[lwptoc]

The impact of the COVID-19 pandemic on the economy has been far-reaching, and almost everyone’s work habits have been impacted in some way. Whether that is a change of schedule, updated responsibilities, or a change in work location. Many people are now taking client meetings via zoom, working from home, and are restricted in movements due to government-imposed lockdowns.

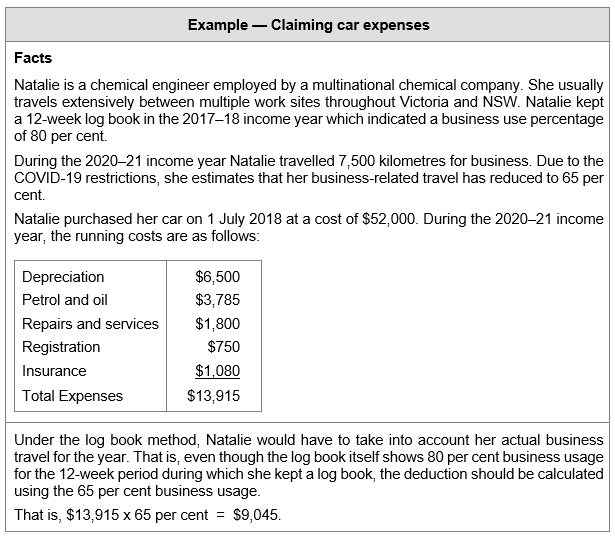

For many people, this may mean that there will be a decrease in car and travel expenses for the 2020–21 and potentially the 2021–22 income year. When claiming car and travel expenses using the logbook method, a taxpayer uses a representative period from the last five years as indicative of current use. But what does this mean for claiming car expenses for a period where the use of the car has changed due to changed work habits as a result of the COVID-19 pandemic?

Given the ATO’s extensive and ever-expanding compliance and data matching capabilities, incorrect car expense claims are more likely to be detected and disproved than ever before. Car and travel expense claims are a focus for the Commissioner year-on-year, and the Commissioner has already flagged that work-related expense claims will be targeted to ensure taxpayers aren’t copy and pasting claims from previous years, given the impact that the pandemic has had on many people’s day-to-day work habits.

The car expense deduction rules for individuals in Div 28 of the ITAA 1997 permit taxpayers to calculate deductions using one of two methods — the ‘cents per kilometre’ method and the ‘log book’ method. This article provides an overview of claiming car expenses using the log book method, and what to do if work habits have changed since the logbook was recorded.

Reference

Reference

The rules for using the log book method are set out in Subdiv 28-F of the ITAA 1997.

A taxpayer can use the logbook method if they held, i.e. owned or leased, a car for some or all of the income year. The logbook provides a record of the car use for at least continuous 12 weeks, which will serve as a representative period of car travel for the income year. The records are then used to determine a business-use percentage, by comparing the proportion of business-related kilometres to total kilometres travelled (i.e. business-related travel plus travel of a private or domestic nature).

The percentage determined from the logbook can be used to claim a deduction for car expenses for up to five years, assuming that the percentage is still representative of the actual use of the car during that income period.

![]() Definition — car expense

Definition — car expense

A ‘car expense’ is defined in s. 28-13.

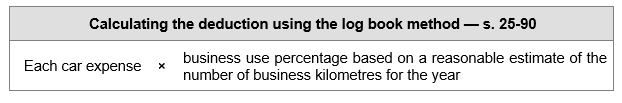

When using the logbook method, a deduction for car expenses is worked out as follows:

![]() Implications

Implications

While the substantiation requirements of using the log book are the most onerous of the methods available, if there is extensive business travel throughout the year, using the logbook method can be preferable because the amount that may be claimed is greater.

The business use percentage which the taxpayer can use is calculated under s. 28-90(3) as:

The number of business kilometres is based on a ‘reasonable estimate’. In making that reasonable estimate, the taxpayer must take into account all relevant matters including:

The substantiation requirements for the log book method are set out in Subdivs 28-G, 28-H and 28-I. They require that:

The rules about keeping a log book are prescriptive:

Odometer records

Odometer records basically document the total number of kilometres the car travelled during a particular period. They also record the car’s engine capacity and other details.

Specifically, the records must state in English:

The records must be in English and made as soon as possible after the start or end of the period or the particular replacement day.

The records must also state:

These records must be made prior to lodging the return or within such time as the Commissioner allows.

Retention of log book and odometer records

Log books must be retained for five years after the end of the latest year in which the person relied on the log book. The five-year period runs from the due date for lodging the return for the latest year or, if the taxpayer lodges late, from the actual date of lodgment. If the log book is not retained for the whole period, the claims made based on the log book can be disallowed.

Odometer records must be retained for the period in each year when the car is held. If a log book is retained, odometer records must be kept for the same period as the log book. The five-year retention period applies in the same way.

If the year of income is one during which a log book was not kept, the odometer records must be kept and retained for the same period as any written evidence of the expenses is kept for that year. This will also generally be for five years.

The general record-keeping provisions in Div 900 of the ITAA 1997 also apply. Subdivision 900-C (about substantiating car expenses) provides that for the log book method of deducting a car expense, the taxpayer must substantiate the expense by getting written evidence in accordance with Subdiv 900-E.

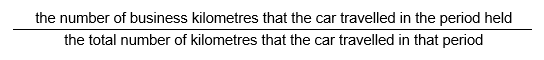

For expenses (other than the decline in value of a depreciating asset) a document must be obtained from the supplier and it must set out, in English or in the language of the country in which the expense was incurred:

PS LA 2005/7 sets out the evidence that the Commissioner will generally accept for substantiating an individual’s claim for deductible work and car expenses (for non-business taxpayers).

Generally, a document or a combination of documents (such as invoices, receipts etc.) that contain the five items stated in s. 900-115(2) — see above — should be accepted as written evidence.

Records made and stored electronically are recognised as documents.

Where the above documents are insufficient, the Commissioner will accept the following documents (or combinations of documents) as evidence of expenses:

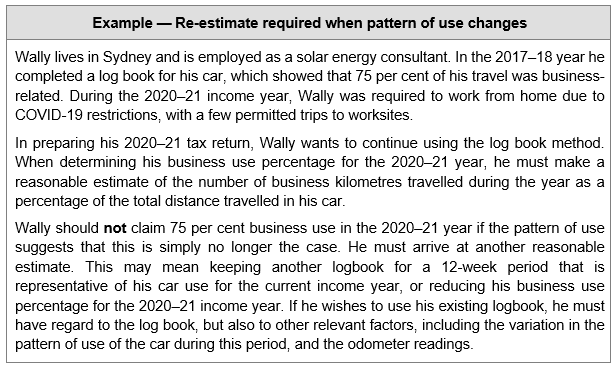

As outlined above, a log book provides a representative period of travel which is used to work out how much of a car expenses is deductible. If the pattern of car usage has changed after the log book was completed due to COVID-19 movement restrictions, does a new logbook need to be kept for an updated representative period of private and business usage during the COVID-19 pandemic? Not necessarily.

Under the law there are only two situations in which a taxpayer is legally obliged to keep a log book for an income year before the five-year expiry:

However this does not mean that taxpayers should or could simply apply the business use percentage calculated using pre-pandemic logbook data. A log book is only one of the ‘relevant matters’ which the taxpayer is required to take into account in determining their reasonable estimate of the business kilometres travelled (see ‘Working out the business use percentage’ above). The taxpayer is obliged to consider the impact of work restrictions as well as any other relevant matter in conjunction with their log book.

However there is nothing to prevent a taxpayer from voluntarily creating a new log book. Indeed, in some cases this may be advantageous for the taxpayer to support a higher business use percentage where they could travel substantial distances as an authorised/permitted worker but private use of the vehicle decreased by comparison.

The ATO has provided the following guidance in its COVID-19 FAQ — Work-related car expenses:

Question: I claim my car-related expenses using the logbook method. Will I need to keep a new logbook for an updated representative period of private and business usage during COVID-19?

Answer: No, you are not required to keep a new logbook for the period in which your travel has been affected by COVID-19 as long as you account for any variation in the use of the car when working out your business kilometres and your business use percentage at the end of the income year.

When working out your business kilometres at the end of the income year, you need to make a reasonable estimate based on any logbooks, odometer records or other records you have.

In relation to the period in which your travel has been affected by COVID-19, you may keep a new logbook if you think it will provide a more accurate indication of your business use of the car. However if your overall business usage has not changed and you are merely using the car less, the odometer readings will reflect this and you will not need to keep another logbook.

