TaxBanter is presenting the webinar Cryptocurrency … the state of play on 31 August in response to client demand.

Cryptocurrency transactions are one of the ATO’s four tax time priorities in 2022. Accountants need to know right now what they should do to manage these transactions. In the webinar, presenters George Housakos and Nicole Rowan will be focusing on:

- The different types of cryptocurrency and digital assets

- Tax treatment of crypto and digital asset transactions

- Record keeping considerations

- Challenging scenarios that might not be specifically envisioned by current tax laws.

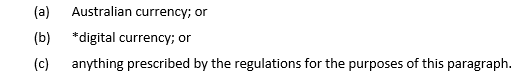

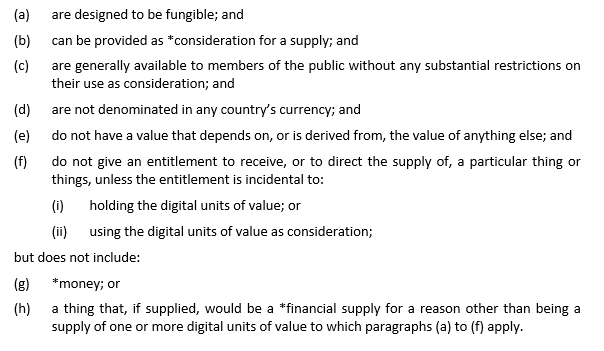

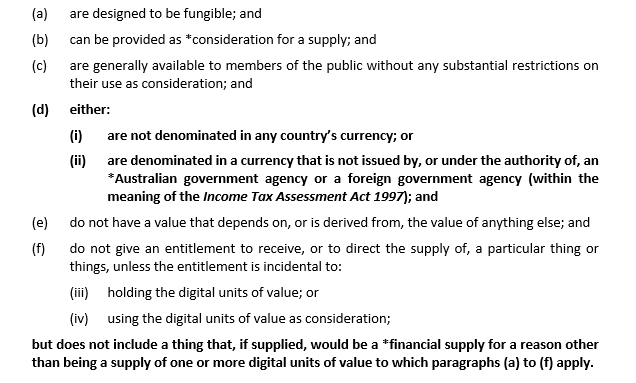

In the Australian tax legislation there is no taxing regime specific to crypto assets. Practitioners and their clients must interpret and apply the existing rules in the context of crypto transactions.

The ATO has in recent months expanded its suite of non-binding general website guidance, some of which is outlined in our previous Banter Blog article Crypto assets — proposed tax amendment and current ATO guidance.

However, there is still a dearth of binding guidance. To date, the ATO has only issued four Taxation Determinations and one GST Ruling, eight years ago in 2014. This article will briefly outline the four Determinations, which set out the Commissioner’s views on the application of the existing law to bitcoin in the areas of:

- foreign currency (Div 775 of the ITAA 1997) — TD 2014/25

- CGT asset (s. 108-5 of the ITAA 1997) — TD 2014/26

- trading stock (Div 70 of the ITAA 1997) — TD 2014/27

- property fringe benefit (FBTA Act) — TD 2014/28

In the webinar the presenters will explain these Determinations and discuss the tax issues arising from crypto assets which the Commissioner has not yet clarified.

(Note: GSTR 2014/3, released with the Determinations, will not be covered in this article.)

Critical point

Critical point

All four of the Determinations relate to bitcoin specifically and not cryptocurrencies generally. The principles covered in the Determinations may also apply to particular cryptocurrencies other than bitcoin. However taxpayers and their advisers will need to consider any material similarities and differences between the cryptocurrency and bitcoin that may be relevant to the application of the Commissioner’s rulings.

Bitcoin Tax Determinations

What is bitcoin?

The non-binding Explanation section of TD 2014/25 sets out in detail the ATO’s view of ‘what is bitcoin’ for the purposes of the Determinations.

