[lwptoc]

The 2021 tax return stationery contains new disclosures relating to the temporary capital allowances incentives.

For a small business entity (SBE) that calculates their depreciation claims under the simplified depreciation system in Subdiv 328-D of the ITAA 1997, these incentives for the 2020–21 income year are the:

This article considers some of the tax return disclosure implications for SBE taxpayers that utilise the temporary incentives.

![]() Note

Note

An SBE using Subdiv 328-D technically is not claiming TFEDA. When the TFEDA was introduced for Div 40 taxpayers, the concept was extended to Subdiv 328-D taxpayers by temporarily removing the IAWO threshold. That is, the TFEDA for Subdiv 328-D takes the form of an uncapped IAWO. For simplicity, this article will refer to the uncapped IAWO as the TFEDA.

![]() Note

Note

Ignore GST throughout this article for the purposes of illustration.

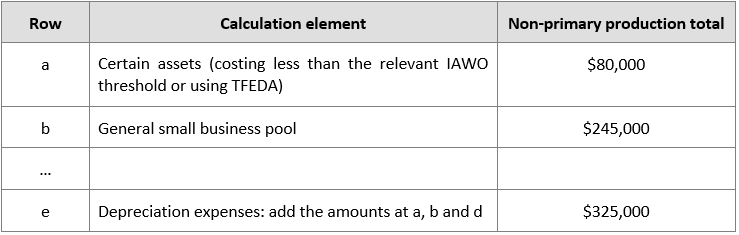

Tara buys a trailer for her dog grooming business on 10 July 2020 for $80,000. Tara uses the simplified depreciation rules and has a pool balance of $245,000 on 1 July 2020.

Assume that Tara does not acquire or dispose of any other depreciable assets during the year ending 30 June 2021.

For 2020–21, Tara is entitled to claim a total depreciation deduction of $325,000, being:

The balance of Tara’s pool on 30 June 2021 is $0.

Page 51, worksheet 2, non-primary production

Page 51, instructions — page 4

Transfer the amount at row a in worksheet 2 to A item P10 Small business entity simplified depreciation

Note that Tara will also show $325,000 at label M of Item P8.

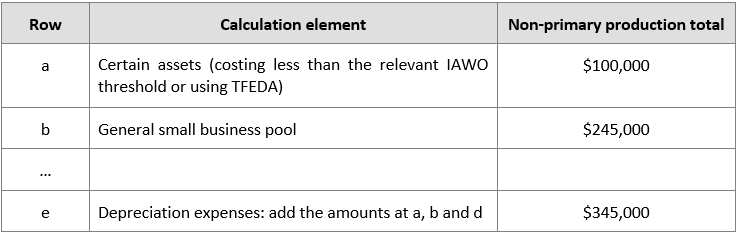

Now assume that Tara also acquired a new dog washing machine on 1 January 2021 for $20,000.

Page 51, instructions — step 4

Transfer the amount at row a in worksheet 2 to A item P10 Small business entity simplified depreciation

The instructions to item P10 are as follows:

Write at A Deduction for certain assets the amount you claimed at item P8 that relates to assets costing less than $150,000 and purchased before 7.30pm (AEDT) 6 October 2020, and first used or installed ready for use for a taxable purpose in the current year. This is one of the components from row a in worksheet 2 but does not include any amounts relating to temporary full expensing.

…

If you claimed any depreciation using temporary full expensing you will need to include those amounts at P11.

Based on our understanding of the instructions, the disclosures are as follows:

![]() Note

Note

Item 15 Net income or loss from business will also need to be completed.

Flynn is a registered BAS agent and carries on a bookkeeping business part time. He regularly visits clients at their premises. Flynn is also employed at a local deli part time and delivers phone and online food orders to local customers as part of his duties.

Flynn acquired a new car on 1 December 2020 for $70,000. He estimates that the car usage is:

Flynn uses Subdiv 328-D.

Flynn is able to claim the taxable purpose proportion of the cost of the car. However, the cost is reduced to $59,136 (the car depreciation limit for 2020–21).

The taxable purpose proportion is 70 per cent (60 per cent business use + 10 per cent employment use).

Flynn may claim $59,136 × 70% = $41,395 in his 2021 tax return.

P8 instructions:

You show at M Depreciation expenses item P8 the total depreciation deductions being claimed under the small business entity simplified depreciation rules and for the business use of other assets under the uniform capital allowances (UCA) rules. This includes your deduction under the small business entity rules for depreciating assets used for work-related or self-education purposes. …

Flynn would include the employment-related use of the car at P8 label M and not at D1 (i.e. work-related expenses).

