Written by: Letty Chen | Senior Tax Writer

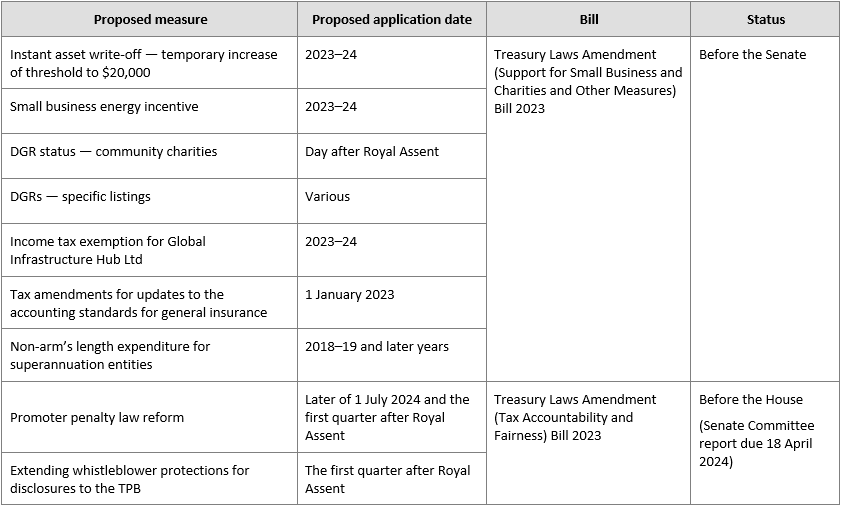

The temporary $20,000 instant asset write-off threshold for small businesses for the 2023–24 income year has finally been enacted, on the eve of the new financial year.

The Treasury Laws Amendment (Support for Small Business and Charities and Other Measures) Bill 2023 (the Bill) received Royal Assent on 28 June 2024.

It has taken almost nine months from introduction to enactment due to the Opposition’s attempts to expand the instant asset write-off.

The Bill also contains other measures including:

- the small business energy incentive — a 20 per cent bonus deduction for expenditure on energy efficient assets incurred in 2023–24

- amendments to the non-arm length expense (NALE) from 1 July 2018 to:

- limit the amount of non-arm’s length income (NALI) that arises relating to general NALE

- narrow the application so the NALE rules no longer apply to expenses incurred before 1 July 2018 or to large APRA-regulated funds.

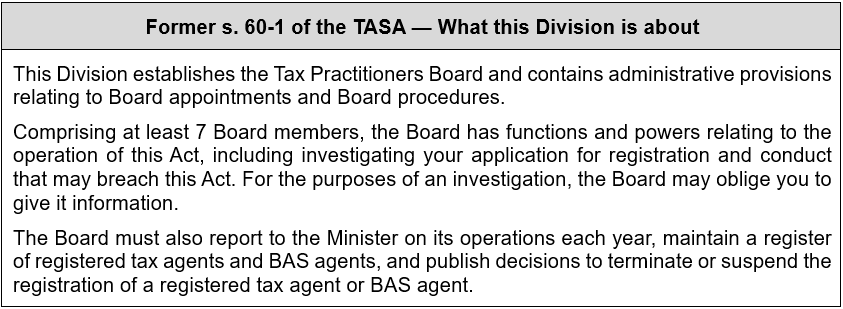

The $20,000 instant asset write-off threshold

Subdivision 328-D of the ITAA 1997 allows an eligible small business entity (SBE) taxpayer (annual turnover of less than $10 million) to deduct 100 per cent of the of the cost of an eligible asset in the current income year The standard and legislated threshold is $1,000 — that is, eligible assets with a cost of less than $1,000 may be fully depreciated in the year in which the taxpayer starts to use the asset, or have it installed ready for use, for a taxable purpose.

To encourage business investment and spending, since 2015 the Government has progressively and temporarily increased the threshold to various higher thresholds. The write-off was uncapped (no cost limit) from 6 October 2020 to 30 Jun 2023.

