[lwptoc]

The Federal Budget 2021–22 was handed down at 7.30 AEST pm on Tuesday, 11 May 2021. TaxBanter’s Federal Budget Summary and Federal Budget Quick Reference Timeline can be downloaded for free from our website.

One of the key tax measures is a long-anticipated proposal to change the tax residency tests for individuals to better reflect the modern world. This article outlines the Board of Taxation recommendations which underpin the Budget measure and sets out the model on which the new rules will likely be based.

This article also briefly outlines other Budget proposals to update tax residency tests for other entity types — trusts, corporate limited partnerships and superannuation funds.

Federal Budget — what residency rules will the Government change?

Modernising the individual tax residency rules

Why do the individual tax residency rules need to change?

Australia’s current tax residency rules for individuals are difficult to apply in practice, creating uncertainty and resulting in high compliance costs for individuals and their employers — including the need to seek third-party advice, despite having otherwise simple tax affairs.

In May 2016, the Board of Taxation (the Board) commenced a self-initiated review of the current individual tax residency. In August 2017 the Board presented its findings to Government in its report titled Review of the Income Tax Residency Rules for Individuals (the 2017 Report).

The Board concluded that the current individual tax residency rules are no longer appropriate and require modernisation and simplification. In particular, the current rules do not reflect global work practices, and impose an inappropriate compliance burden on many taxpayers in all but the simplest of cases — this has led to increased uncertainty and disputes. In addition, the Board identified a number of integrity concerns that arise due to the way in which the current rules operate.

Some of the Board’s key observations are:

- In the over 80 years since the residency rules were introduced, there has been considerable advancement in the way in which individuals work, travel and live, and much change in the global income tax system.

- Some aspects of the rules are outdated and require reconsideration. For example, the concept of domicile, based on a fundamental attachment to a single country, reflects the limited access to high speed travel of that time and the limited capacity for individuals to move between countries on short notice at affordable prices. The concept of domicile is no longer appropriate in the modern day context.

- The complexity of the rules means that a variety of reasonably arguable positions are open to taxpayers.

- There is no clear overarching policy statement for which individual residency represents — this absence leads to uncertainty as to whether the consequences in any given situation are intended or unintended, and to uncertainty in application of the rules.

- Advisers find that providing definitive advice is difficult, and requires significant resources at a substantial cost to the taxpayer. This is supported by a significant trend of increased engagement with the ATO since 2009.

- There is an absence of recent guidance to provide clarity. Key ATO material has not been materially updated since the 1990s for modern work and life patterns. Other ATO website guidance is ambiguous and not binding on the Commissioner.

- Individuals might seek to manipulate their residency status through a number of known integrity issues.

- An integrity concern arises where an outbound individual is no longer a resident but not legally qualifying for residency under another country’s tax law — i.e. a ‘resident of nowhere’.

- The superannuation test no longer meets its objective to treat all Commonwealth officials as residents — the two Commonwealth superannuation schemes are now closed to new members and the Commonwealth no longer obliges officials to join its superannuation funds.

The Board recommended that the Government replace the current rules with an improved and simplified residency test based on a ‘two-step’ model — a simple bright-line test followed by a more detailed analysis in more complex cases.

Before taking a position on the 2017 Report, the Government asked the Board to undertake further consultation on its key recommendations. The Board undertook consultation in late 2018. The Board released its report titled Review of the Income Tax Residency Rules for Individuals: Consultation Guide in September 2018 (2018 Consultation Guide), outlining a series of design principles aimed at developing new residency rules, with a particular focus on the following:

- options for a two-step model for individual tax residency;

- integrity risks to circumvent existing residency rules (e.g. ‘residents of nowhere’);

- options to replace the ‘superannuation test’.

After further consultation, the Board submitted its final report to Government titled Reforming individual tax residency rules — a model for modernisation (the Final Report) in March 2019 in which it set out a model for simplifying and modernising the current individual residency rules.

The Board has developed proposed rules to re-focus tax residency in three critical ways:

- making physical presence the primary measure of residency — moving Australia to closer alignment with international practice;

- focusing on Australian connections — providing that two individuals with identical physical presence and other connections to Australia should be treated the same;

- adopting only objective criteria — removing any requirement to test intention or undertake broad, holistic examinations to promote simplicity, consistency and certainty.

The proposed model is intended to:

- lead to more certain outcomes;

- maintain existing outcomes (in a streamlined and simplified way) where appropriate in order to minimise disruption and revenue implications.

