[lwptoc]

On the evening of Tuesday 29 March 2022, the Treasurer handed down the Federal Budget 2022–23. The Budget documents are available here.

On 31 March 2022, the Treasury Laws Amendment (Cost of Living Support and Other Measures) Bill 2022 (the Bill) received Royal Assent. The Bill amended the Tax laws to implement a number of Budget announcements (as summarised below).

The Excise Tariff Amendment (Cost of Living Support) Bill 2022 and the Customs Tariff Amendment (Cost of Living Support) Bill 2022 (the Fuel Excise Bills), which contain amendments to temporarily reduce fuel excise, also received Royal Assent on 31 March 2022.

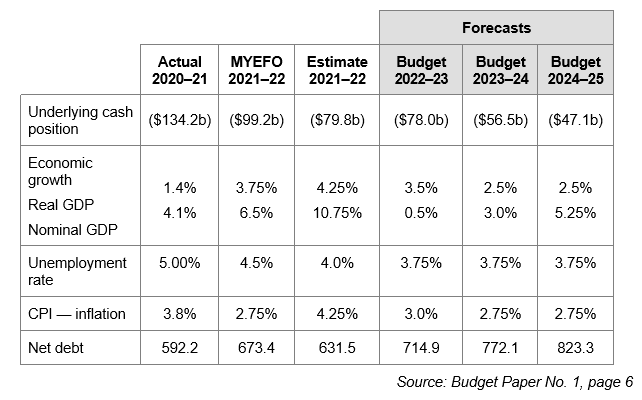

This pre-election Budget was positioned to assist individuals with the sharply rising cost of living. Australians have in particular experienced increasing bills at the supermarket and the bowser, the problem exacerbated by the worldwide COVID-19 pandemic, Australian floods and the Russia-Ukraine conflict all contributing to skyrocketing input and transport costs. National wage growth, forecasted to be 2.75 per cent for the 2022 financial year, is certainly not keeping up with the estimated CPI increase of 4.25 per cent for the year.

This cost of living relief will primarily come in the form of a $420 increase to the Low and Middle Income Tax Offset (LMITO) for this year, a one-off $250 bonus payment for social security support recipients and a six-month halving of the fuel excise. In addition, many soon-to-be new parents — including single parents — will benefit from the proposed enhancements to the Paid Parental Leave (PPL) scheme, which will broaden eligibility to more families and increase flexibility.

There are no big-ticket announcements for businesses, but eligible businesses may benefit from additional deductibility boosts for investments in technology and training, expanded access to employee share schemes, increased support for apprenticeships and a number of improvements to the tax compliance experience.

The key economic forecasts in the Budget papers include:

Budget measures which have been legislated

Measures to help Australians with the rising cost of living

The cost of living tax offset — a $420 increase to the LMITO

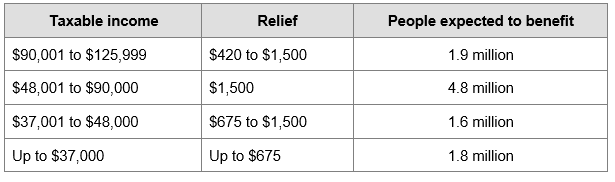

Schedule 6 to the Bill introduces amendments to increase the LMITO by $420 for the 2021–22 income year. This consequentially increases the maximum LMITO benefit to $1,500 (previously $1,080).

Unless the full offset is required to reduce a taxpayer’s tax liability to zero, all LMITO recipients will benefit from the full $420 increase. All other features of the LMITO remain unchanged, including the requirement that relevant income is below $126,000.

Consistent with current arrangements, the LMITO will be received on assessment after the individual lodges their 2022 tax return.

Note

Note

The 2021–22 income year is the final year of the LMITO. All else being equal, recipients of the increased LMITO this year will face a higher tax bill for the 2022–23 income year. The Stage 3 tax cuts are legislated to begin in 2024–25.

Tax relief from the cost of living tax and LMITO

The $250 cost of living payment

Schedule 8 to the Bill introduces the new 2022 cost of living payment. Under this measure, the Government will provide eligible recipients with a one-off, tax-exempt support payment of $250 to assist with higher cost of living pressures.

