[lwptoc]

The Government has passed legislation to ensure that the expenses of COVID-19 testing incurred by individuals will be deductible where there is an appropriate nexus to the derivation of assessable income. Employers will also be exempt from paying FBT where they pay for or reimburse eligible testing costs.

The amendments, which apply to expenses incurred on or after 1 July 2021, are contained in Schedule 2 to the Treasury Laws Amendment (Cost of Living Support and Other Measures) Act 2022, which received Royal Assent on 31 March 2022. The Act implements a package of 2022–23 Federal Budget initiatives.

This article outlines the new rules for individuals and employers, and incorporates some practical guidance from the Explanatory Memorandum to the Act (the Explanatory Memorandum) and the recently released ATO fact sheets for individuals and employers (the ATO guidance).

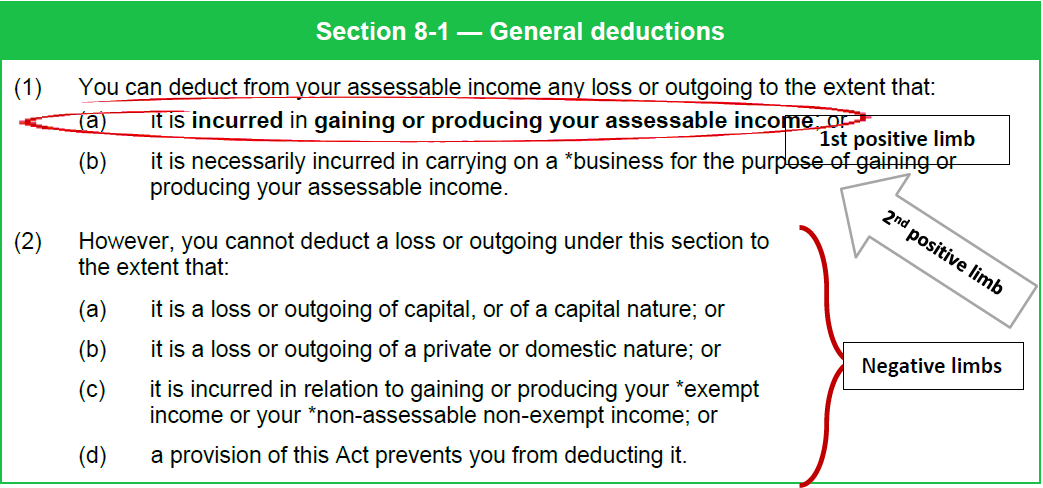

The deductibility rules

New s. 25-125 of the ITAA 1997 allows an individual taxpayer to deduct a loss or outgoing to the extent it is incurred in gaining or producing their assessable income, if:

- the loss or outgoing is incurred in respect of testing the taxpayer for COVID-19;

- the purpose of the test is to determine whether the individual may attend or remain at a place where they engage in activities:

- to gain or produce their assessable income; or

- in the course of carrying on a business for the purpose of gaining or producing their assessable income.

The legislation provides that the loss or outgoing is not deductible to the extent that it is of capital, or of a capital nature. However the Explanatory Memorandum notes that it is not expected that the relevant expenses would be capital in nature due to the consumable nature and expected repeated use of the tests.

The Explanatory Memorandum makes it clear that the amendments cover circumstances where the individual’s positive COVID-19 status means that they will work from home instead of at their place of work. That is, there is no requirement that the work can only be undertaken at the place of work.

Types of tests covered by the deduction

A test is eligible for deduction under s. 25-125 if it is:

- a polymerase chain reaction (PCR) test; or

- a therapeutic good that is included in the Australian Register of Therapeutic Goods and relates to the deduction of COVID-19.

The types of expenses covered by the new deduction would include expenses for PCR tests undertaken through a private clinic where the individual incurs the expense, and rapid antigen tests (RATs).

In practice, most individual deductions will relate to the costs of acquiring over-the-counter RATs. Costs incurred for brands of test kits purchased overseas or imported from overseas which are not appropriately registered in Australia would not be eligible for deduction.

When the costs of tests cannot be claimed

The circumstances in which the cost of a COVID-19 test is not deductible would include the following:

- the individual uses the test for private purposes — e.g. to test their children before they attend school or day care;

- the individual receives a reimbursement from their employer or someone else; or

- the individual works from home and does not intend to attend their workplace.

RATs are commonly sold as multipacks. Where the relevant expense is partially incurred in gaining or producing assessable income and partially incurred for private purposes (e.g. for leisure activities), the amount of the deduction is reasonably apportioned.