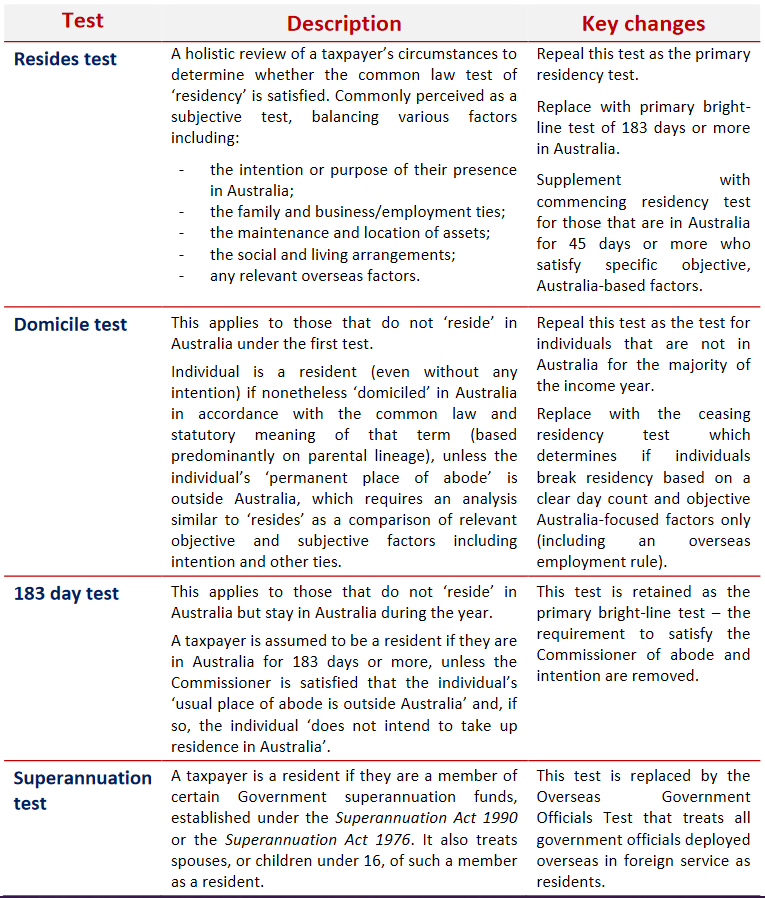

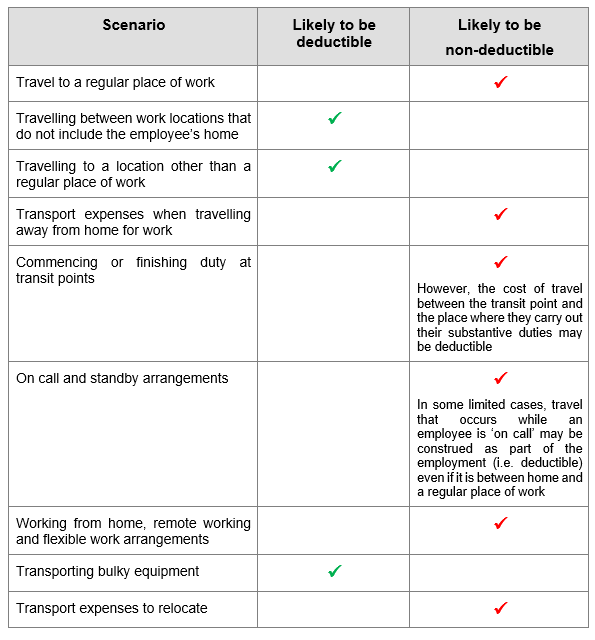

The current four tests of individual residency and the Board’s proposed changes

Under current law, the definition of ‘resident or resident of Australia’ in s. 6(1) of the ITAA 1936 includes an individual who is a resident under ordinary concepts as well as an individual who is resident under one of three statutory tests.

The Final Report summarises the four residency tests and the Board’s proposals as follows:

Source: Board of Taxation, Reforming individual tax residency rules —

A model for modernisation, Table 1, page 112

References

References

The ATO fact sheet Your tax residency provides general guidance on the residency tests.

The ATO fact sheet Residency and source of income sets out the ATO’s guidance in relation to individual residency issues which arise as a result of COVID-19 international travel restrictions.