From 1 July 2023, the threshold for SBEs reverted to $1,000. In the 2023–24 Federal Budget, the Government announced that it would temporarily increase the threshold to $20,000 from 1 July 2023 to 30 June 2024 — the subject of Schedule 1 to the Bill.

The Bill was first introduced into Parliament in September 2023. On 27 March 2024 the Bill was amended by the Senate to increase the $20,000 threshold to $30,000 and to extend the measure to medium entities with turnover of $10 million to less than $50 million, and returned to the House of Representatives for consideration. On 15 May, the House disagreed to the Senate amendments and the Bill — with the original $20,000 threshold — was returned to the Senate. The next day, 16 May, the Senate rejected the Bill again and insisted on its proposed amendments. On 28 May, the House disagreed to the amendments. On 25 June, the Senate did not again insist on its amendments and the Bill passed both Houses.

Implications of the $20,000 threshold

Immediate deduction of the cost of eligible assets

An SBE will be able to deduct the taxable purpose proportion of the cost of the asset in 2023–24 if:

- it is the year in which the SBE starts to use the asset, or has it installed ready for use, for a taxable purpose — this is not necessarily the same year in which the SBE started to hold the asset

- the taxpayer is an SBE for that year and the year in which it started to hold the asset

- the cost of the asset at the end of the income year is less than $20,000 — this looks at the total cost and not the taxable purpose portion of the cost.

If the SBE holds the asset by 30 June 2024 but has not yet started to use the asset, or have it installed ready for use, for a taxable purpose by that date, it will not have access to the $20,000 threshold. Similarly, if the taxpayer was not an SBE in the year it started to hold the asset but becomes an SBE when it begins to use the asset, it will not be eligible for the immediate deduction.

An immediate deduction will also be available for the second element of the cost — of less than $20,000 — for an asset where the first element of the cost has been immediately written off.

Temporary suspension of lock-out rule

The lock-out rule applies to SBEs that are eligible for but choose to opt out of Subdiv 328-D. under the default arrangements, the taxpayer cannot again apply the provisions for a period of five income years after the first later year in which the taxpayer could have made the choice.

However, under transitional rules enacted with the temporary threshold increases, SBEs are currently not required to apply the lock-out rule to income years that end on or after 12 May 2015 but on or before 30 June 2023. Now, the lock-out rule will be deferred for another year until 30 June 2024.

SBEs will be able to opt back into applying Subdiv 328-D to access the threshold during the 2014–15 through to the 2023–24 income years. The lock-out rule will start to apply again from the first income year that ends after 30 June 2024, i.e. from 2024–25.

The lock-out rule will not prevent a taxpayer from opting back into the rules in 2020–21 to 2023–24 if they previously opted out within the last five years.

![]() Implications

Implications

A choice not to use the small business capital allowance rules in the 2023–24 income year will lock the taxpayer out of the rules until the 2028–29 income year. Accordingly, careful consideration should be given to any choice made in the 2023–24 income year.

Proposed extension to 2024–25

In its 2024–25 Federal Budget, the Government announced that it will extend the $20,000 instant asset write-off threshold for one year until 30 June 2025. The Treasury Laws Amendment (Responsible Buy Now Pay Later and Other Measures) Bill 2024 is currently before the House of Representatives. It has been referred to the Senate Economics Legislation Committee, with the report due 2 August 2024. The next Parliamentary sitting commences on 12 August.

If the proposed extension is extended, the abovementioned deduction consequences will also apply for 2024–25 and the suspension of the lock-out rule will be extended for an extra year.

The small business energy incentive

The small business energy incentive (SBEI) is a temporary measure to support small businesses (with aggregated annual turnover of less than $50 million) in improving their energy efficiency and save on energy bills. The incentive will take the form of a bonus deduction equal to 20 per cent of eligible expenditure, capped at a $20,000 deduction ($100,000 expenditure). The bonus deduction will only apply to eligible expenditure incurred from 1 July 2023 to 30 June 2024.