![]() Note

Note

A taxpayer may choose between the log book method and the cents per kilometre method per car on a year-by-year basis. Where the pattern of car usage changed substantially for an income year, the method which the taxpayer does not usually use may produce a better outcome.

For more information about car expense deductions, and other overview and refresher tax topics designed to mirror the everyday tasks found in the workplace, check out our upcoming 2 day Tax Fundamentals workshop, taking place in Sydney and Melbourne throughout the next few weeks.

One of our most popular offerings, this workshop is a great way to upskill your junior staff, those returning to the accounting profession, or anyone wishing for a refresher to the complex Australian tax system.

What we’ll cover: Deductions, Assessable income, Depreciation rules, CGT, GST, FBT, Business & investment structures, Superannuation & Business administration

Right now, we’re also offering 2 spaces for the price of one – so get in quick!

Sydney | 24-25 November | Details and registrations >

Melbourne | 1-2 December | Details and registrations >

Catering and all materials are included.

Can’t make these sessions or prefer online training? Check out Tax Fundamentals Online or sign up to be notified for our 2022 offerings.

Our mission is to offer flexible, practical and modern tax training across Australia – you can view all of our services by clicking here.

In this episode of Tax Yak, Neil Jones yaks with Scott Andersen (Worrells) and Nicole Rowan (Senior TaxBanter trainer) about the risky business of asset protection.

Host: Neil Jones, Managing Director and Senior Tax Trainer (TaxBanter) – Neil on LinkedIn

Guests: Scott Andersen (Partner & insolvency practitioner, Worrells) and Nicole Rowan (Senior Tax Trainer, TaxBanter)

Recorded: 10 November 2021

We’re currently recruiting for a new Senior Tax Trainer. Could this be you?

Our mission is to offer flexible, practical and modern tax training across Australia – you can view our full range of training options here.

You can read about our current team of Senior Tax Trainers here.

To apply for this role, please send a cover letter, along with your CV to enquiries@taxbanter.com.au.

[lwptoc]

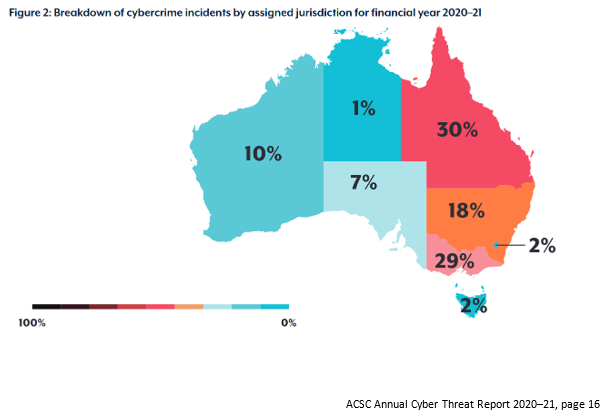

The Australian Cyber Security Centre (ACSC) has reported that over 2020–21, it received more than 67,500 cybercrime reports — an increase of nearly 13 per cent from the previous year. This increase equates to one report of cyber attack every eight minutes compared to one every 10 minutes in the previous year. The increasing frequency of cybercriminal activity is compounded by the increased complexity and sophistication of their operations. Nearly half of reported incidents were categorised as having ‘substantial’ impact.

All sectors of the Australian economy — government agencies, large organisations, critical infrastructure providers, SMEs, individuals — were targeted.

The ACSC identified the exploitation of the pandemic environment as one major cyber security trend seen in 2020–21. In addition, business email compromise continues to present a major threat to Australian businesses and government enterprises, especially as more Australians work remotely. In 2020–21, the average loss per successful event was more than $50,600 — more than 150% higher than the previous year.

Note: October is Cyber Security Awareness Month.

Note: October is Cyber Security Awareness Month.

Tax professionals are amongst those who have shifted their operations from the office to their homes for extended periods, particularly in Victoria, NSW and the ACT. This has inevitably been accompanied by a need to address online security matters for the practice as a whole, for each practitioner or employee working via their home internet networks, and for their clients.

The ATO website contains cyber security guidance to protect practitioners’ businesses and clients. In addition, protecting client data is an obligation of registered agents, regardless of work restrictions, and a revisit of the TPB’s longstanding guidance on cyber security insurance is particularly timely.

While there is an end in sight to protracted stay-at-home orders, remote work arrangements and the online exchange of sensitive client information will not be disappearing. Cyber security guidance remains relevant and tax practitioners need to ensure their security systems and policies remain robust to address ongoing and emerging threats.

The ATO has developed some resources to assist tax professionals with improving their cyber security.

It recommends that tax professionals:

The ATO has also developed cyber security tips for businesses and cyber security tips for individuals.

The advice is developed in consultation with the Cyber Security Stakeholder Group (CSSG), a group of tax practitioner industry associations and other industry partners, such as software developer associations.

In addition, an online security self-assessment tool for businesses and tax professionals is available on the ATO website.

A data breach occurs when confidential taxpayer information has been accessed by an unauthorised third party.

Examples of data breaches include but are not limited to:

An unlawful acquisition of client information can occur not only from cyber attacks conducted remotely, but also from an in-person theft of tangible equipment and paper documents.

The ATO notes that reports of stolen equipment and data are a regular occurrence. Methods of theft include dumpster diving, letterbox theft, unattended paper or electronic files, theft from wallets, and theft of briefcases or laptops.

The ATO has reported that in one instance, a tax agent had their laptop and documents containing confidential client information stolen from their car. Subsequently, it appeared that the stolen data was used to commit identity theft and to lodge fraudulent PAYG summaries using the clients’ accounts.

Where a client has been a victim of a data breach, options can include one or more of the following depending on the severity of the breach and any resultant fraud attempts:

Other government bodies with relevant guidance and information include the following:

Implementing strong cyber security controls is not only good business practice, it is also one way for registered agents to meet their statutory obligations to their clients.

One of the key sources of obligations is the Code of Professional Conduct (the Code) in the Tax Agent Services Act 2009 (the TASA). In particular, registered agents must be mindful of Code item 6 (confidentiality) which provides that a registered practitioner must not disclose any information relating to a client’s affairs to a third party without the client’s permission, unless there is a legal duty to do so.

TPB Practice Note TPB(PN) 1/2017 sets out the TPB’s practical guidance to registered agents in relation to their obligations under the Code in respect of the use of cloud computing.

Relevant factors to consider in ensuring compliance with Code Item 6 include, among other things:

If a registered practitioner breaches the Code, including in the context of cloud arrangements, the TPB may impose one or more administrative sanctions, including issuing a written caution or order or suspending or termination of a registered practitioner’s registration.

There may also be commercial and other legal consequences such as an action for damages.

The Privacy Act sets out a number of Australian Privacy Principles (APPs) which govern the use, storage and disclosure of personal information. Information is available on the OAIC website. The TPB encourages practitioners to seek advice as to whether the provisions of the Privacy Act apply to them.

The Privacy Act also contains the NDB scheme which mandates the reporting of eligible data breaches that occur on or after 22 February 2018.

The NDB scheme requires organisations covered by the Privacy Act to notify any individuals likely to be at risk of serious harm by a data breach. Advice must include recommendations about the steps that should be taken in response to the data breach.

The TPB and the ATO do not have oversight of these requirements — which are administered by the OAIC — but tax practitioners must be aware of their obligations.

The TPB in its NDB guidance material notes that a failure of a registered agent that to comply with the NDB rules may be considered in determining whether the agent has breached the TASA, including the Code. In particular, factors to be considered in the context of Code item 6 include:

Further guidance on the NDB scheme and notification obligations is available on the OAIC website.

The TPB has released Practice Note TPB(PN) 4/2021 to provide practical guidance in relation to using and disclosing a client’s TFN and TFN information in email communications. An email may be vulnerable to unauthorised access during transmission from sender to recipient.

Laws to which a tax practitioner may be subject in relation to TFNs include:

In the Practice Note, the TPB notes that whether a disclosure by a practitioner of a TFN in an unsecured email would amount to an offence under the TAA would be determined by the surrounding circumstances, including the steps taken by the practitioner.

The Practice Note also sets out some suggestions of practical security measures and procedures which tax practitioners may consider to protect the security of TFN information in email communications.

If a registered agent fails to protect the TFNs or TFN information of clients, there may be implications in relation to the TASA — in particular, Code item 6.

A registered tax agent, BAS agent or tax (financial services) agent is required to maintain, or to be able to maintain, professional indemnity (PI) insurance that meets the TPB’s requirements in order to maintain registration eligibility.