Budget measure — Proposed new individual tax residency rules

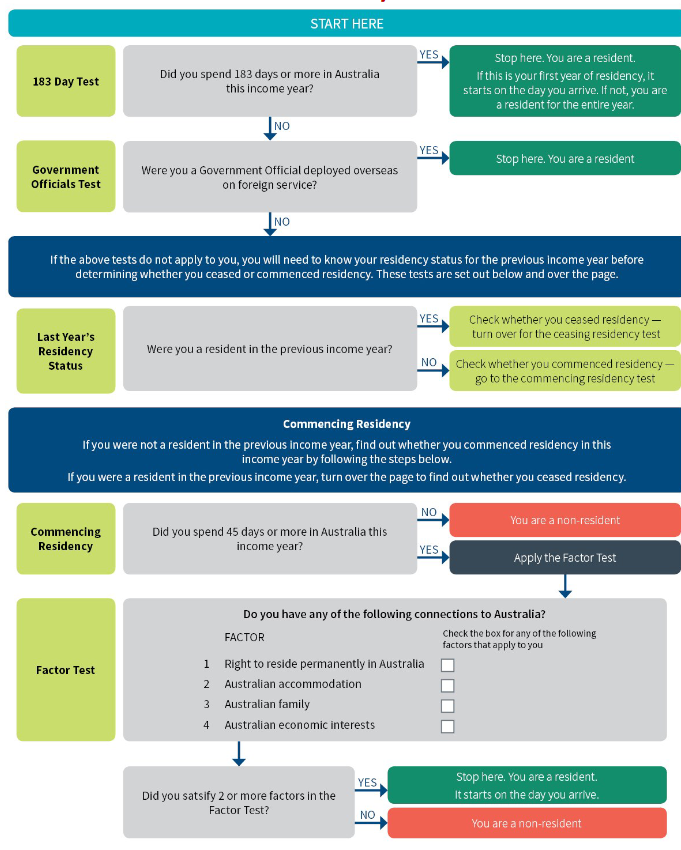

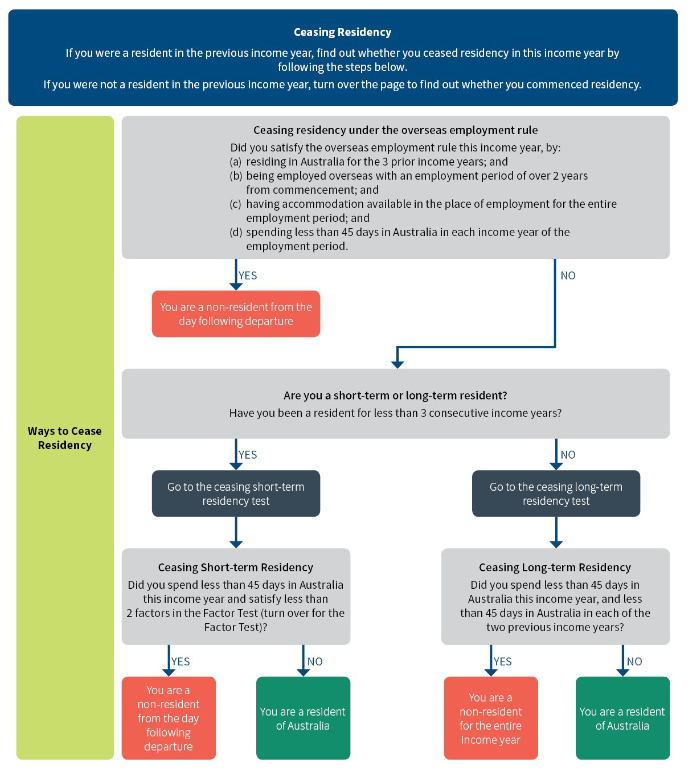

As part of the 2021–22 Federal Budget, the Government announced that it will replace the individual tax residency rules with new primary and secondary tests to determine residency, based on the Board of Taxation’s recommendations.

The primary test will be a simple ‘bright line’ test under which a person who is physically present in Australia for 183 days or more in any income year will be an Australian tax resident.

Individuals who do not meet the primary test will be subject to secondary tests that will depend on a combination of physical presence and measurable, objective criteria.

The new tests are proposed to commence from the first income year after Royal Assent of the enabling legislation.

The Budget papers do not contain any details about the Government’s proposal, but as an indicator of what may be planned, this is the Board’s recommended model:

Board of Taxation: Proposed residency rules flowchart

Source: Board of Taxation, Reforming individual tax residency rules —

A model for modernisation, page 17-18

Extending new corporate tax residency test to trusts and CLPs

Current residency rules for certain entities

| Entity | Residency test |

| Company s. 6(1) of the ITAA 1936 |

A company is a resident if:

|

| Trust estate s. 95(2) of the ITAA 1936 |

A trust estate is a resident trust estate in relation to an income year if:

|

| Corporate limited partnership s. 94T of the ITAA 1936 |

A corporate limited partnership (CLP) is a resident if:

|

Last year’s proposal to amend the corporate tax residency test

The corporate residency rules are fundamental to determining a company’s Australian tax liability. The ATO’s interpretation following the High Court’s 2016 decision in the Bywater Investments Ltd v FCT departed from the long-held position on the definition of a corporate resident. As a result, the Government requested the Board of Taxation review the definition in 2019–20.