The key points include the following:

- the Bitcoin system is decentralised in that it is not under the control of a central authority

- the value of bitcoin is not derived from gold or government fiat, but from the value that people assign it

- the process through which bitcoin are created and enter into circulation is called ‘Bitcoin mining’, which involved using special software to solve complex cryptographic equations for a reward of receiving a specified number of newly created bitcoin

- bitcoin that are already in circulation can be acquired either by exchanging ‘national’ or ‘fiat’ currencies for them through an online exchange, or by accepting them as a gift or in exchange for goods and services

- bitcoin are sent and received via a Bitcoin address, which is a long alphanumeric string used by the network as an identifier

- Bitcoin uses public key cryptography to make and verify digital signatures used in bitcoin transactions

- each user is assigned a ‘public/private’ keypair which is saved in that person’s ‘Bitcoin wallet’

- to transfer bitcoin, a person creates a transaction message with the number of bitcoin to be transferred and signs the transaction with their private key

- a bitcoin is only accessible by the person in possession of the private key that relates to the Bitcoin address associated with that person’s bitcoin holdings. Accordingly, a bitcoin consists not just of the numerical amount (or balance) of bitcoin and the Bitcoin address to which they are associated, but also the related private key that allows the holder to do anything with those bitcoin.

Foreign currency — TD 2014/25

TD 2014/25 — Income tax: is bitcoin a ‘foreign currency’ for the purposes of Division 775 of the Income Tax Assessment Act 1997?

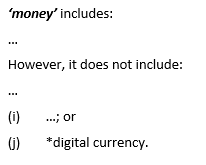

Legislative reform to provide clarity

Legislative reform to provide clarity

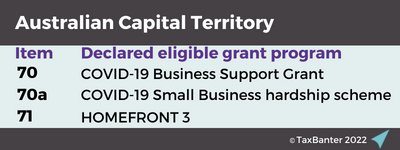

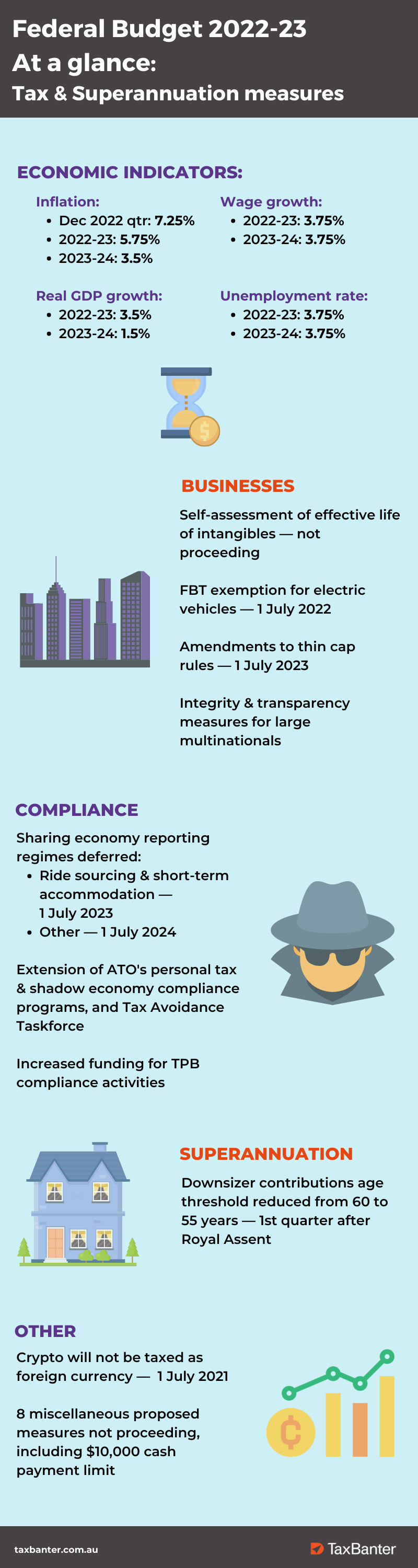

In June 2022, the Government announced that it will amend the tax law to legislate the current administrative arrangements to provide clarity that crypto assets will not be regarded as a foreign currency for tax purposes.