The payment will be made to eligible concession card holders and recipients of the following payments:

- Age Pension

- Disability Support Pension

- Parenting Payment

- Carer Payment

- Carer Allowance (if not in receipt of a primary income support payment)

- Jobseeker Payment

- Youth Allowance

- Austudy and Abstudy Living Allowance

- Double Orphan Pension

- Special Benefit

- Farm Household Allowance

- Pensioner Concession Card (PCC) holders

- Commonwealth Seniors Health Card holders

- Eligible Veterans’ Affairs payment recipients and Veteran Gold card holders.

Recipients must be residing in Australia, and have been receiving one of the qualifying payments or held or had clalimed and qualified for one of the qualifying concession cards on 29 March 2022.

The payments will not count as income support for the purposes of any income support payment. A person can only receive one economic support payment, even if qualify under multiple categories.

The $250 will be paid automatically to eligible recipients in April 2022.

Temporary reduction in fuel excise

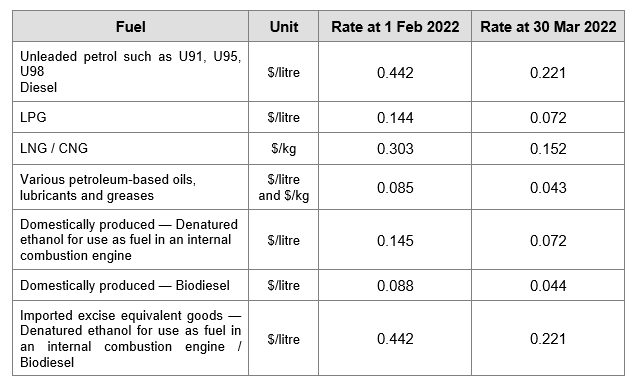

The Fuel Excise Bills enable temporary relief from fuel price pressures by halving the excise and excise-equivalent customs duty rate that applies to petrol and diesel for six months.

The 50 per cent reduction will apply to the excise and excise-equivalent rates that apply to:

- petrol and diesel;

- all other fuel and petroleum-based products, except aviation fuels,

for six months from 12.01 am on 30 March 2022 until 11.59 pm on 28 September 2022.

The impact of the halving of the excise rates and excise equivalent goods customs duty rates is set out in the table below:

The impact of the halving of the excise rates and excise equivalent goods customs duty rates is set out in the table below:

Existing policy settings for fuel excise and excise-equivalent customs duty, including indexation in August, will continue but on the basis of the halved rates.

The excise and excise-equivalent customs duty rates will, at the end of the six-month period, revert to previous rates including indexation that would have occurred on those rates during the six-month period.

The Australian Competition and Consumer Commission (ACCC) will monitor the price behaviour of retailers to ensure that the lower excise rate is fully passed on to Australians.

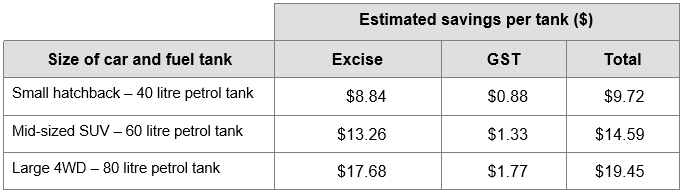

Household savings in excise and GST per tank of fuel are estimated to be as follows:

Implications for businesses

Eligible businesses receive fuel tax credits (FTC) for the excise that is included in the price of fuel. The rate of the FTC depends on the size of the vehicle and where it is used. Heavy vehicles travelling on public roads have their FTC reduced by the road user charge (RUC).

The Government is not changing the existing RUC arrangements for heavy vehicles travelling on public roads, but the temporary reduction in fuel excise will provide a net benefit for heavy vehicle operators of 4.3 cents per litre from 30 March 2022, compared to current settings.

Other measures affecting individuals

Tax deductibility of COVID-19 test expenses

In the Federal Budget, the Government announced that:

- the costs of taking a COVID‑19 test to attend a place of work are tax deductible for individuals from 1 July 2021; and

- FBT will not be incurred by businesses where COVID‑19 tests are provided to employees for this purpose.

