[lwptoc]

We hope you enjoy our Tax Time 2022 content series.

We hope you enjoy our Tax Time 2022 content series.

Related content:

With Tax Time 2022 rolling around in a few weeks, tax practitioners can steady themselves for a barrage of client tax returns over the next few months. With an incentive to reduce taxable income to increase a potential tax refund, clients may be optimistic with what they can deduct as a work-related expense, with tax agents often having to play ‘goalie’ to ensure that any non-deductible expenses do not slip through. It is important for practitioners to understand a client’s work environment to determine what can and cannot be claimed, and to help get the best tax outcome for the client, while keeping them on the right side of the ATO.

Although relatively simple in concept, in reality, a significant amount of time and effort is spent by practitioners in complying with and administering the work-related expense rules. Work-related expense claims are a target area for ATO compliance activity year-on-year. Given the increasing sophistication of the ATO’s compliance activities and data analytics, understanding the ins and outs of what can be deducted for a work-related expense has never been more critical. It is important that a taxpayer can substantiate and rationalise the deductibility of any expenses claims — especially the more contentious ones!

This article considers the work-related expense rules, common mistakes made, and ‘contentious’ deductions that may be deductible in the right circumstances.

![]() Note

Note

This article only focuses on deductions available to employees and not the self-employed.

The ATO has three ‘golden rules’ of work-related expense deductibility. In order to claim a deduction for a work-related expense, the taxpayer needs to:

These golden rules are based on the legislative provisions which apply — mainly the general deduction rule in s. 8-1 and the substantiation rules in Div 900 of the ITAA 1997.

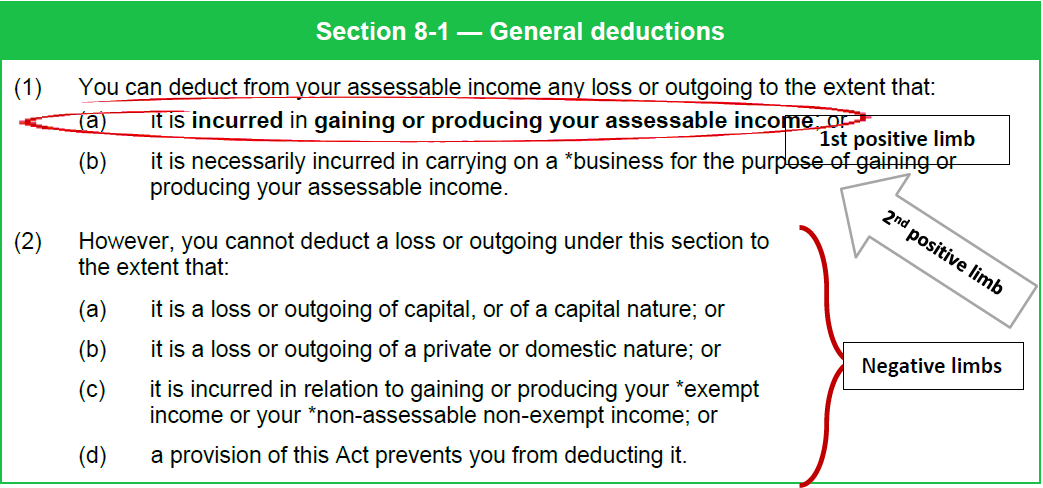

Working out whether a work-related expense is deductible under the Tax law starts with considering whether the expenditure satisfies the conditions under the general deduction provision in s. 8-1 and ensuring that it is not excluded by one of the negative limbs. While there are other provisions in the Tax Acts which allow deductions for specific types of work-related expenses, s. 8-1 is the provision under which work-related expenses most commonly qualify.

Section 8-1 is comprised of two positive limbs, and four negative limbs.

Some types of expenditure may be deductible under a statutory provision even if they do not qualify for deduction under s. 8-1. Provisions which apply to specific types of expenses include:

Not understanding the ins-and-outs of the work-related expense rules is — under the law — no excuse for incorrectly claiming deductions (although motive may affect penalties). The ATO has recently warned taxpayers about ‘double dipping’ deductions. Common mistakes include:

Given the ATO’s extensive and ever-expanding compliance and data matching capabilities, incorrect work-related expense claims are more likely to be detected and disproved than ever before. Taxpayers risk being audited or penalised for providing incorrect information with penalties up to 75 per cent of the shortfall amount if they are found to have intentional disregard to the operation of the tax law.

It is important to understand how the client earns their assessable income as this will determine what they can and cannot claim as a work-related expense. Expenses that may initially seem to be private in nature may be deductible if the client’s work situation warrants it. Conversely, an expense that may seem prima facie deductible, may not have the required nexus with the taxpayer’s assessable income — i.e. a business course that is ‘too general’ on closer inspection of the course syllabus. Below is an outline of examples of ‘contentious’ deductions that may be deductible in certain circumstances.

With more and more employees moving to a hybrid work model where they work remotely for a portion of their working week, or even fully work from home, can they claim a portion of their rent or mortgage? Only in certain circumstances.

