[lwptoc]

The ‘promoter penalty’ laws in Div 290 of Schedule 1 to the TAA are in place to deter the promotion of tax avoidance schemes. Earlier this year, the Federal Court imposed fines totalling $9.415 million on three professionals who together promoted a carbon credits scheme under which the investor paid only a 15 per cent deposit but purportedly could immediately deduct 100 per cent of the purchase price.

The key elements of the promoter penalty laws are that:

Prohibited conduct is conduct that results in:

A scheme is a tax avoidance scheme if, at the time of promotion, it has the sole or dominant purpose of an entity gaining a scheme benefit that would not be legally available otherwise.

An entity gets a scheme benefit from a scheme if:

An entity is a promoter if:

Note

Note

Exceptions to the promoter penalty laws include:

The maximum penalty the Federal Court can impose is the greater of:

One penalty unit is equal to $222.

Depending on the type or seriousness of the conduct, the ATO may also consider the following actions:

Practice Statement Law Administration PS LA 2021/1 sets out the processes the ATO will follow in administering the promoter penalty laws.

Factors that may indicate promoter behaviour include:

ATO officers can refer information to the internal Promoters Program. The objective of the program is to address the behaviours of intermediaries that promote tax avoidance, including consideration of remedies or sanctions. The Promoter Penalty Review Panel advises the on the application of the laws in particular circumstances.

A member of the public can call 1800 060 062, use the form at www.ato.gov.au/tipoffform or use the ATO app.

Factors that might weigh in favour of a civil penalty as the appropriate remedy include where the entity:

Civil penalties cannot be imposed where the prohibited conduct was due to:

The Practice Statement also covers how the ATO will administer the promoter penalty provision in s. 68B of the SIS Act which is designed to deter the promotion of a scheme that has resulted, or is likely to result, in a payment being made from a regulated superannuation fund (an illegal early release scheme).

The promoter penalty laws contain provisions governing the interaction between civil (promoter penalty) proceedings and criminal proceedings. A criminal proceeding can be started against an entity, irrespective of whether a civil penalty application or court order has been made in relation to substantially the same conduct.

The Federal Court decision in FCT v Bogiatto, handed down in August 2020, held that Mr Bogiatto and his two companies were promoters of a tax exploitation scheme to obtain the benefit of an R&D tax offset in 13 alleged tax exploitation schemes.

Mr Bogiatto was a tax accountant whose services included the preparation and lodgment of R&D Tax Incentive Applications and R&D Tax Incentive Schedules. He and his controlled entities engaged in the following general conduct in relation to 20 R&D schemes involving 14 taxpayers in the 2012, 2013 and 2014 income years:

If a client questioned Mr Bogiatto’s calculations or asked for an explanation as to the figures, Mr Bogiatto would typically responded by asserting that he would not disclose his methodology because it was his intellectual property, asserting that he was the expert, and stating that the client should not question him.

Two of the 14 taxpayers did not follow through with lodging R&D claims.

In total, R&D tax offset refunds of $45.5 million were paid to Mr Bogiatto’s clients.

His Honour, Thawley J was satisfied that Mr Bogiatto and his companies marketed and encouraged interest in the schemes and were promoters of tax exploitation schemes in 13 out of the 14 taxpayers. The 14th taxpayer’s claims were found to be genuine, and did not amount to tax exploitation due to the scheme benefits being available at law.

In each case the scheme consisted of Mr Bogiatto advising the taxpayers that they were eligible for an R&D tax offset, the collation of information and the lodgment of the application with AusIndustry, and preparation and lodgment of an R&D Schedule for the relevant years.

The Court’s reasoning is summarised as follows.

The Court held that each of the relevant implemented schemes involved tax evasion, save for the exception where the claim was found to be genuine. The claims were grossly exaggerated or wholly unavailable. Mr Bogiatto deliberately put forward claims which he knew were wholly or partly unjustifiable and engaged in evasion. Mr Bogiatto avoided regulators when investigated and never looked to redress any amount of loss or damage incurred by scheme participants.

In February 2021, the Court imposed civil penalties totalling $22.68 million on Mr Bogiatto and his three companies. The size of the penalty is the highest ever seen in Australia.

The ATO reported that, as a result of the decision, Mr Bogiatto was also investigated and de-registered as a tax agent in October 2017, and forfeited his membership of the Institute of Public Accountants. He had his Chartered Accountants membership terminated in 2018.

In September 2020 the Federal Court in FCT v Rowntree held that three individuals were promoters of tax exploitation schemes.

Dr Rowntree, a solicitor and a qualified tax specialist, Mr Donkin, a chartered accountant and tax agent, and Mr Manietta, a financial planner (the Promoters) promoted investments in emissions reductions purchase agreements (ERPAs).