Failure to maintain appropriate PI insurance may result in sanctions which range from written cautions to suspension or termination of the agent’s registration.

The TPB’s PI requirements are outlined in Explanatory Paper TPB(EP) 03/2010.

Adequate cover is cover that will both:

Whether PI insurance is ‘adequate’ depends on the nature of the agent’s business. Relevant factors may include the volume of business, the number and kind of clients, the types of services provided, the number of employees and the degree of risk.

While the law does not prescribe the specific features of an adequate policy, the Explanatory Paper sets out the TPB’s recommendations on policy features. This list of features includes cyber insurance cover. Relevantly, once an agent has assessed the risk of a cyber-attack, the TPB recommends they consider whether they require additional protection against cyber threats, including losses that an agent may suffer from a cyber-attack.

These losses are known as ‘first party losses’. First party losses resulting from a cyber-attack that an entity may suffer include ‘denial of service’ attack, costs of rectifying harm done (such as repairing and restoring systems that have been damaged by malicious acts), the costs of improving cyber security, undertaking forensic investigations to identify the source of a cyber-attack, reputational damage and the costs of managing a reputational crisis and extortion costs.

PI insurance policies are limited to responding to losses stemming from a deficiency in the tax agent services provided by the tax practitioner. Therefore, PI insurance policies will generally cover tax practitioner liability for cyber-related events or incidents if the liability arises in relation to the tax practitioner’s provision of tax agent services. This is in contrast with cyber insurance cover, which generally covers for events such as third party cyber liability, first party hacker damage, cyber extortion, data breach notification costs and public relations costs.

Accordingly, the TPB recommends that tax agents and BAS agents obtain additional cyber insurance, in addition to maintaining PI insurance that meets the TPB’s requirements.

Need to catch up on the current tax landscape? We offer online tax training on a monthly basis – join us for a general Tax Update or a more in-depth special topic or presentation.

You can view all of our upcoming online training here. Need to catch up on your CPD? Our recordings page hosts all of our past sessions.

In this episode of Tax Yak, Nicole Rowan chats with Emma Rosenzweig, Superannuation and Employer Obligations Deputy Commissioner at the Australian Taxation Office about recent and upcoming changes to Employer Superannuation.

Host: Nicole Rowan, Senior Tax Trainer (TaxBanter) – Nicole on LinkedIn

Guest: Emma Rosenzweig, Deputy Commissioner, Superannuation and Employer Obligations (ATO)

Emma Rosenzweig is the Deputy Commissioner for Superannuation and Employer Obligations.

She is responsible for ensuring a complex ecosystem of employers, workers and retirees, and super funds operates efficiently, supports willing participation, and safeguards entitlements.

Emma has worked for the ATO for 22 years in a range of roles across nearly all areas of the organisation, including client engagement roles focused on small business and employers, law roles including the design and drafting of legislation, and leadership of the ATO’s service strategy design and implementation.

Emma is passionate about developing leaders of the future and invests time in mentoring and coaching individuals and groups.

She holds a Bachelor of Laws, a Bachelor of Commerce and a Masters of Tax.

Recorded: 21 October 2021

[lwptoc]

The 2021 tax return stationery contains new disclosures relating to the temporary capital allowances incentives.

For a small business entity (SBE) that calculates their depreciation claims under the simplified depreciation system in Subdiv 328-D of the ITAA 1997, these incentives for the 2020–21 income year are the:

This article considers some of the tax return disclosure implications for SBE taxpayers that utilise the temporary incentives.

![]() Note

Note

An SBE using Subdiv 328-D technically is not claiming TFEDA. When the TFEDA was introduced for Div 40 taxpayers, the concept was extended to Subdiv 328-D taxpayers by temporarily removing the IAWO threshold. That is, the TFEDA for Subdiv 328-D takes the form of an uncapped IAWO. For simplicity, this article will refer to the uncapped IAWO as the TFEDA.

![]() Note

Note

Ignore GST throughout this article for the purposes of illustration.

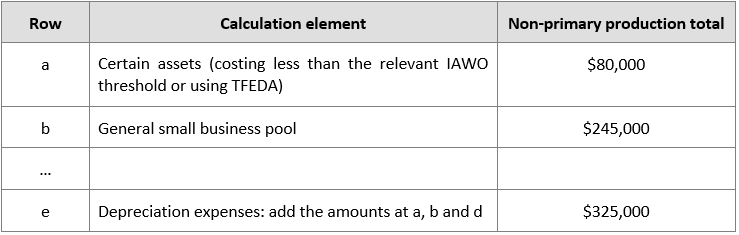

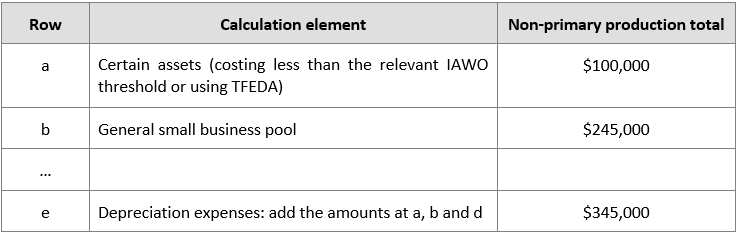

Tara buys a trailer for her dog grooming business on 10 July 2020 for $80,000. Tara uses the simplified depreciation rules and has a pool balance of $245,000 on 1 July 2020.

Assume that Tara does not acquire or dispose of any other depreciable assets during the year ending 30 June 2021.

For 2020–21, Tara is entitled to claim a total depreciation deduction of $325,000, being:

The balance of Tara’s pool on 30 June 2021 is $0.

Page 51, worksheet 2, non-primary production

Page 51, instructions — page 4

Transfer the amount at row a in worksheet 2 to A item P10 Small business entity simplified depreciation

Note that Tara will also show $325,000 at label M of Item P8.

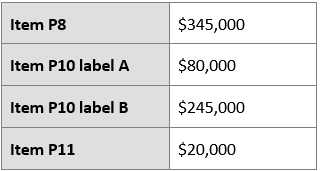

Now assume that Tara also acquired a new dog washing machine on 1 January 2021 for $20,000.

Page 51, instructions — step 4

Transfer the amount at row a in worksheet 2 to A item P10 Small business entity simplified depreciation

The instructions to item P10 are as follows:

Write at A Deduction for certain assets the amount you claimed at item P8 that relates to assets costing less than $150,000 and purchased before 7.30pm (AEDT) 6 October 2020, and first used or installed ready for use for a taxable purpose in the current year. This is one of the components from row a in worksheet 2 but does not include any amounts relating to temporary full expensing.

…

If you claimed any depreciation using temporary full expensing you will need to include those amounts at P11.

Based on our understanding of the instructions, the disclosures are as follows:

![]() Note

Note

Item 15 Net income or loss from business will also need to be completed.

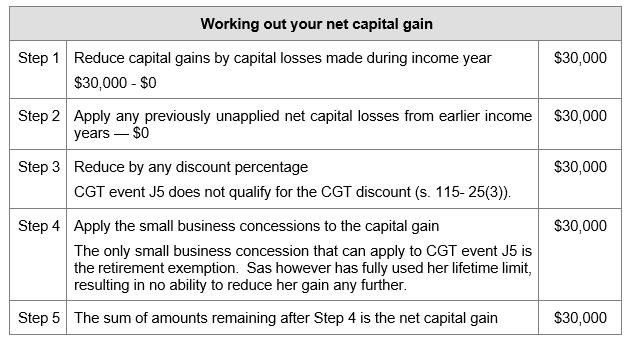

Flynn is a registered BAS agent and carries on a bookkeeping business part time. He regularly visits clients at their premises. Flynn is also employed at a local deli part time and delivers phone and online food orders to local customers as part of his duties.

Flynn acquired a new car on 1 December 2020 for $70,000. He estimates that the car usage is:

Flynn uses Subdiv 328-D.

Flynn is able to claim the taxable purpose proportion of the cost of the car. However, the cost is reduced to $59,136 (the car depreciation limit for 2020–21).

The taxable purpose proportion is 70 per cent (60 per cent business use + 10 per cent employment use).

Flynn may claim $59,136 × 70% = $41,395 in his 2021 tax return.

P8 instructions:

You show at M Depreciation expenses item P8 the total depreciation deductions being claimed under the small business entity simplified depreciation rules and for the business use of other assets under the uniform capital allowances (UCA) rules. This includes your deduction under the small business entity rules for depreciating assets used for work-related or self-education purposes. …

Flynn would include the employment-related use of the car at P8 label M and not at D1 (i.e. work-related expenses).