Eligible entities

An entity will be eligible for the bonus deduction if, in the income year in which the asset is first used or installed, or the improvement cost is incurred, it is:

- a ‘small business entity’ under s. 328-110 of the ITAA 1997 — i.e. an entity that carries on business with an aggregated annual turnover of less than $10 million; or

- an entity that would meet the definition of an SBE under s. 328-110 of the ITAA 1997 if the reference to $10 million was replaced by a reference to $50 million.

Eligible expenditure

The bonus deduction will be calculated based on eligible incurred expenditure which is for:

- an eligible depreciating asset first used or installed ready for use for a taxable purpose between 1 July 2023 and 30 June 2024 (the bonus period); or

- an eligible improvement to a depreciating asset incurred in the bonus period

The expenditure must also be deductible under another provision of the tax law.

Depreciating assets

Expenditure on a depreciating asset is eligible for the bonus deduction in any of the following situations:

1. Assets that use electricity instead of a fossil fuel.

2. Assets that use electricity more efficiently.

3. Assets that facilitate energy storage, efficiency or demand management.

For assets first used or installed for any purpose during the bonus period, expenditure that is included in the first element of cost may be eligible for the bonus deduction to the extent the asset is used for a taxable purpose.

Improvements to existing depreciating assets

Expenditure on an improvement to a depreciating asset is eligible in the following circumstances:

1. Improvements enabling electricity use.

2. Improvements to energy efficiency.

3. Improvements facilitating energy storage, demand management or monitoring.

Expenditure on the part of the second element of cost of an asset that is incurred during the bonus period may be eligible for the bonus deduction. The time that the improvement or the asset being improved is used or installed is not relevant.

Excluded assets and expenditures

Ineligible assets and expenditures are:

- assets, and expenditure on assets, that can use a fossil fuel

- assets which have the sole or predominant purpose of generating electricity

- capital works.

- motor vehicles (including hybrid and electric vehicles) and expenditure on motor vehicles

- assets and expenditure on an asset where expenditure on the asset is allocated to a software development pool

- financing costs, including interest, payments in the nature of interest and expenses of borrowing.

Calculating and claiming the bonus deduction

The amount of the bonus deduction is calculated as 20 per cent of the total amount of eligible expenditure, up to a maximum bonus deduction of $20,000 across the bonus period.

This means that total expenditure eligible for the bonus deduction is effectively $100,000 over the bonus period.

For depreciating assets first used or installed during the bonus period, entities must claim the bonus deduction in the income year in which the asset is first used or installed.

For improvements made to existing assets, entities must claim the bonus deduction in the income year in which the improvement cost is incurred.

For most taxpayers this will be the 2023–24 income year. Early and late balancers may claim the bonus deduction across more than one income year depending on circumstances.

Changes to NALE rules

The amendments change the NALE rules for complying superannuation entities. The amendments apply different rules to different entities based on the size of the entity. In particular, the NALE rules will only apply to small APRA regulated funds and SMSFs.

Application

The new rules apply in respect of income derived in the 2018–19 income year or later years, and any expense incurred, or not incurred but which might have been expected to have been incurred, in the 2018–19 income year or later.

PCG 2020/5 established a transitional compliance approach to the previous NALI rule changes. As a result of consultation, the ATO recognised that trustees may not have been aware that the amendments would apply to NALE of a general nature which is linked to all income of the fund (also referred to as general expenses). In the PCG the ATO announced that it would not allocate compliance resources to determine whether the NALI provisions applied to a complying superannuation fund for the 2018–19 to the 2022–23 income years where the fund incurred NALE of a general nature that has a sufficient nexus to all ordinary and/or statutory income derived by the fund in those respective income years.

Small APRA–regulated funds and SMSFs

The new rules apply a different approach based on the kind of expense that is, or might have been expected to be, incurred. Specific expenses will continue to be subject to the existing NALE rules, however the proposed measures will lessen the consequences of gaining an advantage through a non-arm’s length transaction in relation to general expenses.