Schedule 2 to the Bill introduces new s. 25-125 into the ITAA 1997. Under the new provision, an individual may deduct a loss or outgoing to the extent it is incurred in gaining or producing their assessable income if:

- the loss or outgoing is incurred in respect of testing the individual for COVID-19 using a test covered by s. 25-125(3);

- the purpose of testing the individual is to determine whether the individual may attend or remain at a place where they:

- engage in activities to gain or produce their assessable income; or

- engage in activities in the course of carrying on a business for the purpose of gaining or producing their assessable income;

- it is not a loss or outgoing of capital, or of a capital nature.

Section 25-125(3) specifies a test covered by the provision is a test that is:

- a Polymerase Chain Reaction (PCR) test; or

- a therapeutic good that is included in the Australian Register of Therapeutic Goods and has an intended purpose that relates to the detection of COVID-19.

The Bill does not amend the FBTA Act to provide a separate FBT exemption for COVID-19 testing costs incurred by employers. Instead, from 1 July 2021 employers may apply the otherwise deductible rule to reduce the taxable value of fringe benefits related to the provision of COVID-19 tests for the benefit of employees, or the reimbursements of testing costs incurred by employees.

![]() Implications

Implications

Ancillary costs of acquiring the tests, such as the cost of travelling and parking to purchase a test will not be deductible, however it is not the policy intention to exclude other incidental costs such as vendor credit card surcharge fees and postage and handling for online purchases.

Increasing the Medicare levy low-income thresholds

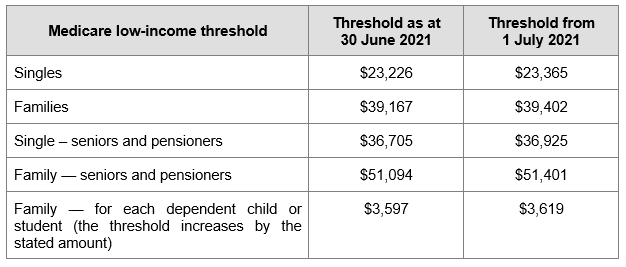

Schedule 1 to the Bill increases the Medicare levy low-income threshold for singles, families, and seniors and pensioners, and the Medicare levy surcharge low-income threshold, from 1 July 2021:

Measures affecting businesses

Employee share schemes — expanding access and reducing red tape

Schedule 4 to the Bill introduces legislative changes to ensure that participants of employee share schemes (ESS) in unlisted companies will be allowed to invest up to:

- $30,000 per participant per year, accruable for unexercised options for up to five years, plus 70 per cent of dividends and cash bonuses; or

- any amount, if it would allow them to immediately take advantage of a planned sale or listing of the company to sell their purchased interests at a profit.

Regulatory relief from the Corporations Act 2001 is also extended to offers to independent contractors, where they do not have to pay for the interests.

The amendments will commence six months after Royal Assent.

GDP uplift factor varied to two per cent

Schedule 5 to the Bill varies the GDP uplift factor for PAYG and GST instalments at two per cent in respect of instalments that relate to the 2022–23 income year. The lower uplift rate will provide cash flow support to small businesses including sole traders and other individuals with investment income.

The two per cent GDP uplift rate — rather than the statutory 10 per cent — will apply to small to medium enterprises which have aggregated turnover of up to:

- $10 million — for GST instalments; and

- $50 million — for PAYG instalments.

Other key Budget measures

Other Federal Budget announcements which have not yet been legislated include the following.

Other measures affecting individuals

Extension of temporary reduction in superannuation minimum drawdown rates

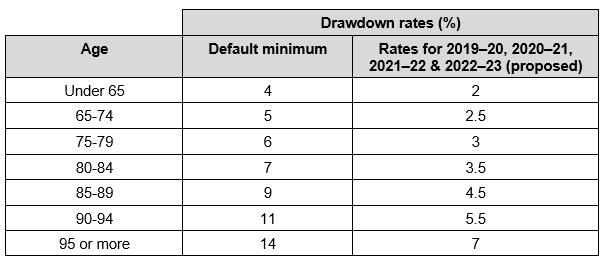

The Government will extend the 50 per cent temporary reduction of the superannuation minimum drawdown requirements for account-based pensions and similar products for a further year to 30 June 2023.