This clarification will deliver a consistent tax requirement for crypto asset holders and will be backdated to 1 July 2021 for the avoidance of ambiguity.

The Government’s announcement follows the decision by the Government of El Salvador to allow Bitcoin as legal tender.

Until the proposed change is legislated, the current law applies.

The Commissioner’s ruling

Bitcoin is not a ‘foreign currency’ for the purposes of the foreign currency rules in Div 775 of the ITAA 1997.

Non-binding explanation

How is ‘foreign currency’ relevant?

Division 775 provides rules for recognising foreign currency gains and losses for income tax purposes. To the extent that a foreign currency gain would be included in a taxpayer’s assessable income under Div 775 and another provision of the Tax Acts, the gain is only included in the taxpayer’s assessable income under Div 775. There is a corresponding rule to prevent a double deduction in relation to a foreign currency loss.

Determining whether a bitcoin is ‘foreign currency’ or ‘currency’ as those terms are used in the income tax law requires consideration of the characteristics of bitcoin.

The Commissioner considers that bitcoin does not constitute ‘currency’ nor ‘foreign currency’ in the context in which those terms operate for the purposes of Australian tax law. It is not ‘foreign currency’ for Div 775 purposes.

Income tax consequences

As bitcoin is not a foreign currency, Div 775 does not apply and transactions involving bitcoin give rise to the same tax consequences as other barter transactions.

A taxpayer that receives bitcoin as payment for goods or services they provide as part of their business, or uses bitcoin to make purchases for their business, is required to include the arm’s length Australian dollar value of their bitcoin transactions in calculating their assessable income.

The Australian dollar value of bitcoin may increase or decrease between the time a taxpayer acquires and disposes of bitcoin. Whether such fluctuations give rise to ordinary income or CGT consequences will depend on the particular facts and circumstances of the taxpayer.

CGT asset — TD 2014/26

TD 2014/26 — Income tax: is bitcoin a ‘CGT asset’ for the purposes of subsection 108-5(1) of the Income Tax Assessment Act 1997?

The Commissioner’s ruling

Bitcoin is a CGT asset for the purposes of s. 108-5(1) of the ITAA 1997 (the definition of ‘CGT asset’).

Non-binding explanation

Is bitcoin a CGT asset?

Is bitcoin a CGT asset?

The term ‘CGT asset’ is defined in s. 108-5(1) as:

- any kind of property, or

- a legal or equitable right that is not property.

Is bitcoin ‘any kind of property’?

Is bitcoin ‘any kind of property’?

The relevant relationship in the nature of property that must be considered is the relationship between:

- the object or thing, bitcoin, being the digital representation of value constituted by three interconnected pieces of information (a Bitcoin address; the Bitcoin holding or balance in that address; and the public and private keypair associated with that address), and

- the bundle of rights (hereafter referred to as ‘Bitcoin holding rights’) ascribed to a person with access to the bitcoin under the Bitcoin software and by the community of Bitcoin users.

The most important of these Bitcoin holding rights are the rights of control over one or more bitcoin in the holder’s Bitcoin wallet, e.g. the capacity to trade a bitcoin for other value or use it for payment. These rights, however, do not amount to a chose in action as a Bitcoin holding does not give rise to a legal action or claim against anyone.

However, there are other factors that support the conclusion that Bitcoin holding rights are proprietary in nature. The most compelling is that bitcoin are treated as valuable, transferable items of property by a community of Bitcoin users and merchants. There is an active market for trade in bitcoin and substantial amounts of money can change hands between transferors and transferees of bitcoin.

As the Bitcoin software prescribes how the transfer and trade of bitcoin can occur and transactions are verified through the Bitcoin mining process, Bitcoin holding rights are definable, identifiable by third parties, capable of assumption by third parties, and sufficiently stable.

