The ATO has also released a new fact sheet titled JobKeeper Payment and the ‘later time’ discretion in its response to the Full Court decision.

The ATO confirmed that it does not intend to appeal the decision.

As a consequence of the Full Court’s decision, the Commissioner will be revisiting decisions where the ATO considers the outcome may have been different if the court’s reasoning was applied. Where eligibility will still not be established (because one or more other eligibility criteria has not been satisfied) even if the Commissioner’s discretion was exercised, the Commissioner will not revisit his previous decision.

If a taxpayer declines to have a decision which declines to exercise the Commissioner’s discretion, the Commissioner will automatically review the taxpayer’s circumstances and whether his discretion should be applied. There is no need to contact the ATO at this time. The ATO will contact the taxpayer upon completion of the review or to request further information.

The ATO aims to have the process completed by the end of June 2021.

The ATO is taking a similar approach in relation to eligibility for the Cash Flow Boost.

The fact sheet also contains some handy eligibility checklists.

Join us at the beginning of each month as we review the current tax landscape. Our monthly Online Tax Updates and Public Sessions are excellent and cost effective options to stay on top of your CPD requirements. We present these monthly online, and also offer face-to-face Public Sessions at locations across Australia. Click here to find a location near you.

Our upcoming Tax Update sessions will discuss the updated Decision Impact Statement and Practice Statement. If you’re a current in-house or public session client, you can expect complete coverage of this topic in your next session.

If you’re not a current client, we can also present these Updates at your firm (or through a private online session) with content tailored to your client base – please contact us here to submit an expression of interest or visit our In-house training page for more information.

Our mission is to offer flexible, practical and modern tax training across Australia – you can view all of our services by clicking here.

Join thousands of savvy Australian tax professionals and get our weekly newsletter.