Expansion to the Home Guarantee Scheme

The Government will broaden the availability and scope of the existing Home Guarantee Scheme by:

- expanding the First Home Guarantee (formerly the First Home Loan Deposit Scheme) — to increase the available guarantees from 10,000 to 35,000 each year to support eligible first homebuyers to purchase a new or existing home with a deposit as low as five per cent — from 1 July 2022;

- establishing a new Regional Home Guarantee — to provide 10,000 guarantees each year to support eligible homebuyers, including non-first home buyers and permanent residents who have not owned a home for five years to purchase or construct a new home in regional areas— from 1 October 2022 to 30 June 2025; and

- expanding the existing Family Home Guarantee — to provide 5,000 guarantees to support eligible single parents with children to buy their first home or to re-enter the housing market with a deposit of as little as two per cent — from 1 July 2022 to 30 June 2025.

Changes to the Paid Parental Leave scheme

The Government will introduce the Enhanced Paid Parental Leave (Enhanced PPL) scheme. Proposed changes to the current PPL scheme include:

- integrating Dad and Partner Pay and Parental Leave Pay to provide eligible families access to up to 20 weeks leave to use in ways that suit their circumstances, reduce complexity and enable parents to share the full PPL entitlement between them;

- enabling dads and partners to be able to access the Government’s scheme at the same time as any employer-funded leave;

- enabling single parents to access the full 20 weeks of PPL; and

- adjustments to the income test to include a household income threshold of $350,000 per year — currently, the income threshold of $151,350 applies to the mother only.

The Government intends to introduce the changes to the PPL no later than 1 March 2023.

This measure forms part of the $2.1 billion investment package in the Women’s Budget Statement.

Measures affecting businesses

Technology investment boost for small business

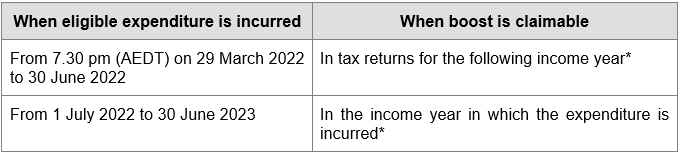

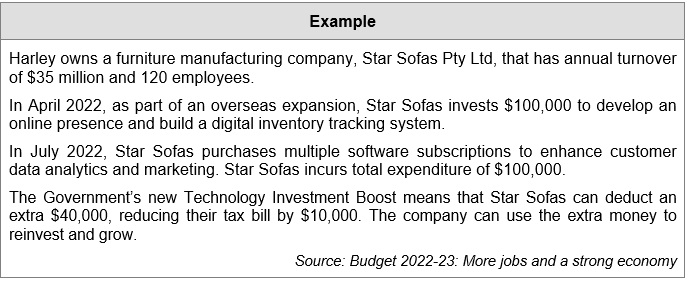

The Government announced that it is introducing a technology investment boost to support digital adoption by small businesses.

Small businesses (with aggregated annual turnover of less than $50 million) will be able to deduct an additional 20 per cent of expenditure incurred on business expenses and depreciating assets that support their digital adoption, such as portable payment devices, cyber security systems or subscriptions to cloud‑based services.

An annual cap will apply in each qualifying income year so that expenditure up to $100,000 will be eligible for the boost.

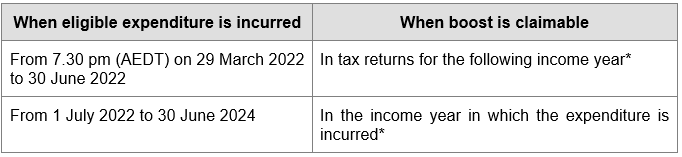

The 20 per cent boost will be claimable as follows:

* This may not be the 2023 tax return if the business is a Substituted Accounting Period taxpayer.

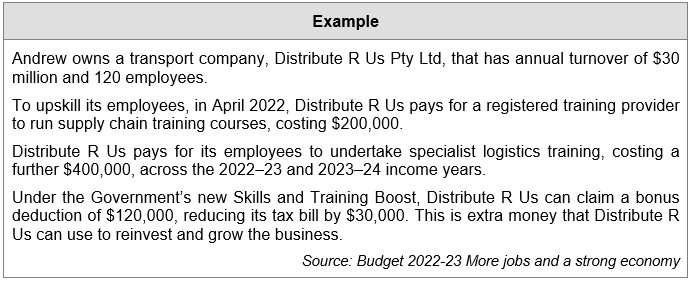

Skills and training boost for small business

The Government announced that it is introducing a skills and training boost to support small businesses to train and upskill their employees.