In weighing all these factors it is considered that Bitcoin holding rights amount to property within the meaning of s. 108-5(1)(a). As such, a person holding a bitcoin is considered to hold a ‘CGT asset’.

CGT consequences of disposing of bitcoin

The disposal of bitcoin to a third party gives rise to CGT event A1. A taxpayer will make a capital gain from CGT event A1 if the capital proceeds from the disposal of the bitcoin are more than the bitcoin’s cost base. The capital proceeds from the disposal of the bitcoin are the money or the market value of any other property received (or entitled to be received) by the taxpayer. The money paid or the market value of any other property the taxpayer gave in respect of acquiring the bitcoin will be included in the cost base of the bitcoin.

Section 118-20 reduces any capital gain made by a taxpayer by an amount that is included in the taxpayer’s assessable income under another provision of the tax law, e.g. ordinary income.

A capital gain made from a personal use asset (a CGT asset used or kept mainly for personal use or enjoyment) is disregarded if the first element of the cost base is $10,000 or less. Any capital loss made from a personal use asset is disregarded.

Bitcoin as a personal use asset

Whether or not bitcoin is used or kept mainly for personal use or enjoyment will depend on the particular facts and circumstances of each case. Relevant considerations include the purpose for which the bitcoin was acquired and kept, as well as the nature of the property acquired when the bitcoin is disposed of (for example, whether the bitcoin is used to purchase an investment). Bitcoin that is kept or used mainly to make purchases of items for personal use or consumption ordinarily will be kept or used mainly for personal use.

- An example of where bitcoin would be considered to be a personal use asset is where an individual taxpayer purchased bitcoin from a Bitcoin exchange and uses the bitcoin to make online purchases for their personal needs, for example clothing or music. If the bitcoin were instead purchased to facilitate the purchase of income producing investments, they would not be personal use assets.

- An example of where bitcoin would not be a personal use asset is where an individual taxpayer mines bitcoin and keeps those bitcoin for a number of years with the intention of selling them at opportune times based on favourable rates of exchange.

Gains instead assessable as ordinary income?

In the case of an isolated transaction that is not carried out as part of a business operation, the Commissioner considers that a gain will generally be ordinary income where the intention or purpose of the taxpayer in entering into the transaction was to make a profit or gain, and the transaction was entered into in carrying out a commercial transaction.

Particularly relevant factors are the amount of money involved in the mining (or acquisition) and disposal of the bitcoin, the magnitude of the profit sought or obtained, the length of time the bitcoin is held before disposal and whether that bitcoin has no other immediate use other than as an object of trade.

For example, where a taxpayer mines a small amount of bitcoin as a hobby and after two years decides to sell the bitcoin for a small profit in order to purchase a more stable investment item, the gain will be assessed under the CGT provisions, not as ordinary income. Further, as the bitcoin were used to purchase an investment, the capital gain will not be disregarded under the personal use asset exception.

If, on the other hand, a taxpayer acquires bitcoin with the purpose of profiting from it upon a commercial transfer, a gain made on its disposal will be assessable under s. 6-5 and any capital gain arising under CGT event A1 will be correspondingly reduced under s. 118-20.

Trading stock — TD 2014/27

TR 2014/27 — Income tax: is bitcoin trading stock for the purposes of subsection 70-10(1) of the Income Tax Assessment Act 1997?

The Commissioner’s ruling

Bitcoin, when held for the purpose of sale or exchange in the ordinary course of a business, is trading stock for the purposes of s. 70-10(1) of the ITAA 1997.

Non-binding explanation

Is bitcoin ‘trading stock’ for the purposes of s.70-10(1)?

Definition — trading stock

Definition — trading stock

The term ‘trading stock’ is defined in s. 70-10(1) as:

-

- anything produced produced, manufactured or acquired that is held for the purposes of manufacture, sale or exchange in the ordinary course of a business; and

- As bitcoin is property for tax purposes (TD 2014/26), bitcoin is ‘trading stock’ for the purposes of s. 70-10(1) where it is held for the purpose of sale or exchange in the ordinary course of a business.