In addition, Flynn would also need to complete P11 labels F and G (TFEDA) as he acquired the car at or after the 2020 Budget time.

If Flynn had instead acquired the asset between 1 July 2020 and the 2020 Budget time, he would need to complete P10 label A (IAWO).

Amy carries on a retail business selling vintage vinyl records as a sole trader. Accordingly, Amy may be eligible to access the TFEDA in respect of assets acquired for her business.

Amy also owns a residential rental property and acquires a new stove for $3,000 which is installed in the property 1 April 2021.

Where Amy is an SBE using the simplified depreciation rules in respect of her retail business, an immediate deduction would also not be available as Subdiv 328-D specifically excludes assets let on a depreciating asset lease.

Alternatively, if Amy has opted out of (or is not eligible to use) Subdiv 328-D, she still cannot access TFEDA in respect of the new stove — even though she is carrying on a busines. Under Div 40, the TFEDA is only available in respect of assets which are used for the principal purpose of carrying on a business. Even though Amy is carrying on a business, the stove is not used in the carrying on of a business.

Amy would simply show her depreciation deduction for the stove as an expense in calculating her net rental income shown at item 21 of her tax return.

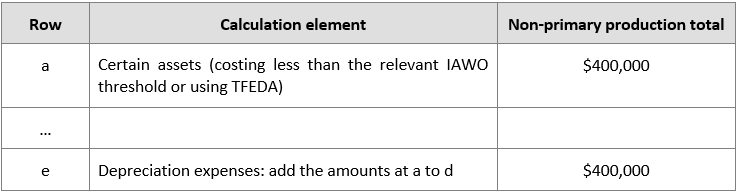

Amy carries on a retail business selling vintage vinyl records as a sole trader. Accordingly, Amy may be eligible to access the TFEDA in respect of assets acquired for her business.

Amy also carries on a commercial rental property business and acquires a new air conditioner for $75,000 which is installed in the commercial building on 1 April 2021.

If Amy chooses to use Div 40, she can claim the TFEDA for the air conditioner as the asset is used for the principal purpose of carrying on a business. there is no exclusion for assets on a depreciating asset lease.

The same deduction is available even if Amy uses Subdiv 328-D for her retail business. There is an exclusion for depreciating asset lease assets, so the air conditioner must be depreciated using Div 40. The TFEDA and the BBI incentives may be available to Amy under Div 40.

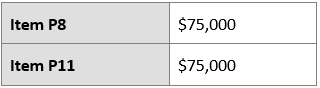

TS Pty Ltd purchased a brand new digger for its earthmoving business on 1 February 2021 at a cost of $400,000. This is the only asset that TS Pty Ltd owns.

Page 74 instructions:

You must also complete item 10 Small business entity simplified depreciation if you claim instant asset write-off. Also complete item 9S and T if you claim temporary full expensing.

Worksheet 1 — page 80

Transfer the amount at e to label X Depreciation expenses at item 6.

![]()

Item 9 — Capital allowances — page 131

If you are a small business using Subdiv 328-D, show at S the total amount of any deduction under TFEDA you claimed at label X Depreciation expenses at item 6.

Show at T the total number of assets you are claiming TFEDA for.

![]()

There is no disclosure in item 10 because the company is not claiming the IAWO as it did not purchase a new asset between 1 July 2020 and the 2020 Budget time.

Join us at the beginning of each month as we review the current tax landscape. Our monthly Online Tax Updates and Public Sessions are excellent and cost effective options to stay on top of your CPD requirements. Our Public sessions take place across 18 locations in Australia. Click here to find a location near you.

Here are a few past and upcoming training options to keep yourself updated with the current tax landscape:

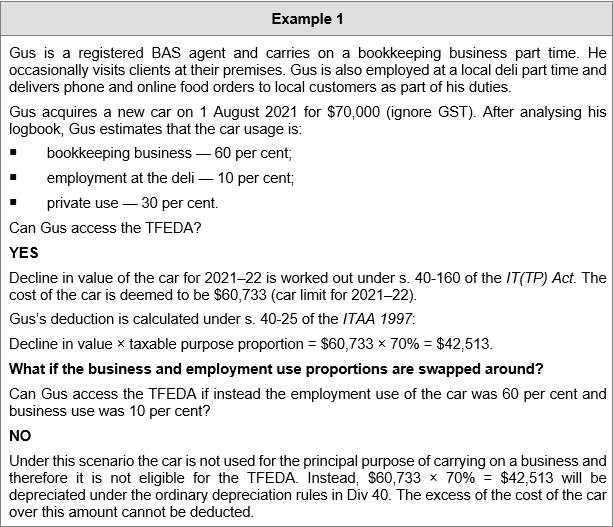

![]() Online training

Online training

You can view all of our upcoming online training here. Need to catch up on your CPD? Our recordings page hosts all of our past sessions.

Tailored in-house training

Tailored in-house training

We can also present these Updates at your firm (or through a private online session) with content tailored to your client base – please contact us here to submit an expression of interest or visit our In-house training page for more information.

Our mission is to offer flexible, practical and modern tax training across Australia – you can view all of our services by clicking here.

[lwptoc]

An employer is subject to the SG charge if it does not make the minimum required amount of SG contributions on behalf of their eligible employees in respect of a quarter.

From 1 July 2021, the minimum SG contributions payable in relation to an employee is 10 per cent of the employee’s ‘ordinary time earnings base’ for the quarter. The ordinary time earnings (OTE) base for a quarter comprises the employee’s OTE and the amount of OTE which is salary sacrificed into superannuation for the quarter.

The SG contributions are due by the 28th day after the end of each quarter (i.e. 28 January, 28 April, 28 July and 28 October).

To the extent that the employer does not pay the required SG contributions on time, the employer is subject to SG charge for the quarter, which is the sum of:

An individual SG shortfall for an employee for a quarter is their ‘salary and wages base’ × 10%. An employee’s ‘salary and wages base’ for a quarter comprises their salary and wages and the amount of salary and wages which is salary sacrificed into superannuation for the quarter.

The employer is required to pay the SG charge and lodge an SG charge statement by the due date for each quarter, which is the 28th day of the second month after the end of the quarter (i.e. 28 February, 28 May, 28 August and 28 November).

In certain circumstances, the employer may choose to treat a late payment of SG contributions as follows:

If the SG charge remains unpaid after its due date, general interest charge is payable on the shortfall amount.

In addition to SG charge, the ‘Part 7 penalty’ may also be payable where the employer fails to lodge an SG charge statement or to provide information upon a request (e.g. during an audit). The penalty is imposed under Part 7 of the Superannuation Guarantee (Assessment) Act 1992 (the SGA Act).

The maximum penalty is an additional SG charge equal to 200 per cent of the SG charge amount (with a minimum of $20). For example, if an employer’s SG charge for a quarter is $10,000, the Part 7 penalty may be as high as $20,000 — for a maximum payable of $30,000.

The Commissioner has the discretion to remit the penalty in part or in full.

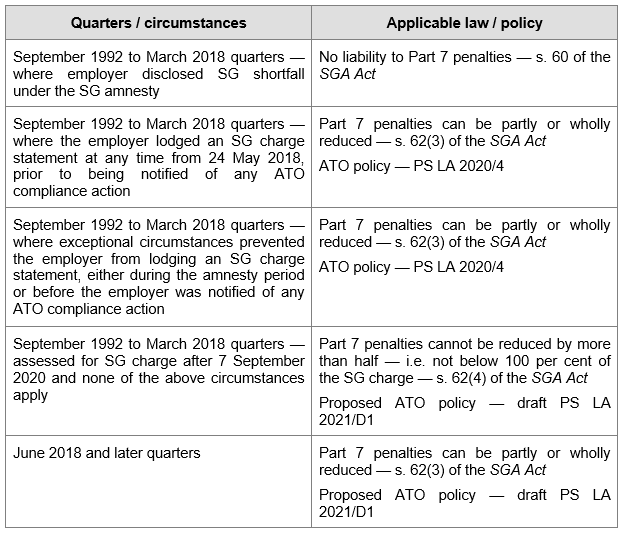

The laws and ATO policies relating to the remission of the penalty differs depending on the quarter involved and whether the employer had voluntarily disclosed SG shortfall in a relevant historical quarter under the SG amnesty.

The following table sets out the legislation and ATO policy which apply to particular SG quarters and employer’s circumstances.