Are ancillary costs, e.g. travel costs, deductible?

The Explanatory Memorandum clearly states that the ancillary costs of acquiring tests, including the costs of travelling and parking, to purchase a test kit — or to attend a PCR testing site — cannot be claimed as a deduction.

However, it is not a policy intention to exclude other incidental costs during the purchase of the test, such as credit card surcharge fees, and postage and handling for online purchases.

Application date

The new deduction rules apply in relation to losses and outgoings incurred on or after 1 July 2021.

Examples

The ATO has provided the following examples of the types of claims which it will accept.

COVID-19 tests that can be claimed

Mary is a casual employee at a local café. In April 2022 Mary buys a qualifying multipack of COVID-19 tests, which she only uses before commencing a shift if she has any COVID-19 symptoms or has been in contact with a COVID-19 case. Her employer does not reimburse her for the cost of the COVID-19 tests.

Mary can claim a deduction for the cost of these COVID-19 tests.

Personal and work-related use

Vinh buys a qualifying two-pack of COVID-19 tests at the local pharmacy. Vinh uses one test to confirm he does not have COVID-19 before attending a local sporting event. A week later he realises that he has been exposed to COVID-19 and uses the other test to check his COVID-19 status before attending his place of work.

As Vinh used one test for personal use and one test for work purposes, he can only claim a deduction for half the cost of the two-pack of COVID-19 tests.

Substantiation rules

As a result of the legislative amendments, a deduction of COVID-19 test expenses is subject to the work expense substantiation rules in Subdiv 900-B of the ITAA 1997. Written evidence to support the deduction must be retained for five years from the later of the due date and the lodgment date of the tax return.

According to the ATO guidance, appropriate evidence may be a receipt or invoice, and correspondence from the individual’s employer stipulating the requirement to test.

Note

Note

The exception from substantiation that applies where an individual’s total work-related expenses for an income year does not exceed $300 also applies to COVID-19 testing costs.

Costs incurred before law change — ‘reasonable evidence’ is sufficient

The ATO states that it will accept ‘reasonable evidence’ of expenses incurred before the new rules became law on 31 March 2021, if the individual did not keep a record of those expenses.

Reasonable evidence is documents that show the cost of the test and the requirement to take it for work purposes. this evidence may include:

- bank and credit card statements;

- a diary or other documents, including receipts, that shows a pattern of buying COVID-19 tests after the law change that could reasonably have applied from 1 July 2021.

Claiming a deduction in tax return

The ATO advises that an individual claiming a deduction should enter the amount at ‘Other work-related expenses’ in their tax return (this was Item D5 in the 2021 Individual Tax Return form), and include in the description field ‘COVID-19 tests’.

At time of writing the 2022 tax return stationery has not yet been released.

FBT implications for employers

As a consequence of the new deduction for individuals, employers that provide relevant COVID-19 testing to employees in the course of their work will not incur FBT liability through the operation of the ‘otherwise deductible’ rule.

Benefits provided by employers

COVID-19 tests may be provided by employers to their employees, or their associates:

- directly;

- through a third party under an arrangement; or

- as a reimbursement of the cost to employees.

These are considered benefits under the FBT regime. For example:

- employee expense payment fringe benefits (s. 24 of the FBTA Act) — where the employer pays for, or reimburses, an employee’s or an employee’s family member’s COVID-19 test;

- property fringe benefits (s. 44 of the FBTA Act) — where the employer purchases the COVID-19 tests and gives them to their employees or their employees’ family members for free or at a discount; or

- residual fringe benefits (s. 52 of the FBTA Act) — where the employer provides their employees or their employees’ family members with a COVID-19 test that is not an expense payment or property benefit.

Application of the otherwise deductible rule to reduce FBT liability

The Act does not introduce any amendments to the FBTA Act. However, where an employer provides the benefit of COVID-19 tests to employees to determine whether they can attend their place of work, and this benefit was provided on or after 1 July 2021, the employer may reduce their FBT liability by applying the ‘otherwise deductible’ rule.

The otherwise deductible rule allows the employer to reduce the taxable value of the fringe benefit (and therefore the FBT liability) by the amount of the income tax deduction the employee would otherwise have been entitled to claim at the time the benefit was provided had the employee incurred the relevant costs.