The amendments include:

a change to the deduction rules in relation to general expenses — the actual amount incurred for a general NALE will not be deductible against the non-arm’s length component:

-

- the approach for calculating the consequence of incurring a general NALE already takes into account any amount actually incurred in relation to the general expense, by subtracting it from the amount that might have been expected to be incurred if the parties had been at arm’s length, before multiplying the result by two to arrive at the NALI.

- the introduction of a cap on the total non-arm’s length component to ensure that assessable contributions minus related deductions are always part of the low tax component

- the non-arm’s length component is calculated as the lesser of:

- the sum of:

- any NALI amount — other than NALI as a result of a general expense — less any deduction attributable to that NALI amount; and

- any NALI as a result of a general expense that is a NALE; and

- the sum of:

- the total of an entity’s taxable income for the year, excluding any contributions that are part of an entity’s assessable income (this is achieved by subtracting them from the calculation) and excluding any deductions against those contributions (this is achieved by adding them to the calculation).

Specific expenses

Specific expenses are incurred as a part of a scheme with related parties where the expense is related to earning income from a particular asset of the fund.

Specific expenses may include:

- acquisition of an asset

- maintenance expenses for a rental property

- investment advice fees for a particular pool of investments

- a limited recourse borrowing arrangement for the purchase of a specific asset.

General expenses are incurred otherwise than in gaining or producing income from any particular asset of the fund. They are expenses with a sufficient nexus to the entirety of the income of the fund, rather than a particular asset of the fund. Usually relates to the operation or obligations of the fund as a whole.

General expenses may include:

- actuarial costs

- accountant fees

- fees to an auditor

- administrative costs in managing the fund

- trustee fees

- costs of complying with the regulatory obligations of the fund

- investment adviser fees that relate to the general operation of the fund and not to a specific investment or pool of investments.

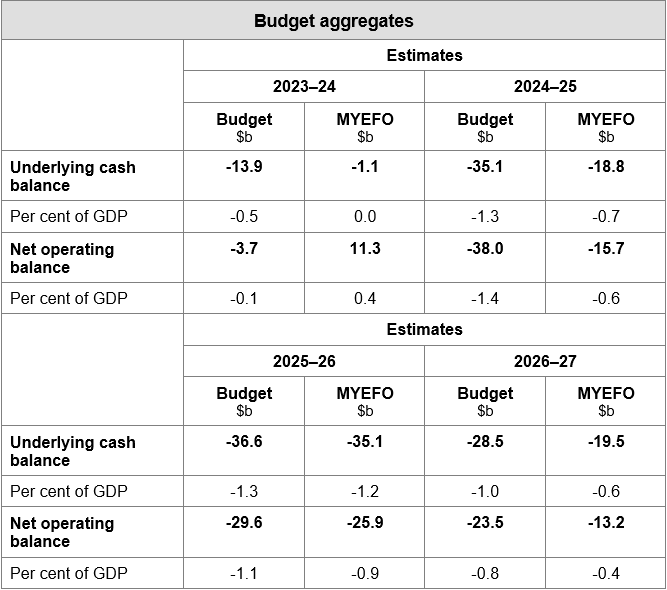

Treatment of general expenses

Under the amendments, when general expenses are incurred on a non-arm’s length basis, the income that is NALI is limited to:

![]()

As the amount of any expense actually incurred has already been taken into account in the above, the amount actually incurred for an arm’s length general expense cannot be deducted against a fund’s non-arm’s length component.

The non-arm’s length component will be capped at the entity’s total taxable income for the year, excluding assessable contributions and deductions against assessable contributions.

This cap applies where it results in a smaller amount than the total of all amounts of NALI calculated for all general and specific non-arm’s length expenses and any other NALI arising from the NALI provisions that are not related to expenses. If the cap calculation results in a negative number, the non-arm’s length component is zero. The maximum amount of non-arm’s length component does not exceed taxable income for the year and never includes contributions even if there is no other income of the fund.

Get our newsletter delivered straight to your inbox – sign up

Get our newsletter delivered straight to your inbox – sign up  Important

Important