Practice Statement Law Administration PS LA 2020/4 (the Practice Statement) sets out the Commissioner’s decision-making principles for the remission of the Part 7 penalty in respect of quarters that were subject to the SG amnesty, i.e. quarters ending on 31 March 2018 and earlier.

For subsequent quarters, PS LA 2021/D1 (the draft Practice Statement — see below) will apply once finalised. Once the draft Practice Statement is finalised, the Practice Statement will be withdrawn.

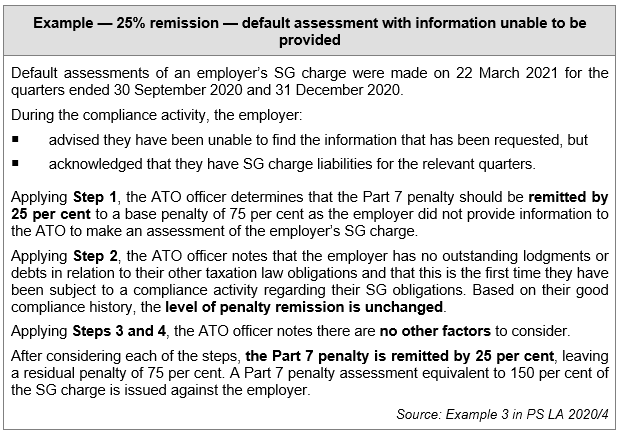

The four-step penalty remission process that applies to quarters ending on 31 March 2018 and earlier is explained in detail in Appendix 1 of the Practice Statement and includes:

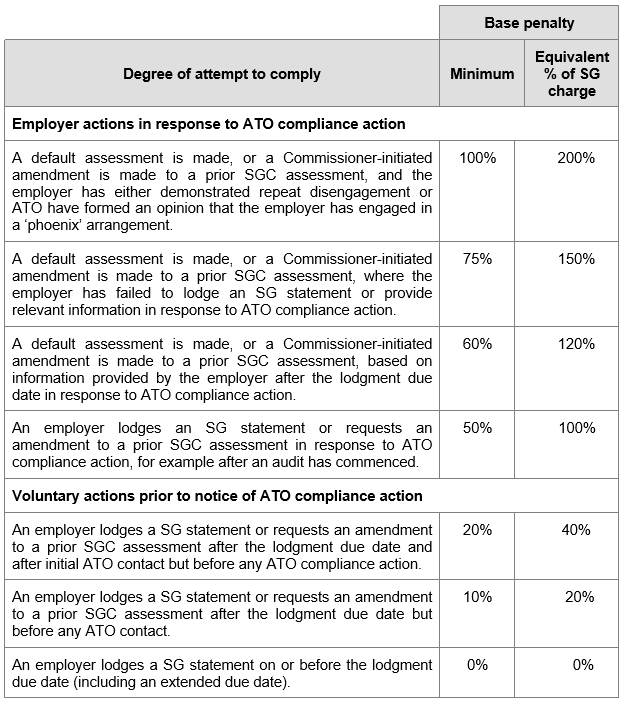

ATO officers are required to assess the employer behaviours that led to an SG Charge assessment as detailed in the table below to determine the base penalty amount.

ATO officers are required to treat an employer’s making initial contact with the ATO to disclose that they have identified SG shortfalls and to advise that they will lodge an SG statement after discussing the relevant matters, in the same way as a lodgment prior to any ATO contact.

ATO officers are instructed to consider the employer’s compliance history for both SG obligations and other taxation laws for the three-year period leading up to the earlier of the day before:

An employer’s SG compliance history is to be given more weight than their compliance history for other taxation laws and ATO officers are required to focus on:

A previous SG assessment resulting from ATO compliance action will reflect a poorer compliance history than an SG assessment that came via a voluntary disclosure.

Where compliance history is good the penalty should remain at the base penalty level in step 1.

ATO officers are required to consider other relevant facts and circumstances of the employer that have not been considered in the first two steps.

Where exceptional circumstances prevented an employer from lodging an SG statement it may be appropriate to remit the penalty below the base penalty level set in Step 1.

While it is not possible to set precise rules for what constitutes exceptional circumstances, the core idea of exceptional circumstances is that there is something unusual to take the case out of the ordinary course. It is a very high threshold.

The exceptional circumstances must have been more than preventing an employer from meeting the due date to make SG contributions. The exceptional circumstances must have prevented the employer from lodging their SG statement.

The penalty relief arrangements that apply for historical quarters is materially the same as the proposed arrangements in the draft Practice Statement — see below.

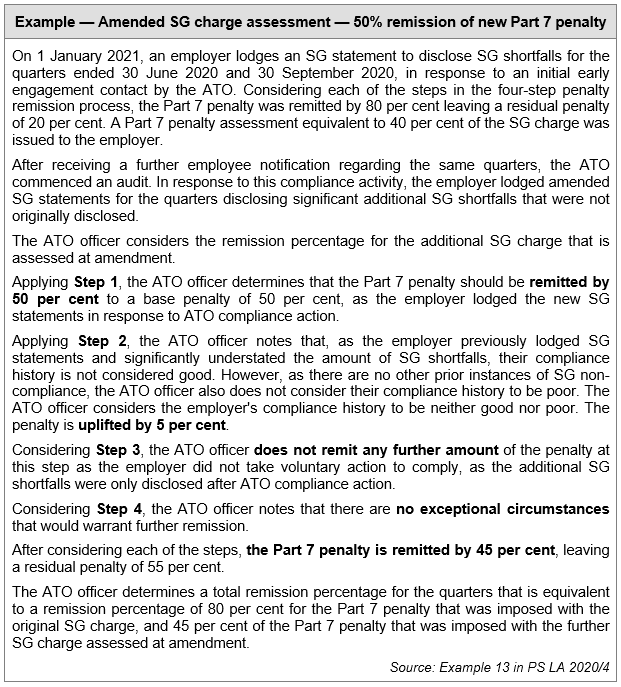

The draft Practice Statement sets out proposed guidelines to ATO officers about the factors to consider when making a decision on the remission, in whole or part, of the Part 7 penalty where an employer fails to lodge an SG statement by the lodgment due date.

The draft Practice Statement sets out a four-step process — designed to ensure that employers in like circumstances receive like treatment — that ATO officers should follow in making a decision on remission, in whole or part, of the Part 7 penalty.

For SG charge assessments made after 7 September 2020, the law generally limits the ability of the ATO to remit Part 7 penalties for historical quarters, i.e. from 1 July 1992 to 31 March 2018.

Where a historical quarter is assessed for SG charge after 7 September 2020, the Part 7 penalty cannot be reduced by more than half — i.e. not below 100 per cent of the SG charge unless:

Exceptional circumstances need to have prevented the employer from lodging the SG statement continuously from the start of the amnesty period (24 May 2018) until the date of lodgment or notification of ATO compliance action (whichever is earlier).

There are no precise rules for what constitutes exceptional circumstances. The core idea is that there is something unusual to take the case out of the ordinary course. It is not enough for the employer to demonstrate exceptional circumstances that prevented them from meeting the due date to make SG contributions, or to make payment of an SG charge liability after disclosing it. The exceptional circumstances must have prevented the employer from lodging their SG statement.

Some factors which may point towards exceptional circumstances include where an employer’s ability to lodge has been directly impacted by a natural disaster or COVID-19; where an employer relied on incorrect ATO advice that they did not have an SG shortfall; or where an employer was suffering from severe illness or other affliction that rendered them incapable of lodging an SG statement.

Some examples of factors that are unlikely to constitute exceptional circumstances on their own are where an employer is facing financial difficulty, did not understand their obligations, made an error in determining their obligations, or claims that they failed to come forward during the amnesty due to a lack of time between the amnesty being legislated and the end of the amnesty.