The ATO guidance states that the otherwise deductible rule does not apply to:

- COVID-19 tests the employer provides if:

- the employee uses the test for private purposes e.g. to test their children before they return to school or day care;

- the employee works from home and does not intend to attend the workplace; or

- the employer has not received the declarations that are required under the FBT law;

- any travel or parking expenses the employer pays or reimburses their employees to get their COVID-19 test. These expenses do not have a sufficient connection to the employee obtaining or undergoing a COVID-19 test to be regarded as being incurred in respect of testing them for COVID-19.

The otherwise deductible rule only applies to the extent that the employee could have claimed the work-related portion of the expenditure on COVID-19 tests as an income tax deduction. For example, if the employer buys a multipack of COVID-19 tests and allows the employee to use some for private purposes (such as by other family members or for leisure activities), the otherwise deductible rule only applies to the portion of the expense, property or residual benefit used for a work-related purpose.

Specific exemptions from FBT

Some benefits are exempt from FBT. If one of these exemptions applies, the employer will not need to consider whether the otherwise deductible rule applies.

Exemption for work-related medical screening

The work-related medical screening exemption (s. 58M of the FBTA Act) applies if both of the following apply:

- testing is carried out by, or on behalf of, a legally qualified medical practitioner or nurse;

- testing is available to all employees.

If only some of the employer’s employees get COVID-19 tests, the tests are still exempt if they are offered to all employees.

Minor benefits exemption

The minor benefits exemption (s. 58P of the FBTA Act) will only apply if:

- the tests are provided infrequently and irregularly;

- the cumulative value of the tests provided to an employee during the FBT year is less than $300.

Application date

The otherwise deductible rule may be applied to reduce the taxable value of benefits provided on or after 1 July 2021. For the FBT year ending 31 March 2022, the otherwise deductible rule would not apply for the period 1 April 2021 to 30 June 2021. However the medical exemption and minor benefits exemption may be applicable for the entire 2021–22 FBT year. Note that these general FBT exemptions do not impose a requirement that a RAT is registered in the Australian Register of Therapeutic Goods and therefore may be available in relation to benefits provided in relation to tests acquired or administered overseas for Australian employees.

Examples

The ATO has provided the following examples.

COVID-19 tests fully deductible to employee

Stella is a casual employee at a local café. In April 2022 Stella’s employer buys a qualifying multipack of COVID-19 tests, which is given to Stella. Stella only uses the tests before starting a shift if she has any COVID-19 symptoms or has been in contact with a COVID-19 case.

Stella would be able to claim deduction for the cost of these COVID-19 tests if she had paid for them and had not been reimbursed by her employer.

Stella’s employer can reduce the cost of the property fringe benefit to nil under the otherwise deductible rule, provided the required records are kept.

COVID-19 tests where only partly deductible to employee

Brett buys a qualifying two-pack of COVID-19 tests at the local pharmacy. Brett’s employer reimburses Brett for the cost of the tests.

Brett uses one test to confirm his child does not have COVID-19 before going to school. A week later he uses the other test to confirm his COVID-19 status before attending his place of work, as he was exposed to COVID at a child’s birthday party.

Brett’s employer can reduce the value of the expense payment benefit by 50 per cent by applying the otherwise deductible rule, provided the required records are kept.

FBT record keeping

The existing FBT record keeping requirements apply. Where the otherwise deductible rule is applied, the employer would need to ensure they have the relevant documentation and employee declarations to substantiate the extent to which the benefit provided would have been otherwise deductible to the employee.

To apply the otherwise deductible rule, the employer must keep records, including:

- a record of the costs of COVID-19 tests the employer pays for your employees (including reimbursements) and the dates the employer paid for them — this may include a receipt or invoice;

- a completed appropriate employer declaration or employee declaration.

Refer to the ATO fact sheet for detailed information about relevant FBT declarations that may apply.

Further info and training

Join us at the beginning of each month as we review the current tax landscape. Our monthly Online Tax Updates and workshops are excellent and cost effective options to stay on top of your CPD requirements.

We’ll cover up-to-date legislative developments and also the status of Federal Budget measures at our upcoming Tax Update sessions:

Tailored in-house training

Tailored in-house training

We can also present these Updates at your firm (or through a private online session) with content tailored to your client base – please contact us here to submit an expression of interest or visit our In-house training page for more information.

Our mission is to offer flexible, practical and modern tax training across Australia – you can view all of our services by clicking here.

We hope you enjoy our Tax Time 2022 content series.

We hope you enjoy our Tax Time 2022 content series. Note

Note Reference

Reference

Reference

Reference Warning

Warning

Warning — Impact on main residence exemption

Warning — Impact on main residence exemption