In addition, Flynn would also need to complete P11 labels F and G (TFEDA) as he acquired the car at or after the 2020 Budget time.

If Flynn had instead acquired the asset between 1 July 2020 and the 2020 Budget time, he would need to complete P10 label A (IAWO).

Amy carries on a retail business selling vintage vinyl records as a sole trader. Accordingly, Amy may be eligible to access the TFEDA in respect of assets acquired for her business.

Amy also owns a residential rental property and acquires a new stove for $3,000 which is installed in the property 1 April 2021.

Where Amy is an SBE using the simplified depreciation rules in respect of her retail business, an immediate deduction would also not be available as Subdiv 328-D specifically excludes assets let on a depreciating asset lease.

Alternatively, if Amy has opted out of (or is not eligible to use) Subdiv 328-D, she still cannot access TFEDA in respect of the new stove — even though she is carrying on a busines. Under Div 40, the TFEDA is only available in respect of assets which are used for the principal purpose of carrying on a business. Even though Amy is carrying on a business, the stove is not used in the carrying on of a business.

Amy would simply show her depreciation deduction for the stove as an expense in calculating her net rental income shown at item 21 of her tax return.

Amy carries on a retail business selling vintage vinyl records as a sole trader. Accordingly, Amy may be eligible to access the TFEDA in respect of assets acquired for her business.

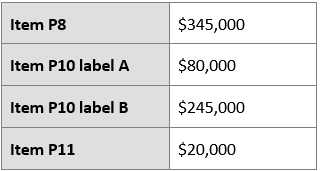

Amy also carries on a commercial rental property business and acquires a new air conditioner for $75,000 which is installed in the commercial building on 1 April 2021.

If Amy chooses to use Div 40, she can claim the TFEDA for the air conditioner as the asset is used for the principal purpose of carrying on a business. there is no exclusion for assets on a depreciating asset lease.

The same deduction is available even if Amy uses Subdiv 328-D for her retail business. There is an exclusion for depreciating asset lease assets, so the air conditioner must be depreciated using Div 40. The TFEDA and the BBI incentives may be available to Amy under Div 40.

TS Pty Ltd purchased a brand new digger for its earthmoving business on 1 February 2021 at a cost of $400,000. This is the only asset that TS Pty Ltd owns.

Page 74 instructions:

You must also complete item 10 Small business entity simplified depreciation if you claim instant asset write-off. Also complete item 9S and T if you claim temporary full expensing.

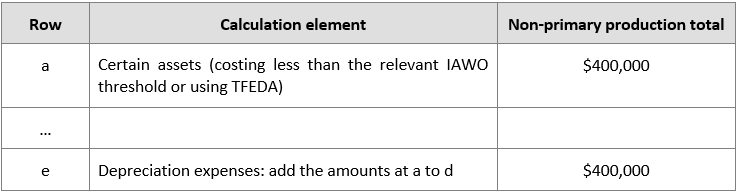

Worksheet 1 — page 80

Transfer the amount at e to label X Depreciation expenses at item 6.

![]()

Item 9 — Capital allowances — page 131

If you are a small business using Subdiv 328-D, show at S the total amount of any deduction under TFEDA you claimed at label X Depreciation expenses at item 6.

Show at T the total number of assets you are claiming TFEDA for.

![]()

There is no disclosure in item 10 because the company is not claiming the IAWO as it did not purchase a new asset between 1 July 2020 and the 2020 Budget time.

Join us at the beginning of each month as we review the current tax landscape. Our monthly Online Tax Updates and Public Sessions are excellent and cost effective options to stay on top of your CPD requirements. Our Public sessions take place across 18 locations in Australia. Click here to find a location near you.

Here are a few past and upcoming training options to keep yourself updated with the current tax landscape:

![]() Online training

Online training

You can view all of our upcoming online training here. Need to catch up on your CPD? Our recordings page hosts all of our past sessions.

Tailored in-house training

Tailored in-house training

We can also present these Updates at your firm (or through a private online session) with content tailored to your client base – please contact us here to submit an expression of interest or visit our In-house training page for more information.

Our mission is to offer flexible, practical and modern tax training across Australia – you can view all of our services by clicking here.

Join thousands of savvy Australian tax professionals and get our weekly newsletter.