Small businesses (with aggregated annual turnover of less than $50 million) will be able to deduct an additional 20 per cent of expenditure incurred on external training courses provided to their employees. The external training courses will need to be provided to employees in Australia or online and delivered by entities registered in Australia.

Some exclusions will apply, such as for in‑house or on‑the‑job training and expenditure on external training courses for persons other than employees.

The 20 per cent boost will be claimable as follows:

* This may not be the 2023 or 2024 tax return if the business is a Substituted Accounting Period taxpayer.

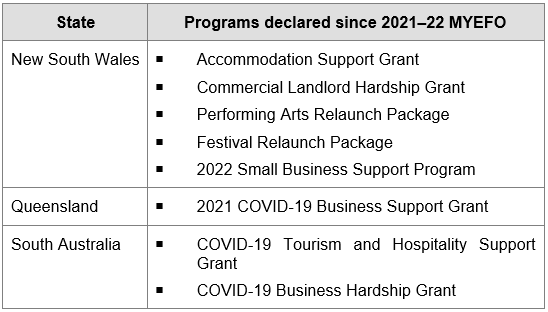

More COVID-19 business grants declared non-assessable non-exempt income

The Government announced that it will extend the measure which enables payments from certain state and territory COVID‑19 business support programs to be made non‑assessable non‑exempt (NANE) for income tax purposes until 30 June 2022 (extended from 30 June 2021). This extension was passed into law in June 2021.

In the Budget the Government announced that the following State grant programs have been declared eligible for NANE treatment since the 2021–22 MYEFO:

Insolvency reform — clarifying treatment of trusts with corporate trustees

The Government has announced that it will provide additional funding to further reform insolvency arrangements, including:

- reforms to unfair preference rules;

- clarifying the treatment of trusts with corporate trustees; and

- implementing the Government’s response to the recommendations of the Independent Safe Harbour Review.

Patent Box expansion

The Government has announced that it will expand the Patent Box regime to:

- update policy specifications for Australian medical and biotechnology innovations to allow for patents granted or issued after 11 May 2021, and various patents issued by the US and Europe, to be eligible for the regime;

- support practical, technology-focused innovations in the Australian agricultural sector;

- support commercialised patented technologies which have the potential to lower emissions.

For the agricultural sector and low emissions technology innovations, eligible corporate income will be subject to an effective tax rate of 17 per cent in relation to rights and patents granted after 29 March 2022 and for income years starting on or after 1 July 2023.

Skills development — apprenticeships

The Government will support employers to engage and retain new apprentices and reform the Australian Apprenticeships system by:

- introducing a new Australian Apprenticeships Incentive System from 1 July 2022;

- extending the Boosting Apprenticeship Commencements and Completing Apprenticeship Commencements wage subsidies by three months to 30 June 2022; and

- increasing the apprenticeship In-Training Support by an additional 2,500 places for young Australians aged 15 to 20 years in the 2022–23 income year.

Various changes affecting tax administration and compliance

The Government has announced a suite of proposed measures intended to improve the tax compliance and administration experience for businesses:

Reportable taxable payments to go on same lodgment cycle as activity statements

The Government has announced that — subject to software providers being able to have systems in place — businesses will have the option to report Taxable Payments Reporting System data (via accounting software) on the same lodgment cycle as their activity statements.

It is anticipated that systems will be in place by 31 December 2023, with the measure to commence on 1 January 2024, for application to periods starting on or after that date.

Currently a Taxable Payments Annual Report must be lodged by 28 August each year.

Deferral of ABN measure

Currently, ABN holders are able to retain their ABN regardless of whether they are meeting their obligations to lodge income tax returns, or to update their ABN details on the Australian Business Register.

As part of the 2019–20 Federal Budget, the Government announced that it would strengthen the ABN system to disrupt Black Economy behaviour.

The Government has announced that it will defer the start date of this measure by 12 months to assist with integration into the Australian Business Registry Services.

As a result:

- from 1 July 2022 — ABN holders, with an income tax return obligation, will be required to lodge their income tax return; and

- from 1 July 2023 — ABN holders will be required to confirm the accuracy of their details on the Australian Business Register annually.

Modernisation of PAYG instalment systems

The Government will provide companies with the option of having their PAYG instalments calculated based on current financial performance, extracted from their business accounting software, subject to some tax adjustments.