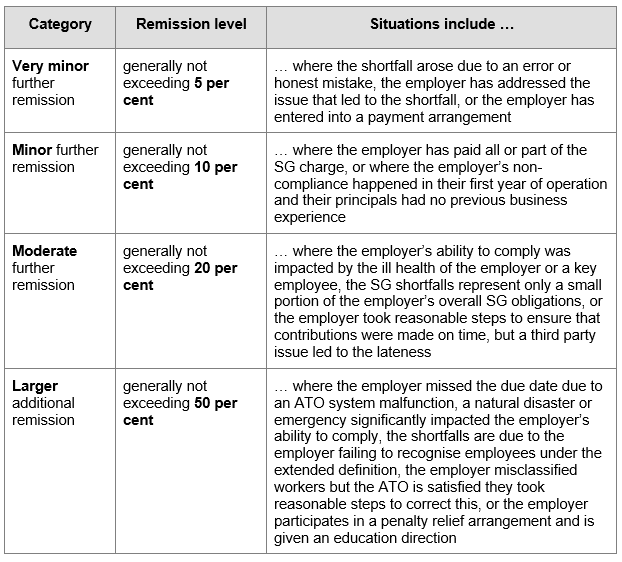

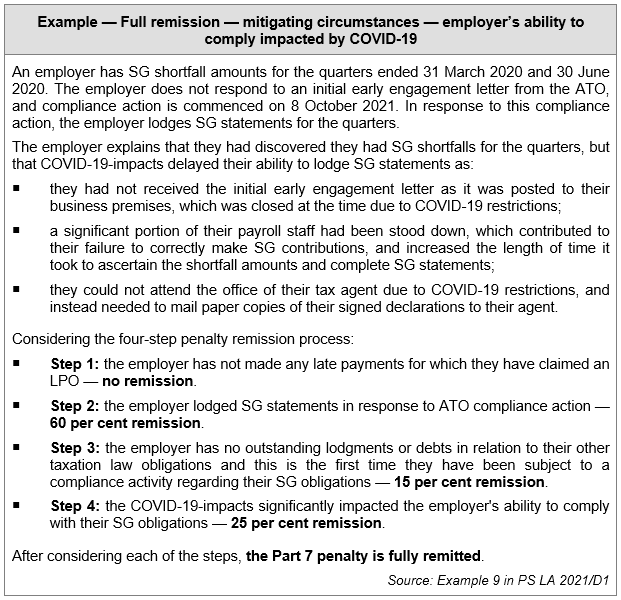

The proposed four-step process is explained in detail in Appendix 1 of the draft Practice Statement and includes the following:

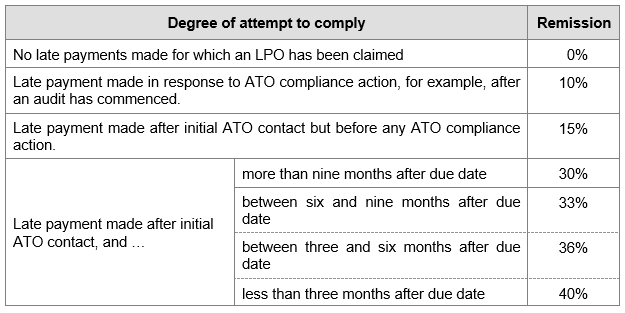

Where an employer has made these late payments, they can claim a LPO when they lodge their SG statement. Although the LPO does not reduce the amount of penalty imposed, some remission is warranted in recognition that the employer has met their employees’ entitlement, albeit late.

This step only considers late payments for which an LPO has been claimed in respect of the relevant quarters.

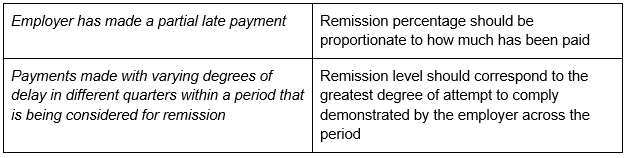

ATO officers, using the following table, should consider further remission based on the employer’s attempt to comply through lodging a SG statement to self-assess their SG Charge liability.

The draft Practice Statement states that where the employer has lodged an SG statement before any ATO contact, or after initial contact but before any compliance action, they will satisfy this requirement and there will be no restriction on remission.

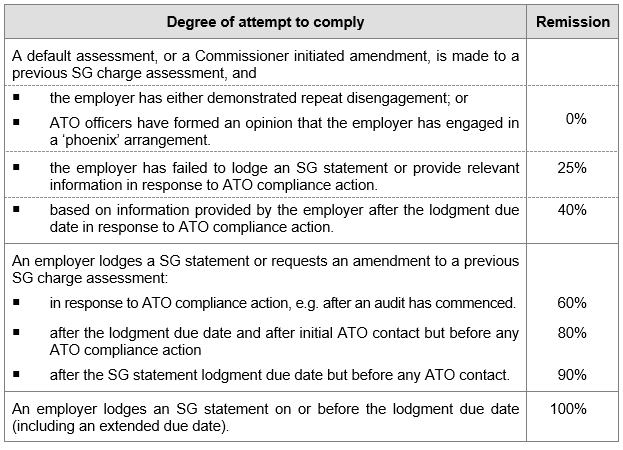

Consider and evaluate the employer’s compliance history for both SG obligations and other taxation laws for the three-year period leading up to the earlier of the day before:

More weight should be given to an employer’s SG compliance history than to their compliance history for other taxation laws and the focus should be on:

A previous SG charge assessment resulting from ATO compliance action will reflect a poorer compliance history than an SG charge assessment that came via a voluntary disclosure.

Depending on an employer’s compliance history, ATO officers may provide additional remission or may reduce the level of remission provided by the other steps in this remission process. Generally, the amount of additional remission or reduced remission should not exceed the amounts in the following table:

All other relevant facts and circumstances should be considered to ensure the resulting Part 7 penalty is appropriate.

Different mitigating facts or circumstances may warrant different levels of further remission, depending on their significance in contributing to the employer’s non-compliance. Where there are multiple mitigating circumstances present, they should each be considered for remission.

Mitigating facts or circumstances that warrant further remission are in the following categories:

In limited cases, it may be appropriate to provide additional remission to an employer in conjunction with a direction for education — known as a ‘penalty relief’ arrangement. This may be appropriate where education is considered a more effective option to positively influence employer behaviour.

The ‘penalty relief’ arrangement recognises that whilst the ATO expects all employers to meet their SG obligations, an employer may have SG knowledge gaps that led to non-compliance and these can be addressed through education.

Only employers with a turnover of less than $50 million should be considered for a penalty relief arrangement and only if they have not previously been provided with penalty relief and they:

Interested into delving into this a little further? Join our next Special Topic webinar, Superannuation Guarantee post amnesty. Each registrant will receive a copy of the recorded session. You can check out a full list of our 2021 Special Topics here.

We can also present these Special Topics at your firm (or through a private online session) with content tailored to your client base – please contact us here to submit an expression of interest or visit our In-house training page for more information.

Our mission is to offer flexible, practical and modern tax training across Australia – you can view all of our services by clicking here.

[lwptoc]

The small business CGT concessions contained in Div 152 of the ITAA 1997 are arguably some of the most concessional provisions in the Tax Acts. For example, the 15-year exemption in Subdiv 152-B results in eligible capital gains being completely tax-free.

Accessing the concessions involves satisfying a set of basic criteria, with each specific concession having its own additional eligibility requirements. Choosing which concession gives the taxpayer the best outcome involves an understating of how the small business CGT concessions fit within the basic CGT method statement in s 102-5 of the ITAA 1997.

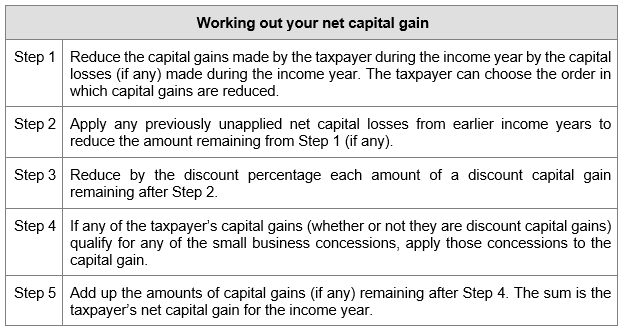

The method statement in s. 102-5 of the ITAA 1997 sets out how to calculate the net capital gain that a taxpayer includes in their assessable income.

There are four small business CGT concessions:

Each concession operates differently. For example the 15-year exemption and the retirement exemption disregard a capital gain — in some instances completely. On the other hand, the 50 per cent reduction and the small business roll-over are not exemptions and they respectively reduce the gain by 50 per cent and defer any gain to a later point in time. As each concession delivers their beneficial treatment differently, they come into the net capital gain method statement at different points in time.

![]() Important

Important

The ‘basic conditions’ in Subdiv 152-A are common to all of the small business CGT concessions and must be satisfied as well as the specific conditions for each concession.

If the taxpayer qualifies for the 15-year exemption under Subdiv 152-B, they can entirely disregard the gain, and no other concessions need to be applied. Accordingly the taxpayer will not have any capital gains during the year to include at Step 1.

Practically this also means that a taxpayer will not be required to offset any capital losses against the gain.