ERPAs were contracts with an offshore entity to purportedly purchase offshore carbon credits generated through offshore carbon reduction activities, and to acquire a licence to use a logo owned by the offshore entity. Investors could also acquire an option which, if exercised, required the offshore entity to purportedly purchase the number of offshore carbon credits contracted for by the participant for approximately the same amount as the balance payable by the investor.

Upon entering the arrangement, investors were obliged to pay a non-refundable first instalment equal to 15 per cent of the purchase price. The balance of the purchase price was not payable until the Investors received a notice of delivery. The investors would claim to deduct the entire purchase price of the offshore carbon credits in the income year that they entered the arrangement.

Each of the Promoters directly — or indirectly though his associates — received the following from more than 200 investors over the 2009 to 2012 tax years:

In 2010, the ATO began querying an investor’s 2009 tax returns, on which the investor had claimed a 100 per cent deduction for the purchase price.

The Federal Court was satisfied that Dr Rowntree and Mr Manietta were promoters of each of the 2009, 2010, 2011 and 2012 tax exploitation schemes Mr Donkin was a promoter of the 2011 and 2012 schemes.

Rares J was satisfied that the Promoters entered into the scheme for the sole or dominant purpose of obtaining tax benefits, and that it was not reasonably arguable that the scheme benefits were available at law. Therefore, the schemes amounted to tax exploitation.

The schemes were entered into for the sole or dominant purpose of obtaining tax benefits as there was no evidence that there were arrangements to actually deliver any carbon credits under the ERPAs, or that it had taken any steps to ensure that the project was in a position to deliver a product. Further, the contracts for carbon credits were uncommercial and the ERPAs did not give the investors any right to compel delivery of the carbon credits for which they had paid a 15 per cent deposit.

The Promoters’ primary market for ERPAs consisted of health professionals, accounting firms and real estate agents — taxpayers that would have no bona fide use for carbon credits in their businesses or operations. The scheme benefit was the use of the full purchase price as a deduction from the investor’s taxable income that, if allowed, would result in its tax-related liability being less than it would have been apart from the scheme.

The purpose of each Promoter was to make money for himself or his associates from sales of contract lots through inducing investors to enter into the ERPAs and with the dominant purpose that each investor would pay only the 15 per cent deposit and get the scheme benefit of an immediate deduction of the full purchase price of each contract lot in the tax year, worth about twice the expenditure on the deposit.

It was not reasonably arguable that the scheme benefit is available at law. The full purchase price of a contract lot was not a loss or outgoing incurred in gaining or producing the investor’s assessable income within the meaning of s. 8-1(a) because the investor had not completely subjected itself to its payment. In addition, there was no apparent nexus between the loss or outgoing for the ERPA, or the 15 per cent deposit, and the production of any of the investor’s assessable income.

His Honour held that the schemes involved tax evasion. Critically, when the ATO commenced investigating investors’ tax returns, Dr Rowntree and his associates requested that the investors withhold contractual documents from the ATO on the basis that ‘the investment vendors are considering the ATO defence strategy’. This evasive behaviour was designed to ‘keep the ATO in the dark’.

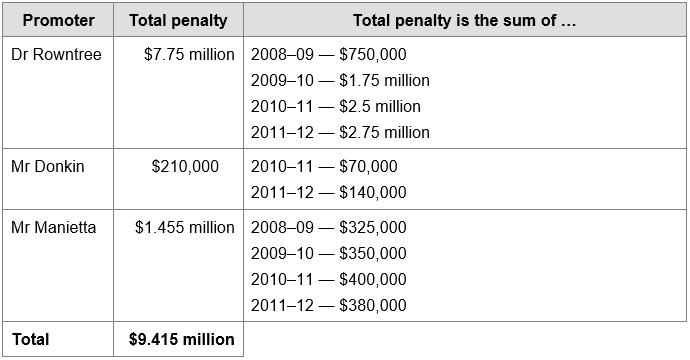

More recently, in March, the Federal Court, taking into account each of the relevant factors, imposed civil penalties on the Promoters as follows:

The Promoters have lodged a notice of appeal to the Full Federal Court against the penalty decision.

Further info and training

Join us at the beginning of each month as we review the current tax landscape. Our monthly Online Tax Updates and workshops are excellent and cost effective options to stay on top of your CPD requirements. We present these monthly online, and also offer face-to-face Public Sessions at 18 locations across Australia.

Tailored in-house training

Tailored in-house training

We can also present these Updates at your firm (or through a private online session) with content tailored to your client base – please contact us here to submit an expression of interest or visit our In-house training page for more information.

Our mission is to offer flexible, practical and modern tax training across Australia – you can view all of our services by clicking here.

Join thousands of savvy Australian tax professionals and get our weekly newsletter.