Expenses associated with the ownership, or running, of an individual’s home are usually private and domestic in nature. However, deductions may be available where part of a home is used for work-related purposes as follows:

Notably, expenses classified as occupancy costs are only deductible where there is a place of business.

The ATO outlines its views on what constitutes a ‘place of business’ in paragraphs 11 to 13 of TR 93/30.

An employee may find it difficult to determine whether, as a matter of fact, they are conducting a business from their home. This is because it is the employer’s business which is the relevant business that must be examined. As such, the Commissioner has stated that a place of business will exist for an employee only where:

Expenses associated with a dedicated ‘home office’ are usually incurred by individuals working in professional occupations. Where work is done from home or the home is used as place of business, individuals who are not professionals should also consider whether they are entitled to any deductions — e.g. sportspeople.

![]() Note — Areas that are not strictly an ‘office’

Note — Areas that are not strictly an ‘office’

It may be possible to deduct expenses associated with other areas of the home if they are used for work purposes even though they are not strictly a home ‘office’. For example, in PBR 1012404426597 (archived) a performing artist was entitled to a deduction for additional running expenses where a bedroom was used to rehearse. However, the individual must establish a sufficient relationship between the outgoing and the gaining or producing of their assessable income (see Ogden v FCT [2016] AATA 32) .

When determining whether there is an ‘alternative place of business’, it may be important to consider whether a work space is available at a client’s premises (see PBR 1011279145499 (archived)).

The condition that the need for a place of business ‘is inherent in the nature of the taxpayer’s activities’ directs attention to what the employee does for the employer and where the activities take place.

The condition that the need for a place of business ‘is inherent in the nature of the taxpayer’s activities’ was considered in Bhatti and FCT [2016] AATA 24.

The Taxpayer was an accountant who worked from home one day per week and claimed a percentage of her occupancy costs in respect of the area she had set aside to work from. The Tribunal decided that the expenses were not deductible. The Tribunal was not satisfied that the Taxpayer was required to work from home.

Warning — Impact on main residence exemption

Warning — Impact on main residence exemption

An individual who runs a business, or their employer’s business, from a dedicated space in their main residence will not be entitled to the full main residence CGT exemption in Subdiv 118-B of the ITAA 1997. A partial exemption may be available using the same apportionment process as they applied to claim a deduction for their mortgage interest and their occupancy costs — i.e. generally, floor area and time used.

![]() Tip

Tip

When an individual first starts to use their home as a place of business, they should obtain a market valuation at that time so that contemporaneous evidence of the market value is available when they later have to calculate the capital gain on the main residence.

Working from home for extended periods saw a lot of people welcome a furry friend into their home — it has been reported by Animal Medicines Australia that over a million additional dogs have been brought into Australian homes since 2019. Your pet might keep you company during the day while working from home, but does this mean you can claim expenses relating to them? Unfortunately, this is unlikely to fly with the ATO.

But there ARE certain circumstances where you may be able to claim expenses for your pet if your dog was purchased or procured for the purpose for producing your assessable income.

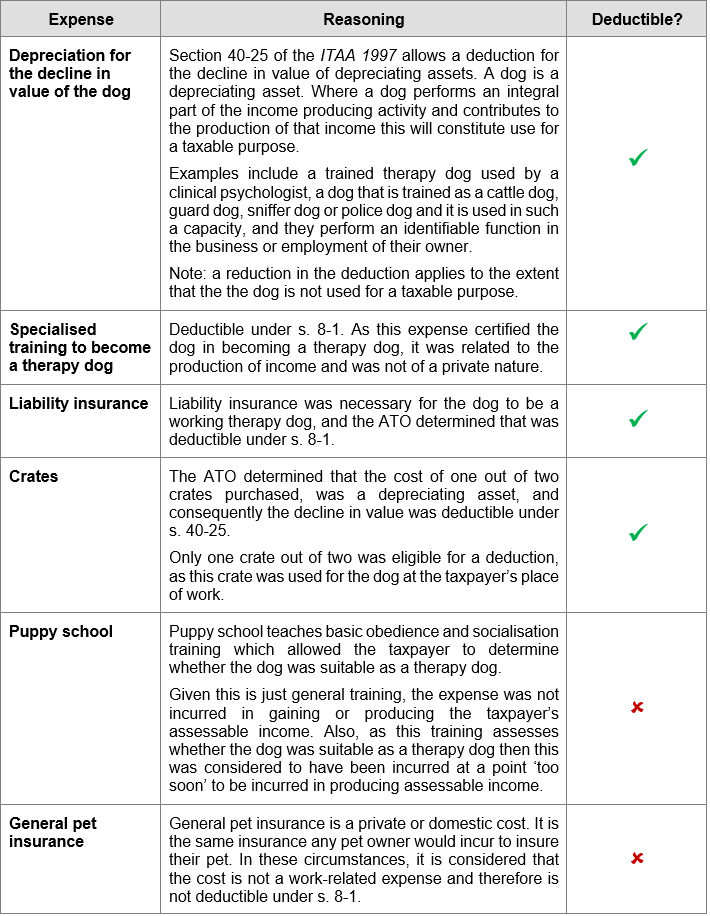

For example, in the recent PBR 1051948550599, the ATO determined that a person who purchased a dog with the sole intention for it to be used as a therapy dog for their income producing activities in their field of employment, could claim certain expenses relating to their pet dog. The person had received a letter of support from their employer which outlined the positive influences and benefits of having a therapy dog in the employment setting.

The ATO’s views as to whether certain expenses were deductible or non-deductible are set out in this table:

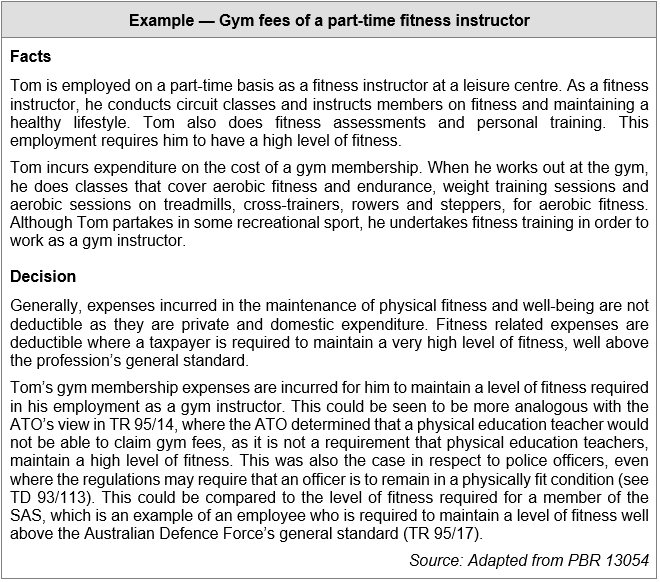

Gym memberships are generally a non-deductible expense unless regular strenuous physical activity is a part of the individual’s ordinary duties and they are required to have a level of physical fitness well above the standard for their occupation. For example:

![]() Note — sports supplements

Note — sports supplements

It doesn’t appear that the rules concerning deductibility of gym memberships extend to the cost of sports supplements, even for taxpayers who are required to maintain a level of fitness well above the standard for their occupation. In PBR 1051838210802 the ATO determined that a member of the ADF who was part of a special combat squad, was not entitled to claim a deduction for sports supplements purchased as a fitness/gym expense on the basis that expenditure on food and drink is of a private nature.

The deductibility of self education expenses is one of the more common work-related expense issues that is determined in private binding rulings.

TR 98/9 states that self-education expenses are deductible under s. 8-1 where they have a relevant connection to the taxpayer’s current income-earning activities. Therefore, if a course is only indirectly connected to a taxpayer’s current role (for example, a university teacher who completed a course which was a requirement to teach in a particular type of college and with certain other education providers — see PBR 1051938138370), it will not be an allowable deduction.

The self-education expenses will be allowable as a deduction if:

![]() Note

Note

There may be other circumstances which establish a direct connection between the course and an individual’s current work activities. The relevant facts and circumstances of each case will need to be considered. If the nexus is due to ‘other circumstances’ this must be disclosed in the individual’s tax return by printing the relevant code and may lead to further questions from the ATO.

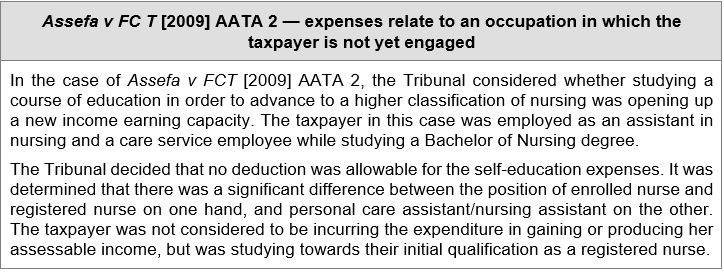

On the other hand, if the study will enable a taxpayer to get employment, to obtain new employment or to open up a new income-earning activity — whether in business or in the taxpayer’s current employment — the expenses are incurred at a point too soon to be regarded as incurred in gaining or producing assessable income (FCT v Maddalena (1971) 2 ATR 541, see also PBR 1051786502508). This includes studies relating to a particular profession, occupation or field of employment in which the taxpayer is not yet engaged.

If an individual’s tax agent is unsure whether a particular expense is deductible for the taxpayer, they can apply for a private binding ruling with the ATO. This can be done via an ATO form or a letter.

The following information must be included:

Reference — ATO guide for private rulings

Reference — ATO guide for private rulings

The ATO has a reference guide on applying for a private rulings.

Join us at the beginning of each month as we review the current tax landscape. Our monthly Online Tax Updates and Public Sessions are excellent and cost effective options to stay on top of your CPD requirements as we approach the EOFY. You can also browse our recording library for past topics if you need to catch up on your CPD!

Our Public Session Tax Updates are available in 16 locations nationally and are presented monthly. Click here to find a location near you.

Tailored in-house training

Tailored in-house trainingWe can also present these Updates at your firm (or through a private online session) with content tailored to your client base – please contact us here to submit an expression of interest or visit our In-house training page for more information.

Our mission is to offer flexible, practical and modern tax training across Australia – you can view all of our services by clicking here.

Join thousands of savvy Australian tax professionals and get our weekly newsletter.