Both Step 1 and Step 2 require a taxpayer to reduce the capital gain by:

As the 50 per cent reduction, the retirement exemption and the small business roll-over are dealt with at Step 4, gains eligible for these concessions will firstly need to be offset against any capital losses.

If the taxpayer is eligible for the CGT discount under Div 115, the taxable amount of the capital gain is reduced by the relevant discount percentage (generally, 50 per cent).

It is important to note that this is not a choice and where a taxpayer is eligible for the CGT discount they must utilise it.

![]() Tip

Tip

A taxpayer wishing to maximise the retirement exemption (and therefore the amount that they can contribute into their superannuation fund outside the contribution caps) could — if eligible — use the indexation method to calculate their cost base and therefore their capital gain included at Step 1. Using the indexation method means the CGT discount is unavailable at Step 3 (s. 115-20).

If the taxpayer satisfies the basic conditions in Subdiv 152-A, they may choose to apply the 50 per cent reduction under Subdiv 152-C.

Alternatively, the taxpayer may choose not to apply this concession in order to maximise use of the retirement exemption.

The 50 per cent reduction applies at Step 4 of the method statement, i.e. after offsetting any capital losses and applying any discount.

If the taxpayer qualifies for the retirement exemption under Subdiv 152-D or the small business roll-over under Subdiv 152-E, these concessions may be applied in either order to the capital gain.

These concessions apply at Step 4 of the method statement.

The remaining capital gain is included in the taxpayer’s assessable income for the income year.

Where a taxpayer chooses the small business roll-over in respect of a capital gain, CGT events J2, J5 or J6 can happen, broadly speaking, if:

A capital gain that arises from CGT event J2, J5 or J6 is not a discount capital gain and is not eligible for the 50 per cent reduction. In addition, the small business roll-over does not apply to CGT events J5 and J6.

In other words, the retirement exemption can apply to any capital gain arising under CGT event J2, J5 or J6, but only CGT event J2 can access the small business roll-over.

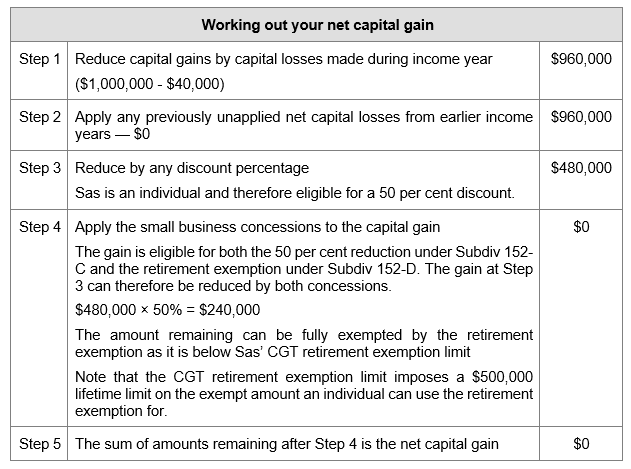

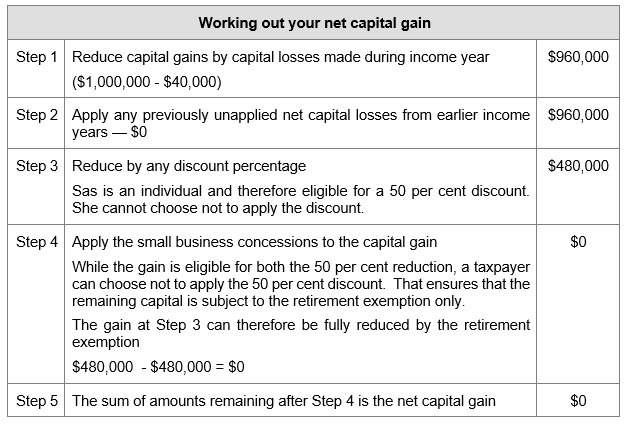

Sas is a graphic designer operating a business as a sole trader. Sas sold her business premises and made a capital gain of $1 million. Sas satisfies the basic conditions in Subdiv 152-A and has an unutilised prior year capital loss of $40,000.

Assume Sas satisfies the criteria for the 15-year exemption.

As the gain qualifies for the 15-year exemption, the gain is disregard and the capital losses are not impacted. Sas’ net capital gain is therefore $0.

Assume that:

After calculating the above gain, Sas realises she can only contribute $240,000 into her SMSF using the retirement exemption.

As Sas wants to fully maximize the amount that can be contributed to her SMSF, advise on an alternative option.

Assume the gain is now $1.1 million. Sas still has carry forward losses of $40,000 and wants to maximise the retirement exemption, so she can maximise the contribution made to her SMSF.

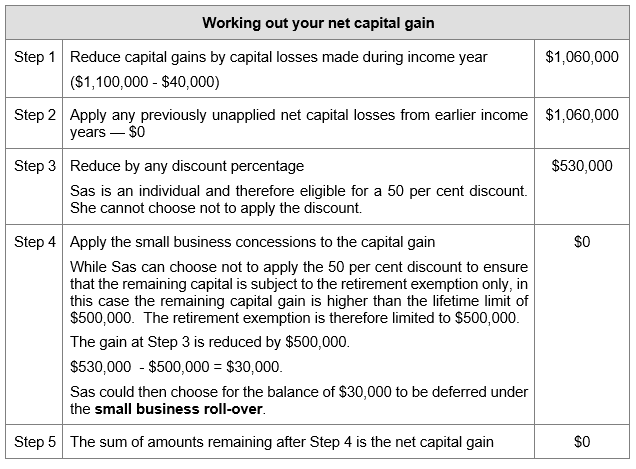

Sas chose the roll-over in Variation Four. At the end of the replacement asset period a replacement asset was not found. CGT even J5 was therefore triggered.

The small business CGT concessions are arguably some of the most generous provisions in the ITAA. The concessions are targeted to small business and consist of:

Depending on which concession (or concessions) applies, a taxpayer can defer, reduce or even disregard a capital gain.

In our upcoming two-part webinar series, we will go through the core rules and then dive deeper into each of the concessions. Click here or the button below to learn more or register. Register before the first session on 16 September and get 10% off the package.

[lwptoc]

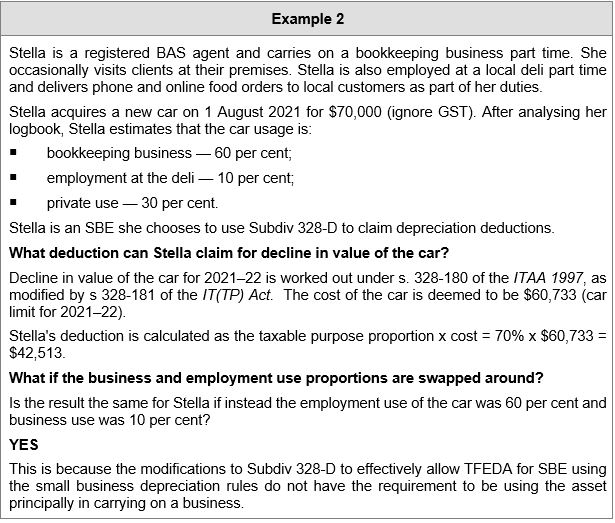

The Treasury Laws Amendment (A Tax Plan for the COVID-19 Economic Recovery) Act 2020 inserted Subdiv 40-BB into the Income Tax (Transitional Provisions) Act 1997 (IT(TP) Act) which sets out rules for a temporary full expensing of depreciating assets (TFEDA). The rules achieve this by providing that, for the purposes of Div 40 of the ITAA 1997 (the capital allowances provisions), the decline in value of a depreciating asset is equal to the asset’s cost.

For those entities using the small business depreciation rules in Subdiv 328-D of the ITAA 1997, full expensing is accessed by way of the removal of the instant asset write-off threshold (previously $150,000) in s. 328-180 which effectively compels all newly acquired assets to be fully expensed. Further, entities that have previously used the small business depreciation rules and have a small business pool balance prior to the introduction of the full expensing rules (or entities that begin to use the rules and allocate existing assets to a small business pool), will have those pool balances written off as a consequence of these amendments.

Taxpayers are eligible for TFEDA if they satisfy the s. 328-110 definition of a small business entity (SBE), assuming that the aggregated turnover threshold of $10 million was instead $5 billion (noting there is also an alternative eligibility test for larger corporate tax entities which is not relevant to this article). Critically, while assets subject to Div 40 can only be fully expensed if they are used for the principal purpose of carrying on a business, SBEs using the small business depreciation rules are eligible for full expensing regardless of whether the asset is used principally in carrying on a business (so long as they meet the usual criteria for Subdiv 328-D treatment).

