The ATO has announced that it will be contacting some individual professional practitioners (IPPs) — who may be in a higher risk category — to find out more about their profit allocation arrangements and assist them with using PCG 2021/4 (the Guideline), which came into effect on 1 July 2022.

The ATO will contact IPPs who may be in a higher risk category to:

There is a dedicated team responsible for the oversight and management of profit allocation arrangement risks. If an IPP wishes to discuss their profit allocation arrangement with the ATO, they can email ProfessionalPdts@ato.gov.au.

PCG 2021/4 is about arrangements where:

PCG 2021/4 applies from 1 July 2022. The Guideline replaces the web material published in 2015, Assessing the Risk: Allocation of profits within professional firms guidelines, which was suspended in December 2017.

ATO guidance on the application of the Guideline, including detailed examples, is available here.

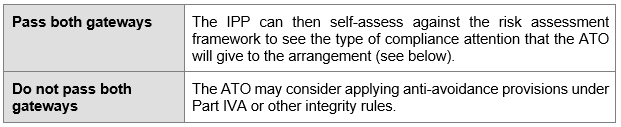

The IPP must assess if their arrangement is commercial and does not have high-risk features. The IPP must pass these ‘gateways’ before they can apply the Guideline.

The IPP must assess if their arrangement is commercial. An arrangement that shows a lack of commercial rationale can:

The IPP must also assess that your arrangement does not have high-risk features.

Arrangements with high-risk features can:

Where the IPP has passed both gateways, they can self-assess against the risk assessment framework.

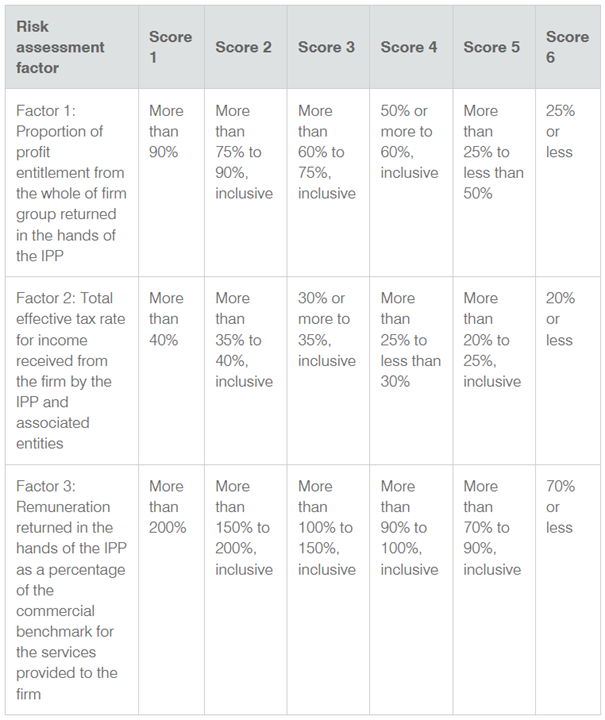

If the IPP returns 100 per cent of the profit entitlement from the firm in their tax return, they are automatically int eh green zone and do not need to assess against the other risk assessment factors.

The total effective tax rate is the average rate of tax for the entire income received from the firm by the IPP expressed as a percentage. It is calculated using the following formula:

Total tax paid by the IPP, and associated entities of the IPP, on professional firm income

÷ Total firm income collectively received × 100

The total effective tax rate excludes any levies such as Medicare levy.

* The IPP can self-assess against the risk assessment factors 1 and 2 only, only if it is impractical to accurately determine an appropriate commercial remuneration against a benchmark for risk assessment factor 3.

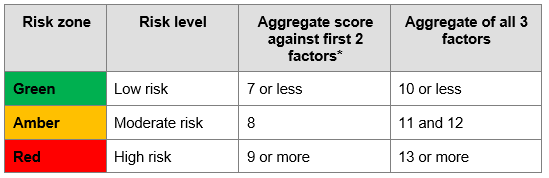

The ATO is likely to further analyse the facts and circumstances of the arrangement or initiate compliance activity if either the:

The IPP can continue to rely on the suspended guidelines for 1 July 2017 to 30 June 2022 if their arrangement:

The arrangement will be considered low risk for 1 July 2017 to 30 June 2022.

The IPP may find that your arrangement was low risk under the suspended guidelines but has a higher risk rating under PCG 2021/4. If so, the IPP can continue to apply the suspended guidelines until 30 June 2024. If the IPP wishes to transition their high-risk rating arrangement to a lower risk zone they can email ProfessionalPdts@ato.gov.au.

Join us at the beginning of each month as we review the current tax landscape. Our monthly Online Tax Updates and Public Sessions are excellent and cost effective options to stay on top of your CPD requirements. You can also browse our recording library for past topics if you need to catch up!

Our Public Session Tax Updates are available across 16 locations nationally and are presented monthly. Click here to find a location near you.

Personalised tax training

Personalised tax trainingWe can also present these Updates at your firm (or through a private online session) with content tailored to your client base – please contact us here to submit an expression of interest or visit our In-house training page for more information. You can also call us at 1300 TAX CPD if you have any questions, or to discuss your training needs.

Our mission is to offer flexible, practical and modern tax training across Australia – you can view all of our services by clicking here.

Join thousands of savvy Australian tax professionals and get our weekly newsletter.