In Bywater the High Court was required to determine whether a number of foreign companies were residents. The majority confirmed that the test for central management and control has, since its inception, been concerned primarily with identifying the actual location of a company’s central management and control, as opposed to mechanically placing central management and control in the jurisdiction in which a company’s board of directors meet.

TR 2004/15 expressed the ATO’s former view that carrying on business in Australia is a separate requirement of the central management and control test, and one that needs to be established independently of the exercise of central management and control in Australia.

The ATO, in response to the decision, withdrew TR 2004/15 and replaced it with TR 2018/5, in which the ATO expressed its revised view that, to satisfy the central management and control in Australia requirement:

It is not necessary for any part of the actual trading or investment operations of the business of the company to take place in Australia. This is because the central management and control of a business is factually part of carrying on that business.

It is possible under this view that the central management and control test can be satisfied by a foreign incorporated company that carries out operational activities wholly outside Australia.

In the 2020–21 Federal Budget, the Government announced that it would make technical amendments to clarify the corporate tax residency test.

The law will be amended to provide that a company that is incorporated offshore will be treated as an Australian tax resident if it has a ‘significant economic connection to Australia’, which will be satisfied where both the company’s core commercial activities are undertaken in Australia and its central management and control is in Australia.

The proposed change is in line with the Board’s key recommendation in its 2020 report Review of Corporate Tax Residency and will mean the treatment of foreign incorporated companies will reflect the position prior to Bywater.

The amendment is proposed to apply to the first income year after the date of Royal Assent of the enabling legislation, with an option to apply the new law from 15 March 2017. Legislation to give effect to the measure is yet to be introduced.

Budget measure — Extending the proposed definition to trusts and CLPs

As part of the 2021–22 Federal Budget, the Government announced it would consult on broadening the amendment to the corporate residency test to trusts and corporate limited partnerships. As per the table above, both of these definitions also include the central management and control test.

The Government will seek industry’s views as part of the consultation on the original corporate residency amendment. The timeframe for the consultation is yet to be announced.

Relaxing the SMSF residency test

The current superannuation fund residency definition

Section 295-95(2) of the ITAA 1997 sets out the requirements for a superannuation fund (including an SMSF) to be an ‘Australian superannuation fund’. Broadly, this is the case if:

- the fund was established in Australia or any asset of the fund is situated in Australia;

- the central management and control of the fund is ordinarily in Australia;

- the fund satisfies the ‘active member test’, which is satisfied at the relevant time if the fund:

- has no active members, or

- at least 50 per cent of the following are attributable to superannuation interests held by active members who are Australian residents:

- total market value of the fund’s assets attributable to superannuation interests held by active members, or

- the sum of the amounts that would be payable to or in respect of active members if they voluntarily ceased to be members.

The residency safe harbour

The law also contains a safe harbour in s. 295-95(4) under which the central management and control of a superannuation fund is deemed to be in Australia if the central management and control is temporarily outside Australia for a period of not more than two years.

Trustees who were genuinely intended to be temporarily absent from Australia for less than two years may have become stranded overseas because of the COVID-19 crisis, resulting in a forced absence of more than two years. The ATO has provided website guidance that:

If the individual trustees of an SMSF or directors of its corporate trustee are stranded overseas due to COVID-19, in the absence of any other changes in the SMSF or the trustees’ circumstances affecting the other conditions, we will not apply compliance resources to determine whether the SMSF meets the relevant residency conditions.

Budget measure — Easing the superannuation fund residency test

The Government proposes to ease the residency test by:

- extending the central control and management test safe harbour from two to five years for SMSFs;

- removing the active member test for both SMSFs and small APRA-regulated funds.

This will allow members of these two types of funds to continue to contribute to their superannuation fund whilst temporarily overseas, ensuring parity with members of large APRA-regulated funds.

This measure will have effect from the start of the first income year after Royal Assent of the enabling legislation, which the Government expects to have occurred prior to 1 July 2022.

Further info and training

Join us at the beginning of each month as we review the current tax landscape. Our monthly Online Tax Updates and Public Sessions are excellent and cost effective options to stay on top of your CPD requirements. We present these monthly online, and also offer face-to-face Public Sessions at locations across Australia. Click here to find a location near you.

If you’d like a full rundown of the Federal Government Budget, check out our resources page or listen to our recent Federal Government Budget webinar.

If you’re a current in-house or public session client, you can expect complete coverage of the Budget and how it will affect you and your clients in your next session.

If you’re not a current client, we can also present these Updates at your firm (or through a private online session) with content tailored to your client base – please contact us here to submit an expression of interest or visit our In-house training page for more information.

Our mission is to offer flexible, practical and modern tax training across Australia – you can view all of our services by clicking here.

Note:

Note:

Comments and submissions

Comments and submissions

ATO fact sheet

ATO fact sheet Implications

Implications

Tailored in-house training

Tailored in-house training