Any deductions will be limited to the extent the taxpayer uses the asset for a taxable purpose. Relevant to this article, a taxable purpose includes a purpose of producing assessable income — such as business, employment or investment income.

The TFEDA rules apply for eligible expenditure on eligible assets where the taxpayer:

after 7.30pm AEST 6 October 2020 and on or before 30 June 2022.

![]() NOT YET LAW

NOT YET LAW

As part of the 2021–22 Federal Budget, the Government announced that it will extend the temporary full expensing measure for 12 months until 30 June 2023. All other elements of the incentive will remain unchanged. At time of writing, the amending legislation has not been introduced into Parliament.

Given the broad nature of these rules, many taxpayers will ask the question ‘Can I really write off the entire cost of my car for tax purposes?’

A car is a depreciating asset and accordingly a deduction for its decline in value can be claimed where the car is used for a taxable purpose, i.e. to produce assessable income.

The deduction for decline in value is determined by reference to an asset’s cost and the cost of a car that is principally designed for carrying passengers is reduced to a limit as notified by the Commissioner each year (see s. 40-230). In the 2021–22 income year this limit is $60,733. Importantly, this limit is applied only to the first element of a car’s cost.

Both the non-taxable purpose proportion and the car limit may reduce the amount that is available for a deduction under both the ordinary rules in Div 40 and the small business depreciation rules of Subdiv 328-D.

The starting point for working out if full expensing is available in respect of the cost of a car is to determine which regime applies:

If a taxpayer is using Div 40, then TFEDA will be available if the taxpayer is using the car for the principal purpose of carrying on a business. This means that the taxpayer must use the car in carrying on a business for more than 50 percent of the time. In the case of an individual taxpayer, the car may also be used for the purposes of deriving the taxpayer’s assessable non-business income (employment or investment), but the majority of the use of the car must be in a relevant business.

Whilst to access TFEDA the car must be used principally in a business, the deduction is still based on total taxable use, as s. 40-160 of the IT(TP) Act simply states that the decline in value of the asset is its cost. Section 40-25 of the ITAA 1997 then provides that a deduction is available for an asset’s decline in value after reducing it by the proportion of its use that was not for a taxable purpose.

Additionally, as s 40-160 of the IT(TP) Act provides that the decline in value of the asset is its cost, the rules regarding the car cost limit also apply.

The result is that, provided the car is principally used in carrying on a business, TFEDA will allow a deduction for the car’s cost, limited to the car limit, based on the taxable purpose use of the car.

The choice to use the TFEDA however is optional under Div 40 on an asset by asset basis.

Where a taxpayer is an SBE and chooses to use the small business depreciation rules, Subdiv 328-D allows an immediate deduction for the taxable purpose proportion of the cost of any asset, where the cost (before the reduction for non-taxable use) is less than the relevant threshold (see s. 328-180). However, as a result of the TFEDA changes to Div 40, transitional rules in s. 328-181 of the IT(TP) Act remove the threshold completely. Consequently the taxable purpose proportion of an asset’s cost is immediately deductible, subject to the car limit and any non-taxable use.

These rules apply automatically, therefore an SBE using the small business depreciation rules cannot opt out of full expensing.

The choice to use the small business depreciation rules obliges the SBE to use Subdiv 328-D for all the depreciating assets that it holds — subject to certain exceptions (see for example s. 328-175). This means that SBEs that are individuals who earn non-business income (e.g. salary and wages, or investment income) must apply the Subdiv 328-D pooling rules to eligible assets used in earning that income.

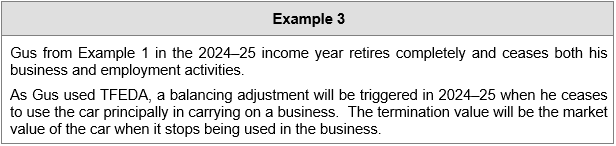

Usually the mechanism to adjust for any private use in a later year is to reduce that year’s claim for decline in value to the extent the asset has been used other than for a taxable purpose (s. 40-25(2)). Where an asset has been fully expensed, however, there is no decline in value in a later year and therefore nothing to adjust. To circumvent this, s. 40-185 of the IT(TP) Act triggers a balancing adjustment specifically when the asset ceases to be used primarily for carrying on a business i.e. the asset is applied for private use. Importantly this balancing adjustment arises where:

… it becomes not reasonable to conclude that you will use the asset principally in Australia for the principal purpose of carrying on a business …

The balancing adjustment is only triggered by a change in use that results in the asset not being used for the principal purposes of carrying on a business (e.g. a change in business use from 70 per cent to 60 per cent will not trigger this balancing adjustment, but a change from 60 per cent to 20 per cent would do so).

Where the balancing adjustment is triggered, the legislation includes the asset’s termination value at the time of the balancing adjustment in taxpayer’s assessable income and also treats that termination value as the asset’s cost going forward. This means that if the asset is partly used for a taxable purpose later, depreciation deductions for decline in value can be claimed from that point. The termination value will be the market value of the asset at the time of the balancing adjustment (s. 40-300(2)) ITAA 1997).

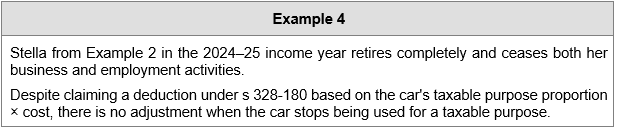

Under the small business depreciation rules, the mechanism for adjusting for private use is in s. 328-225 of the ITAA 1997 and applies only to assets that have been allocated to a small business pool. There is no adjustment for assets that have been fully written off under s. 328-180.

Warning

Warning

Whilst there is no adjustment if the asset is used privately, when the asset is sold the termination value will be assessable based on the taxpayer’s upfront taxable use, see below.

The balancing adjustment is only triggered by a change in use that results in the asset not being used for the principal purposes of carrying on a business (e.g. a change in business use from 70 per cent to 60 per cent will not trigger this balancing adjustment, but a change from 60 per cent to 20 per cent would do so).

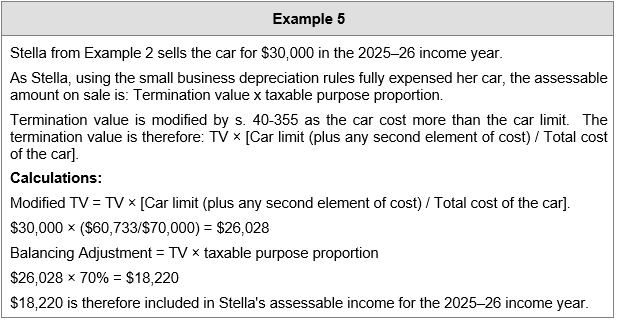

Accordingly, the taxable purpose proportion of the entire termination value (usually the sale proceeds) is assessable. However, a further adjustment to the termination value arises under s. 40-335 of the ITAA 1997 where the car was subject to the car limit. The termination value in this case is adjusted as follows:

TV × [Car limit (plus any second element of cost) / Total cost of the car]

Where there has been a change in use of the asset that was subject to TFEDA such that a balancing adjustment was triggered under s. 40-185 of the IT(TP)A, the asset effectively has its cost reset to market value from that time. Division 40 can then apply as per normal from that point in time where the taxpayer uses any portion of the asset for a taxable purpose. Upon disposal the taxpayer will calculate a balancing adjustment as per normal rules.

Where an immediate deduction was claimed under s. 328-180, upon disposal the taxable purpose proportion of the asset’s termination value will be included in assessable income under s. 328-215(4). Taxable purpose proportion is defined in s. 328-205. With reference to the purpose proportion of the asset’s termination value where a newly acquired asset has not had any adjustments to its taxable use, the legislation states that the taxable purpose proportion will be the amount estimated when the asset was first used or installed ready for use.

Accordingly, regardless of any change in taxable use of the asset, the taxable purpose proportion of the entire termination value (usually the sale proceeds) is assessable to the taxpayer in the year the car is sold. Although, where the car was subject to the car limit, the termination value is also adjusted as set out above.

Need to brush up on this topic a little more? Download our recent Special Topic webinar, Capital allowances revisited. You can check out a full list of our 2021 Special Topics here.

We can also present these Special Topics at your firm (or through a private online session) with content tailored to your client base – please contact us here to submit an expression of interest or visit our In-house training page for more information.

Our mission is to offer flexible, practical and modern tax training across Australia – you can view all of our services by clicking here.

Join thousands of savvy Australian tax professionals and get our weekly newsletter.