[lwptoc]

The superannuation general transfer balance cap (transfer balance cap) of $1.6 million will be indexed to $1.7 million from 1 July 2021. The ATO’s available information includes the fact sheet Indexation of the general transfer balance cap.

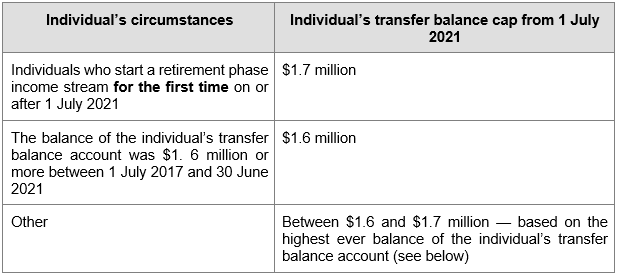

Currently, up to 30 June 2021, all individuals have a transfer balance cap of $1.6 million. In contrast, from 1 July 2021, the transfer balance cap varies between $1.6 million and $1.7 million depending on the individual’s circumstances:

The ATO states that it will calculate the individual’s entitlement to indexation and their personal transfer balance cap after indexation, based on the information reported to the ATO. If the individual’s superannuation fund subsequently reports information that affects the highest ever balance prior to 1 July 2021, the ATO will re-calculate the individual’s entitlement to indexation and new personal transfer balance cap.

All transfer balance cap information for a taxpayer is available on ATO Online, before and from 1 July 2021. Before 1 July 2021, individuals and their advisers will be able to see the highest ever balance in the transfer balance account, and if their personal transfer balance cap will be proportionally indexed.

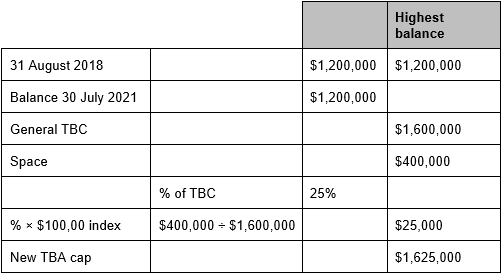

A proportional indexation of the transfer balance cap based on the highest ever balance of the individual’s transfer balance account is calculated by:

To calculate the individual’s unused cap percentage:

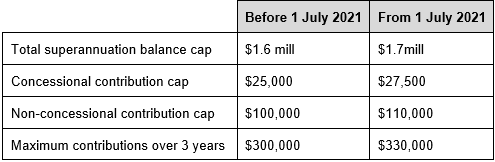

The indexation of the transfer balance cap will affect other superannuation caps from 1 July 2021 as follows:

The ATO fact sheet sets out other implications of the indexation, including for child death benefit income streams, capped defined benefit income streams, government co-contributions and spouse contributions.

The difficulty that may arise for an adviser is knowing how much is in their client’s transfer balance account. Ensuring that the highest balance in any APRA based funds, defined benefits funds and SMSF funds that the client is a member of is captured will be imperative. This section provides several general examples of the practical outcomes of the indexation.

![]() Important

Important

Advisers can only give general advice about superannuation caps and contributions to their clients unless you have an Australian Financial Services (AFS) licence. Superannuation is a financial product. All accountants who provide specific advice on SMSFs must hold an AFS licence.

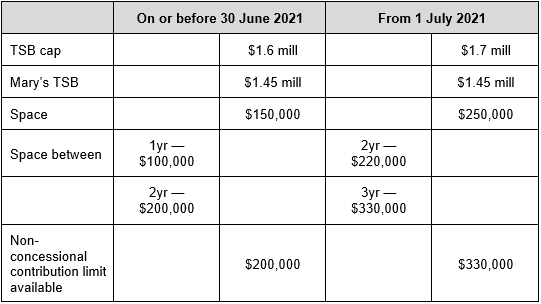

Mary is 58 years old and has a $1.45 million Total Superannuation Balance (TSB). She has just inherited $400,000 and wishes to put as much into superannuation as soon as possible.

The following is the difference between making a non-concessional superannuation contribution by 30 June 2021 and making one on 1 July 2021 or after.