The measure proposes to leverage from a company’s electronic reporting systems to improve the alignment between PAYG instalment liabilities and profitability. The measure should also reduce compliance costs, improve processing times and support cash flow management for SMEs (for example the measure may enable a company to automatically receive refunds of instalments paid if financial performance declines).

The measure is proposed to commence on 1 January 2024 for periods starting on or after that date — subject to software providers’ capacity to deliver operational systems by 31 December 2023.

Enhanced sharing of STP data and pre-filling of payroll tax returns

The Government will commit $6.6 million towards the development of IT infrastructure required to allow the ATO to share Single Touch Payroll (STP) data with State and Territory Revenue Offices on an ongoing basis, following further consideration of which States and Territories are able and willing to make investments in their own systems and administrative processes to pre-fill payroll tax returns with STP data, to reduce compliance costs for businesses.

Digitalising trust income reporting

The Government will digitalise trust and beneficiary income reporting and processing, by allowing all trust tax returns to be lodged electronically. This will allow greater pre-filling and automating of ATO assurance processes.

As trust income reporting and assessment calculation processes have not been automated to the same extent as individual or company tax returns, there are longer processing times and limited pre‑filling opportunities. This measure, by facilitating the electronic lodgment for up to 30,000 trusts that currently lodge by paper, will reduce the compliance burdens on taxpayers, reduce processing times and enhance ATO processes.

Note

Note

Currently trust tax returns for large managed investment trusts or public unit trusts are excluded from electronic lodgment.

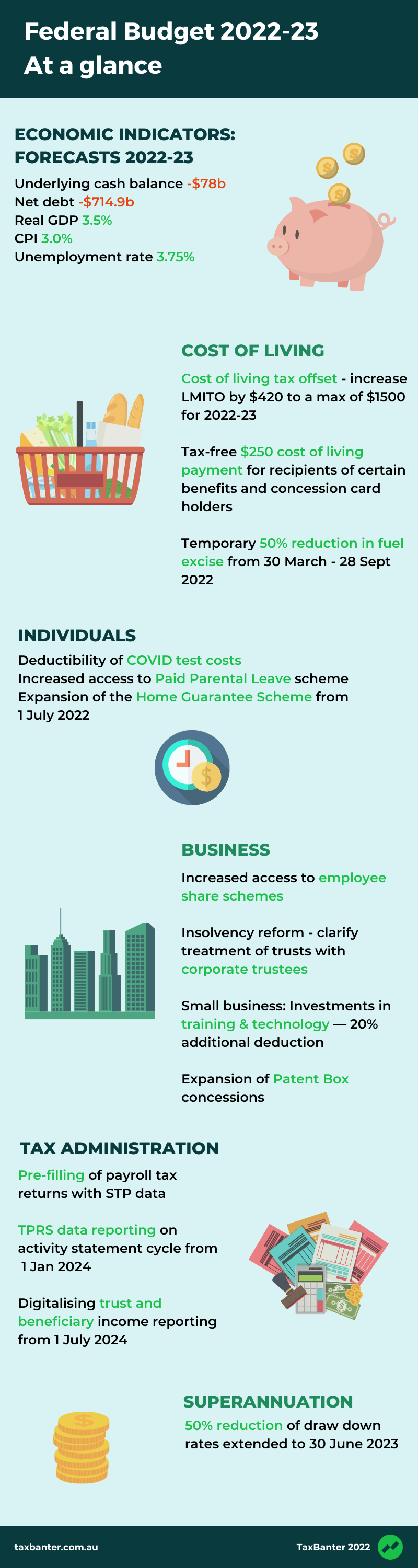

2022-23 Budget infographic

You can view the full resolution/size here.

Further training and info

Our upcoming Tax Updates will cover the recently passed Budget legislative package, as well as the yet to be legislated Budget announcements. You can view our upcoming April sessions through our Public Sessions page (face-to-face sessions – choose location, then month), or alternatively you can join our April Online Tax Update.

Have a group of 5 or more on your team? Check out our in-house training option, which is the most cost effective options for larger groups. One of our Senior Tax Trainers will come to your firm and deliver a tailored session specifically for your staff and client base.

Our mission is to offer flexible, practical and modern tax training across Australia – you can view all of our services by clicking here.

Warning

Warning

Note:

Note: