[lwptoc]

The ATO has recently released its Tax Time 2022 package for tax professionals and its suite of 2022 tax returns and accompanying instructions. The ATO has also announced its four priority areas for 2022.

For Tax Time 2022, the ATO will be focusing on four priority areas:

The ATO will be taking ‘firm action’ to deal with taxpayers who deliberately try to increase their refund, falsify records or cannot substantiate their claims.

Here is information on the penalties that may be imposed for false or misleading statements or for failing to meet record-keeping obligations.

Some people have changed to a hybrid working environment — i.e. partly in the office and partly at home — since the start of the pandemic, which saw one in three Australians claiming working from home expenses for 2020–21.

If a taxpayer has continued to work from home, the ATO would expect to see a corresponding reduction in car, clothing and other work-related expenses such as parking and tolls.

There are three methods for calculating a deduction for working from home expenses:

The ATO reminds taxpayers that:

If the taxpayer has kept track of their expenses with the myDeductions tool in the ATO app, they can email the records to their tax agent.

Rental property owners need to include all the income they have received from their rental, including short-term rental arrangements, insurance payouts and rental bond money retained.

The ATO advises that if it notices a discrepancy, it may delay the processing of the refund as it may need to contact the taxpayer or their registered tax agent to correct their return or to ask for documentation to support claims made.

For more information visit www.ato.gov.au/rental

If the taxpayer disposes of an asset such as property, shares, or a crypto asset, including non-fungible tokens (NFTs), they will need to calculate a capital gain or loss and disclose it.

Through the ATO’s data collection processes, it knows that many Australians are buying, selling or exchanging digital coins and assets. The ATO expects to see more capital gains or capital losses reported this year. the ATO also reminds taxpayers that they cannot offset crypto losses (capital losses) against their salary and wages.

For more information visit www.ato.gov.au/crypto

See the cryptocurrency 2014–15 to 2022–23 data-matching program protocol

Listen to our Tax Yak Episode 61 — Cryptocurrency and tax

The Tax Time 2022 package includes the following guidance for tax professionals.

Key changes that affect 2022 tax returns include:

To prepare for Tax Time 2022, the ATO recommends that tax agents:

The lodgment due dates will be available in Online services for agents by the end of July 2022.

The ATO will start processing 2021–22 tax returns on 7 July 2022 and expects refunds to be paid from 16 July 2022.

The ATO aims to finalise most electronically lodged current year tax returns within 12 business days of receipt. Paper tax returns may take up to 50 days for processing.

The ATO will advise of the progress of clients’ tax returns in several ways, including:

There are educational resources tailored for individuals and small business, and are available in languages other than english. Amongst other resources, there is a suite of occupation guides, an Individuals Tax Time Toolkit, an Investors Toolkit, small business guides and a Small Business Tax Time Toolkit.

This section provides the links to the new tax return forms and instructions for 2022.

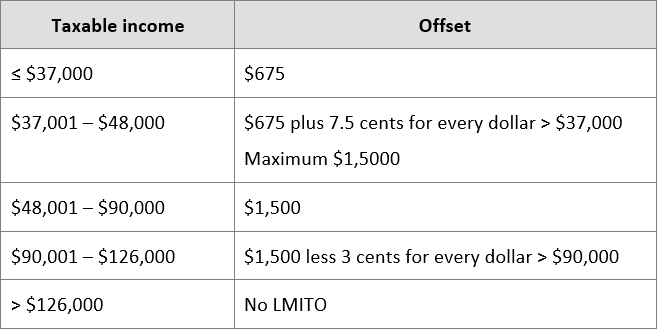

The LMITO has increased by $420 for 2021–22. This increases the base amount to $675 and the maximum amount to $1,500.

The LMITO rates for 2021–22 are:

The LMITO is not available after 2021–22.

From 2021–22, no CGT event arises for individuals when eligible granny flat arrangements are created, varied or terminated.

A granny flat arrangement is a written agreement that gives an eligible person the right to occupy a property for life. A granny flat interest can be held in any type of property, provided it is a dwelling. The property could be the owner’s main residence or a separate property, and may be part or all of the property.

An eligible person with a granny flat interest must either have reached pension age, or require assistance for day-to-day activities because of a disability.

The CGT exemption applies where:

Measures and support available for individuals impacted by COVID-19 include:

The What’s new section includes a number of items including the following key developments:

The loss carry back tax offset tool can be used by a taxpayer to:

There are also new label items relating to the loss carry back tax offset.

The corporate tax rate for base rate entities has reduced to 25 per cent from 2021–22 (26 per cent in 2020–21).

Join us at the beginning of each month as we review the current tax landscape. Our monthly Online Tax Updates and Public Sessions are excellent and cost effective options to stay on top of your CPD requirements as we approach the EOFY. You can also browse our recording library for past topics if you need to catch up prior to 30 June!

Our Public Session Tax Updates are available in 16 locations nationally and are presented monthly. Click here to find a location near you.

Tailored in-house training

Tailored in-house trainingWe can also present these Updates at your firm (or through a private online session) with content tailored to your client base – please contact us here to submit an expression of interest or visit our In-house training page for more information.

Our mission is to offer flexible, practical and modern tax training across Australia – you can view all of our services by clicking here

Join thousands of savvy Australian tax professionals and get our weekly newsletter.