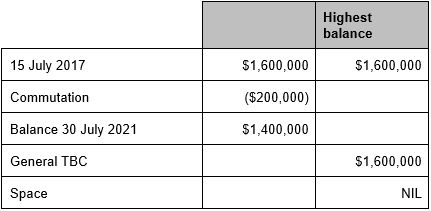

Sandra retired on 15 July 2017. Her personal transfer balance cap is $1.6 million.

She transferred $1.6 million into her transfer balance account on 15 July 2017. Besides taking out the minimum pension amount each year over the next two years, she needed to renovate her house so commuted $200,000 from her pension account. As at 1 July 2021 the amount in her transfer balance account is $1.4 million.

Since the space between Sandra’s highest balance in her TBA and the general TBC is nil there will be no increase in Sandra’s TBA cap.

Steven retired on 31 August 2018. His personal transfer balance cap is $1.6 million.

He transferred $1.2 million into his TBA on 31 August 2018. He then paid out the minimum pension amount and did not commute any funds. As at 1 July 2021 the amount in his TBA $1.2 million.

The space between Steven’s highest balance and the general transfer balance cap is $400,000 is used to calculate the percentage increase in Steven’s transfer balance cap. This percentage is applied to the index amount to create the new cap (see the method statement outlined above).

Narelle retires on 1 November 2021. Her personal transfer balance cap is $1.7 million.

Since the JobKeeper assistance finished in March 2021, some employers may be having difficulty paying their superannuation guarantee (SG) amounts by the due date. If this is the case, they should ensure that they pay the SG charge to the Commissioner once the assessment has been issued. If they instead pay the outstanding amount to the fund they will not be able to offset the amount paid against the SG charge.

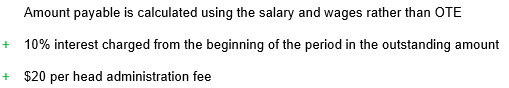

In general once the due date has been missed the amount of SG charge payable to the ATO is calculated as follows:

Section 23A of the SGA Act allows an employer to elect to offset a contribution made to a fund against an SGC if:

If the employer pays the outstanding SG to the fund after the assessment of SGC for the quarter, then it will not be able to offset this payment against the outstanding SGC. The Commissioner has no discretion to allow the offset to happen.

In a case from last July, Jordyn Properties Pty Ltd and FCT [2020] AATA 3805 the Tribunal found that the Commissioner was correct to refuse to issue amended assessments to the Taxpayer under the SGA Act to take into account late superannuation contributions as an offset against the SG charge assessed to the Taxpayer.

Since the late SG contributions were not capable of being offset against the SG charge, they could not be the subject of a valid election under s. 23A of the SGA Act — i.e. the employer could not choose to offset the contribution against the SG charge, and the SG charge was thereby not discharged.

This can be a disadvantage to any employer especially if they are trying to clean up their books after the business has ceased because the SG will have to be paid twice and there will be no ability to claim the deductions as there are no employees to whom to allocate the SG amounts paid directly to the fund.

Employers are reminded that the rate of compulsory SG will rise from 9.5 per cent to 10 per cent on 1 July 2021. Between now and year end, employers will need to ensure that their SG arrangements for each employee from 1 July will satisfy the new minimum requirement as well as any applicable employment agreement in place. If the SG increase is not appropriately prepared for, the employer may end up with unpaid SG amounts and SG charges down the track even if the employer did not intend to underpay SG. At time of writing, the ATO has not announced how it intends to administer the transition to the 10 per cent rate.

Join us at the beginning of each month as we review the current tax landscape. Our monthly Online Tax Updates and Public Sessions are excellent and cost effective options to stay on top of your CPD requirements. We present these monthly online, and also offer face-to-face Public Sessions at locations across Australia. Click here to find a location near you.

Our upcoming Superannuation Online training will cover these changes in full. You can learn about the changes via our quarterly Superannuation Update. We also delve into specialty areas of tax law specific to superannuation in our Superannuation Special Topic series.

If you’re a current in-house client and interested in this topic, we can tailor your next session to include further coverage of this – just contact your regular trainer or our friendly training operations team through enquiries@taxbanter.com.au.

If you’re not a current client, we can also present these Updates at your firm (or through a private online session) with content tailored to your client base – please contact us here to submit an expression of interest or email us for more information.

Our mission is to offer flexible, practical and modern tax training across Australia – you can view all of our services by clicking here.

Join thousands of savvy Australian tax professionals and get our weekly newsletter.