Bitcoin held by a taxpayer carrying on a business of mining and selling bitcoin, or a taxpayer carrying on a Bitcoin exchange business will be considered to be trading stock. Further bitcoin received as a method of payment by any business that sells goods will also be considered to be trading stock of that business where the bitcoin is held for the purposes of sale or exchange in the ordinary course of the business.

Property fringe benefit — TD 2014/28

TD 2014/28 — Fringe benefits tax: is the provision of bitcoin by an employer to an employee in respect of their employment a property fringe benefit for the purposes of subsection 136(1) of the Fringe Benefits Tax Assessment Act 1986?

The Commissioner’s ruling

The provision of bitcoin by an employer to an employee in respect of their employment is a property fringe benefit for the purposes of s. 136(1) of the FBTA Act.

Non-binding explanation

Is the provision of bitcoin a property benefit?

Definition — Property benefit

Definition — Property benefit

‘Property benefit’, as defined in s. 136(1), ‘means a benefit referred to in section 40, but does not include a benefit that is a benefit by virtue of a provision of Subdivision A of Divisions 2 to 10 (inclusive of Part III)’.

Bitcoin is not a benefit described in Divs 2 to 10.

Section 40 provides that where a person (the ‘provider’) provides property to another person (the ‘recipient’), the provision of the property ‘shall be taken to constitute a benefit provided by the provider to the recipient’.

Property as defined in s. 136(1) means ‘intangible property’ and ‘tangible property’. Both of these terms are separately defined.

Bitcoin is not tangible property for the purposes of the FBTA Act. Nor is bitcoin real property and bitcoin holding rights are not a chose in action. However as the definition of intangible property also includes ‘any other kind of property other than tangible property’, bitcoin will fall within this definition. The provision of bitcoin by an employer to an employee is therefore a property benefit.

Is bitcoin a property fringe benefit?

Definition — Property fringe benefit — s. 136(1)

Definition — Property fringe benefit — s. 136(1)

A fringe benefit that is a property benefit.

A benefit will not be a fringe benefit if it is ‘salary or wages’ (see the exclusion in the definition of ‘fringe benefit’ in s. 136(1)).

Section 12-35 of Schedule 1 to the TAA, which provides that an entity must withhold an amount from salary or wages, will not apply to require withholding on ‘a payment in so far as it consists of providing a non-cash benefit’. Section 995-1 of the ITAA 1997 defines the term ‘non-cash benefit’ as ‘property or services in any form except money’.

As bitcoin is not money but is considered to be property for tax purposes, bitcoin satisfies the definition of a ‘non-cash benefit’ and it is excluded from PAYG withholding. This exclusion from PAYG withholding means that bitcoin is not ‘salary or wages’ within the definition of that term in s. 136(1) and accordingly is not ‘salary or wages’ for the purposes of the exclusion in the definition of ‘fringe benefit’.

Accordingly, the provision of bitcoin by an employer to an employee in respect of the employee’s employment will be a property fringe benefit.

FBT consequences

The employer is liable to pay FBT on the taxable value of the property fringe benefits. Income derived by a taxpayer by way of the provision of a fringe benefit is not assessable and is not exempt income of the taxpayer under s. 23L(1) of the ITAA 1936.

Further info and training

Our upcoming webinar will also touch on GST and SMSF issues relating to cryptocurrency.

ATO guidance on GST and digital currency is available here.

ATO guidance on SMSF investment in crypto assets is available here.

Online training

Online training Personalised training options

Personalised training options![The tax status of COVID-19 grants [updated]](https://taxbanter.com.au/wp-content/uploads/2022/11/pexels-fauxels-3184339-scaled.jpg)

Implications

Implications

Legislative reform to provide clarity

Legislative reform to provide clarity

Definition — trading stock

Definition — trading stock

Note:

Note: